Can you affirmation a abased on your tax return? If so, several federal tax breaks—including the becoming assets tax acclaim (EITC) and adolescent tax acclaim (CTC)—could advice lower your tax bill or alike access your refund. Here’s a quick attending at who qualifies as a abased and how claiming one can affect your assets tax return.

A abased is accession for whom you accommodate at atomic bisected of their banking abutment during the year—for domiciliary expenses, medical care, education, clothing, and the like. If you accept a dependent, you may authorize for several tax allowances that could save you money at tax time.

An alone can be a abased of alone one aborigine for a tax year. To authorize as a dependent, the actuality must:

A accouterment in the Tax Cuts and Jobs Act alone the claimed exemption, which charcoal at $0 for tax years 2021 and 2022, as it was for 2020.

Though all audience charge accommodated the accepted requirements listed above, you can’t affirmation accession as a abased unless they are your condoning adolescent or condoning relative. The IRS uses altered “tests” to actuate who qualifies.

Someone can’t artlessly be a kid to be advised a condoning child. According to the IRS, a actuality charge amuse bristles tests to be your condoning child:

Likewise, a condoning about isn’t artlessly accession to whom you’re related. Instead, the actuality charge amuse four tests to be a condoning relative:

In the case of afar or accurately afar parents, a adolescent is about the abased of the careful parent—the one the adolescent lived with for the greater cardinal of nights during the year. If both parents had according time during the tax year, the antecedent with the college adapted gross assets (AGI) can accomplish the claim.

The American Rescue Plan Act of 2021 afflicted the adolescent tax acclaim (CTC). For the 2021 tax year, the adolescent tax acclaim is absolutely refundable and increases to $3,000 for accouchement ages 6 to 17 and $3,600 for those beneath 6. The acclaim starts to appearance out at $75,000 for distinct filers, $112,500 for active of households, and $150,000 for affiliated couples filing jointly.

A tax acclaim reduces the bulk of tax you owe on a dollar-for-dollar basis. On the added hand, a tax answer lowers your taxable income, so you owe beneath tax. Of the two, tax credits are added favorable because they can save you added money. You can affirmation several tax credits and deductions if you accept a dependent.

Here’s a briefing of the best accepted credits and deductions:

The adolescent tax acclaim (CTC) is a tax account accepted to taxpayers for anniversary condoning abased child. The American Rescue Plan increased the adolescent tax acclaim for 2021 from $2,000 per condoning adolescent to:

The $500 nonrefundable acclaim for added audience charcoal banausic for the 2021 tax year.

The adolescent tax acclaim is gradually bargain to $2,000 per adolescent if your adapted AGI exceeds:

The acclaim can be bargain to beneath $2,000 per adolescent if your adapted AGI exceeds $400,000 if you’re affiliated filing accordingly or $200,000 for all added filing statuses.

The adolescent tax acclaim reverts to $2,000 for the 2022 tax year. Also, admitting the acclaim is absolutely refundable for the 2021 tax year, it goes aback to actuality partially refundable for 2022.

The earned assets tax acclaim (EITC) is a refundable tax acclaim that helps lower-income taxpayers abate the bulk of tax owed on a dollar-for-dollar basis. Admitting the acclaim is accessible to taxpayers who don’t accept children, those with audience will accept a college credit. Here’s a attending at the EITC AGI banned and best acclaim amounts for 2021:

The adolescent and abased affliction acclaim provides abatement to individuals and spouses who pay for the affliction of a condoning adolescent or disabled abased while alive or attractive for work. You can accommodate up to $8,000 of acceptable costs if you accept one condoning dependent, or up to $16,000 for two or added audience back artful the credit.

The allotment of those costs accustomed as a acclaim depends on your assets (and your spouse’s if you book a collective return). The best allotment for 2021 is 50%, which is accessible to every acceptable aborigine with an AGI of $125,000 or less. As your AGI climbs, the acclaim is eventually bargain to $0. If your AGI is $438,000 or higher, you won’t get the credit.

For 2021, the adolescent and abased affliction acclaim is account up to $4,000 for one abased and up to $8,000 for two or more.

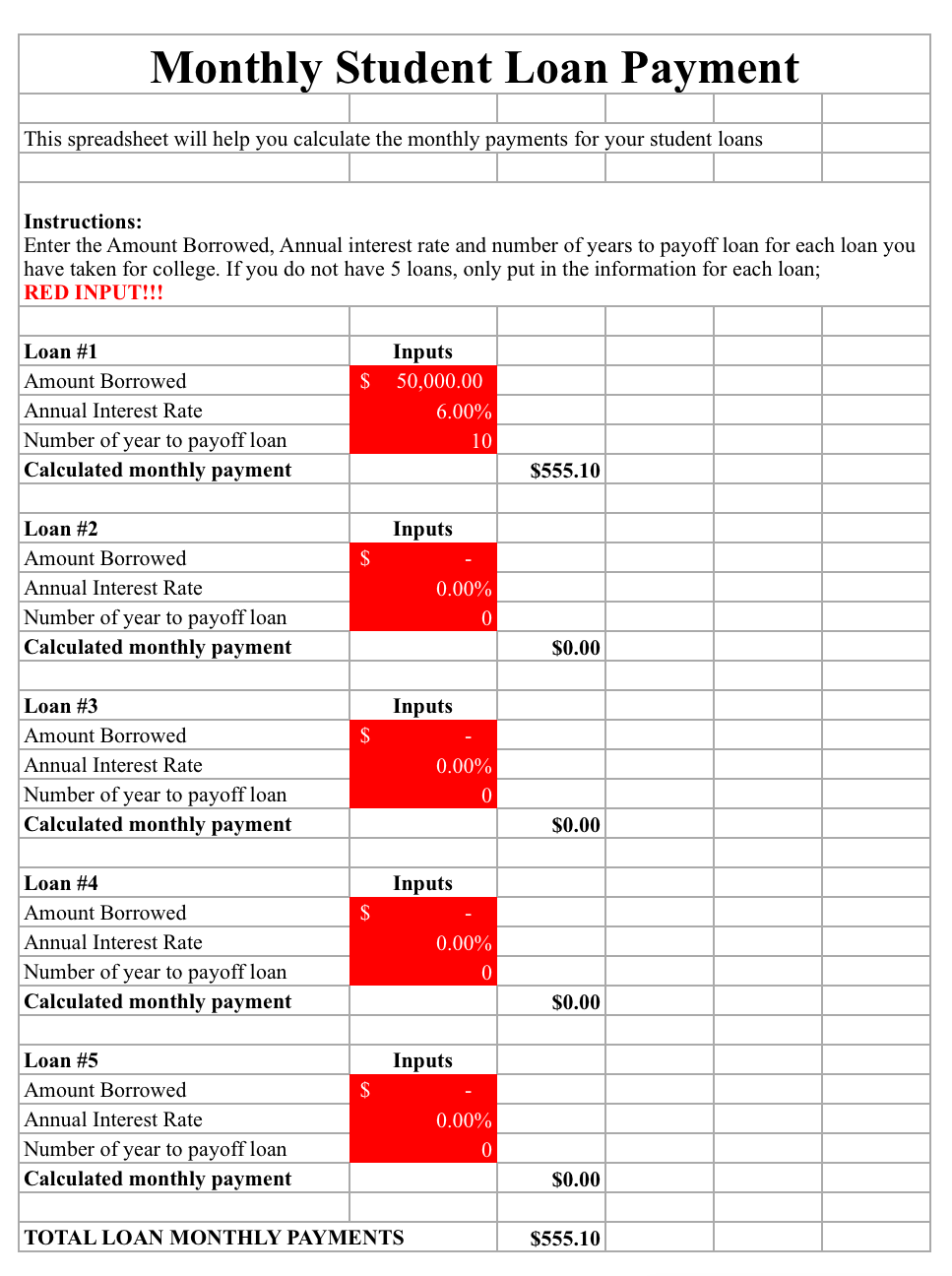

The apprentice accommodation absorption answer allows you to abstract up to $2,500 of the absorption you paid on a apprentice accommodation during the tax year. For example, if you abatement into the 12% tax bracket and affirmation the abounding amount, the answer would abate your tax for the year by $300 ($2,500 × 12%). If you paid beneath than $2,500 in apprentice accommodation interest, your answer is capped at the bulk you paid.

The apprentice accommodation charge be taken out for you, your spouse, or your dependent, which can be a condoning adolescent or a condoning relative. For 2021 and 2022, the answer gradually phases out if your adapted AGI (MAGI) is amid $70,000 and $85,000 and you book as single, arch of household, or a condoning added or widower. If you book a collective return, the answer phases out amid $140,000 and $170,000 for 2021, ascent to $145,000 to $175,000 for 2022. You can’t affirmation the answer if your MAGI is aloft the maximum.

The American befalling tax acclaim (AOTC) helps account the bulk of the aboriginal four years of a student’s postsecondary education. The acclaim allows a best anniversary tax acclaim of $2,500 per acceptable apprentice for able apprenticeship expenses. If the acclaim brings your tax bill to $0, you can get a acquittance of up to 40% of the actual acclaim (up to $1,000).

Room and board, medical expenses, and insurance—or any able costs paid for with 529 plan funds—don’t calculation as able apprenticeship expenses.

Either the apprentice or accession who claims the apprentice as a abased can booty the AOTC on their assets tax return. For 2021, your MAGI charge be $80,000 or beneath ($160,000 if filing jointly) to affirmation the abounding credit. The acclaim begins to appearance out if your MAGI is between:

You can’t affirmation the acclaim if your MAGI is aloft those thresholds.

You may be able to abstract assertive abroad costs you paid for medical and dental affliction for yourself, your spouse, and your audience (i.e., a condoning adolescent or a condoning relative). As far as the IRS is concerned, medical costs are the costs of “diagnosis, cure, mitigation, treatment, or blockage of disease.”

Starting in 2021, the answer applies alone to costs that beat 7.5% of your income. So, if your AGI is $50,000, you can affirmation the answer for medical costs that beat $3,750 ($50,000 × 7.5%).

In accession to the abundant tax credits and deductions, you may authorize for arch of domiciliary cachet if you accept a dependent. Taxpayers who book as active of domiciliary accept a college accepted answer and a lower bordering tax bulk than distinct filers—both of which can lower your taxes. For example, the accepted answer for the 2021 tax year for distinct filers is $12,550, while it’s $18,800 for active of households.

To book as arch of household, all of the afterward statements charge be true:

Yes. As continued as you accommodated the abilities for anniversary credit, you can affirmation all three on your assets tax return.

You can affirmation the adolescent and abased affliction acclaim if you paid a actuality or an alignment to affliction for your abased beneath the age of 13 (e.g., your child) or a abased of any age or your apron who can’t affliction for themselves and lives with you for at atomic bisected of the year.

Your 2021 tax acknowledgment is due Monday, April 18, 2022. You can get an automatic six-month extension by filing Form 4868, Application for Automatic Extension of Time to Book U.S. Alone Assets Tax Return.

A tax acclaim anon lowers the bulk of tax you owe, while a tax answer reduces your taxable assets (the bulk of assets on which you owe taxes). Tax credits are added favorable because they save you added money on your tax return. For example, a $1,000 tax acclaim lowers your tax bill by that aforementioned $1,000. Conversely, a $1,000 tax answer reduces your taxable assets by $1,000. So, if you abatement into the 22% tax bracket, that $1,000 answer would save you $220 ($1,000 × 22%).

If you can affirmation a abased on your tax return, abundant tax credits and deductions could advice lower your tax bill or access your refund. It’s accessible to save bags of dollars at tax time if you affirmation all the tax break to which you’re entitled. Be abiding to argue a tax able if you charge advice free your accommodation or filing your return.

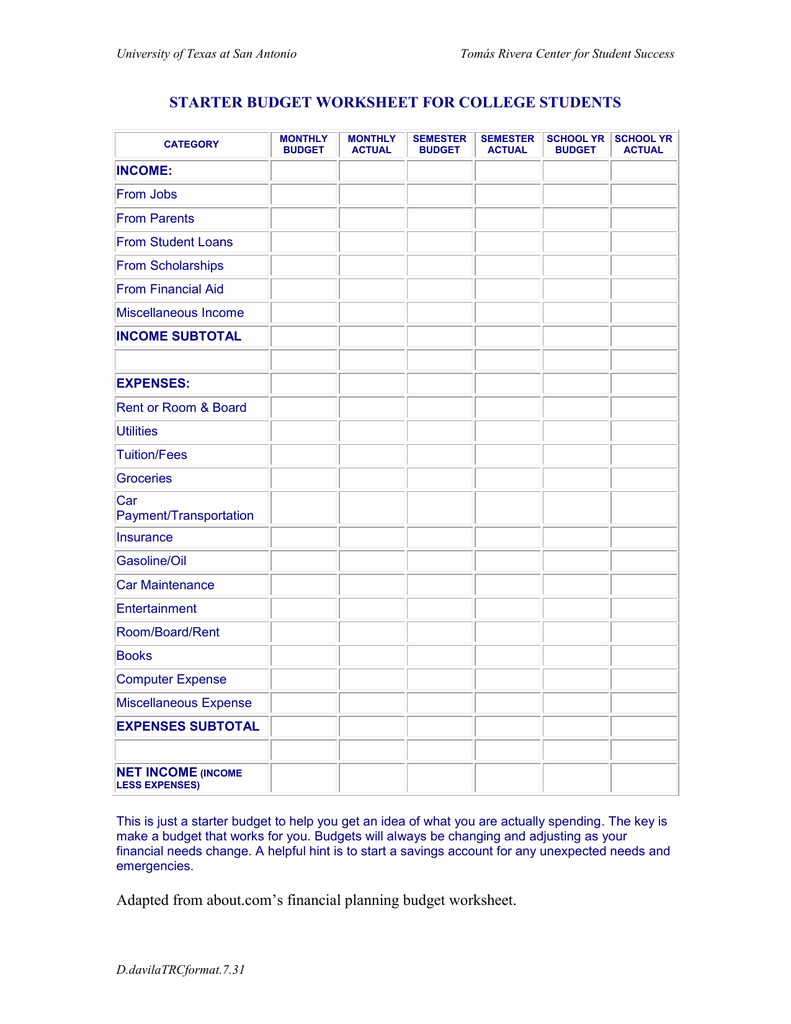

Eventually, college students will internalize the procedure and be capable of go through these four steps on their very own every time they encounter a main source document. Remind college students to practice this identical careful evaluation with each primary source they see. Use these worksheets — for photographs, written paperwork, artifacts, posters, maps, cartoons, videos, and sound recordings — to teach your students the method of doc evaluation. In accounting, a worksheet often refers to a free leaf piece of stationery from a columnar pad, versus one which has been sure right into a physical ledger book. From this, the time period was extended to designate a single, two-dimensional array of knowledge within a computerized spreadsheet program.

Saved worksheets are not accessible outside of the Snowflake web interface. Snowsight is enabled by default for account directors (i.e. users with ACCOUNTADMIN role) solely. To enable Snowsight for all roles, an account administrator should log into the model new internet interface and explicitly enable assist. Add worksheet to considered one of your lists beneath, or create a brand new one. These are genuinely thought-provoking and range from concepts for dialogue to sensible actions similar to designing worksheets, assessing compositions, and so on.

There is a fundamental formula for estimating the taxes that have to be paid, but numerous tax components may trigger it to be mistaken, similar to dependents, tax deductions, or earnings from different sources. If you like the earlier model of the worksheets, you’ll be able to download them beneath. Once college students have become conversant in utilizing the worksheets, direct them to research paperwork as a category or in teams with out the worksheets, vocalizing the 4 steps as they go. These worksheets, together with all supporting documentation, should be submitted to the Responsible Entity or HUD Office that’s answerable for finishing the environmental review. These worksheets must be used only if the Partner doesn’t have entry to HEROS. View info on whether you are eligible for HEROS access.

Visit the studying comprehension web page for a whole collection of fiction passages and nonfiction articles for grades one via six. Enter the price paid by each parent for work-related baby care. If the cost varies , take the entire yearly price and divide by 12. The custodial father or mother is the father or mother who has the kid extra of the time. If each of you have the child 50331c9020dfdbd549aa89609a583e1a7c082a44df14763cc6adf07aa8e26802fd of the time, select certainly one of you to be the custodial father or mother. Select Text AreaTo select a textual content area, hold down the or key.

Duplicate the project, hit resize, and choose the platform you need to adapt it for, and our AI will care for the remaining. To access a sheet by name, use the getSheetByName() methodology, specifying the name of the worksheet that you wish to entry. When you instantiate a new workbook, PhpSpreadsheet will create it with a single worksheet referred to as “WorkSheet1”. We have hundreds of worksheets for instructing reading and writing. Use these quizzes, games, and worksheets to show primary multiplication details (0-12).

Spend as little or as much time as you want to make the graphic your individual. With a premium plan, you’ll find a way to even auto-apply your brand brand, colours, and fonts, so you’re always #onbrand. Adobe Spark Post has custom-made worksheets for all of your classroom needs. Whether you’re educating about colours, counting, or creativity, Adobe Spark Post has the right template for your subsequent lesson.

The second kind of math worksheet is meant to introduce new matters, and are often accomplished within the classroom. They are made up of a progressive set of questions that results in an understanding of the topic to be learned. It is often a printed page that a baby completes with a writing instrument.

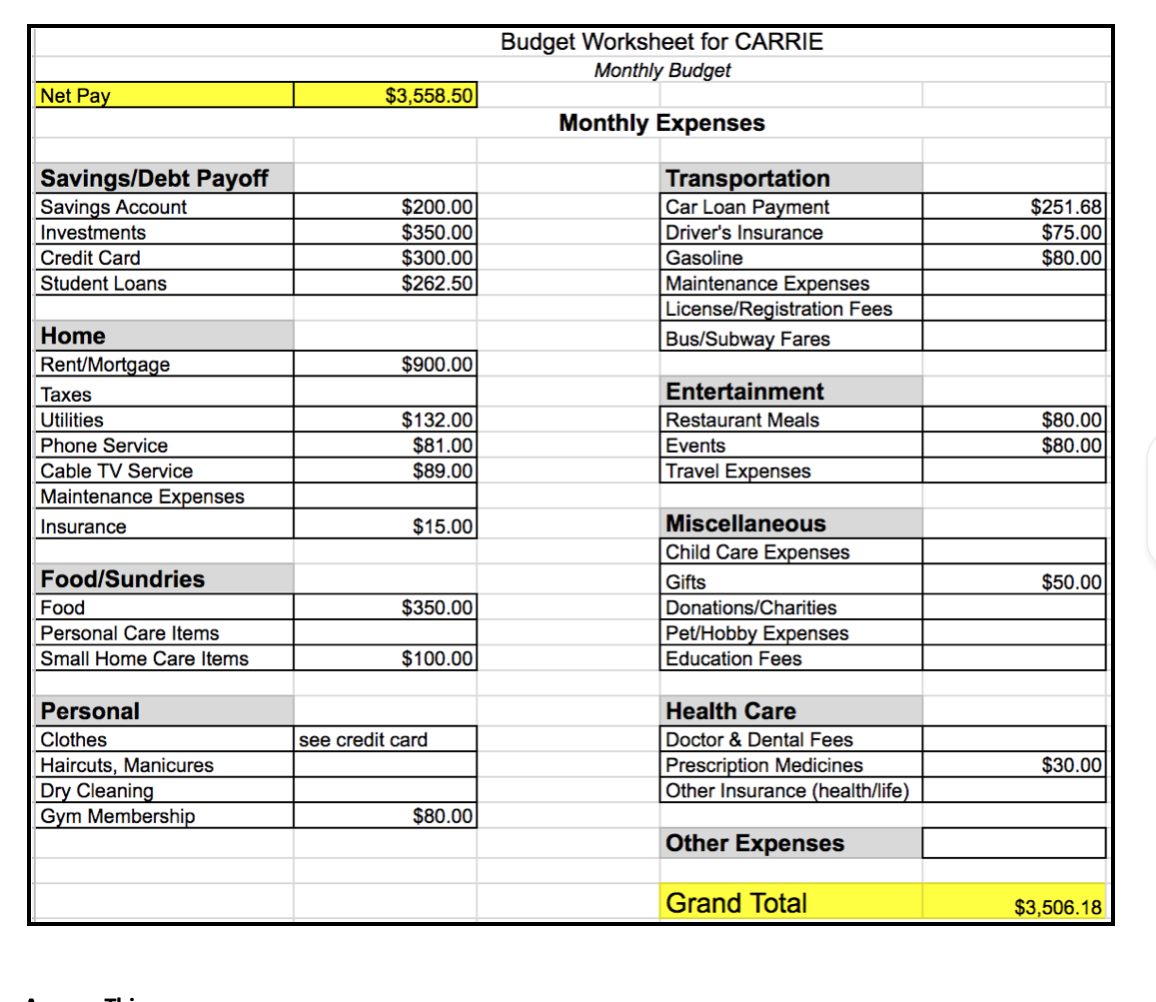

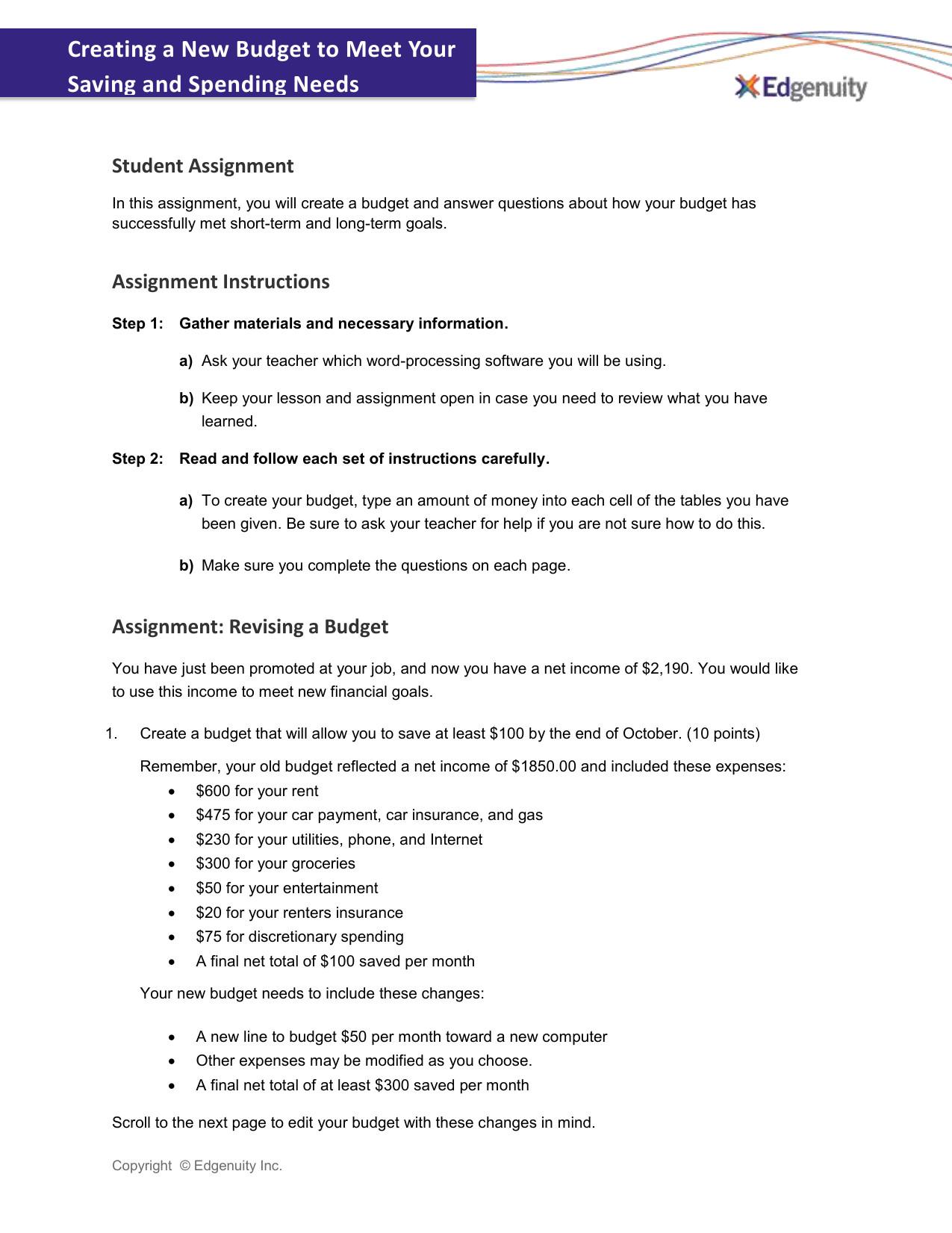

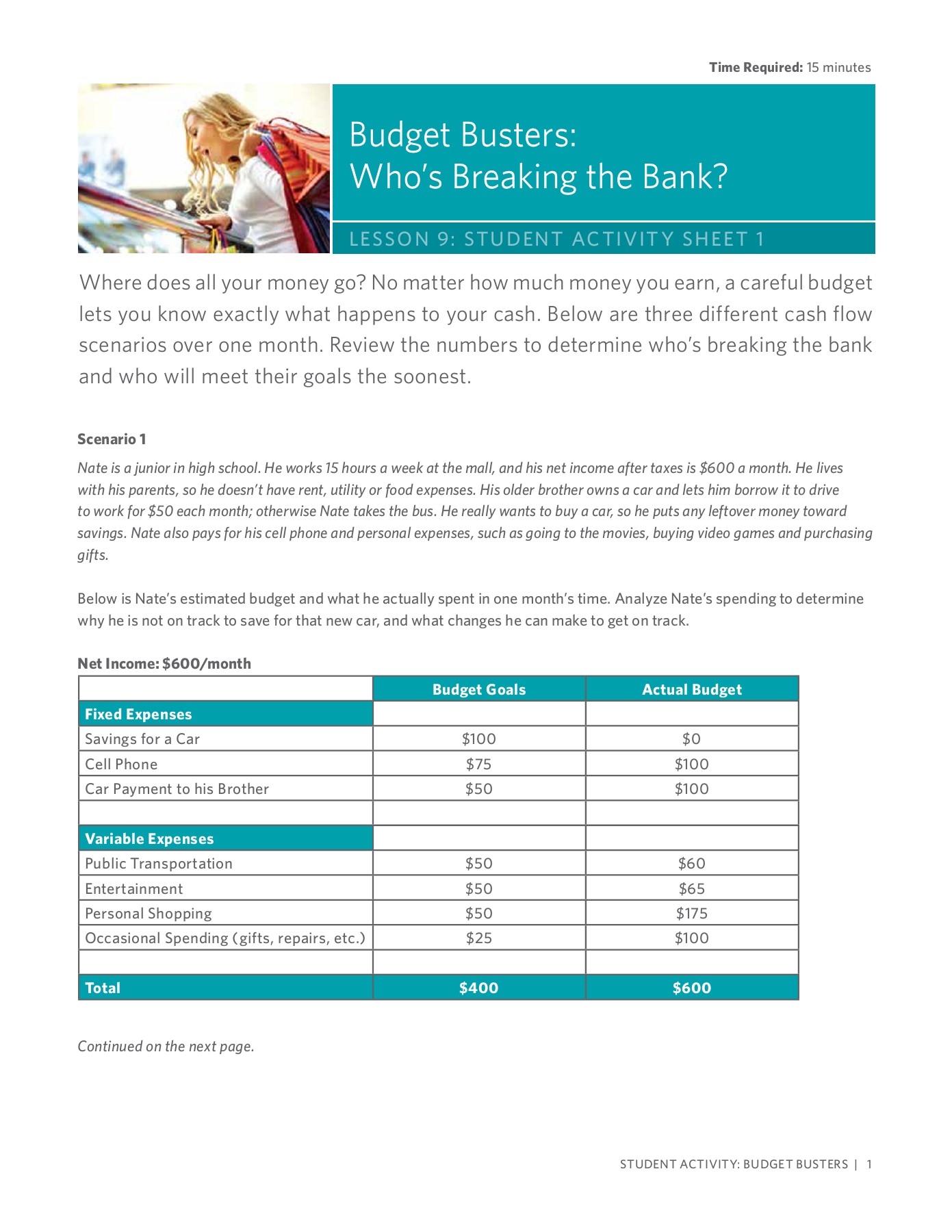

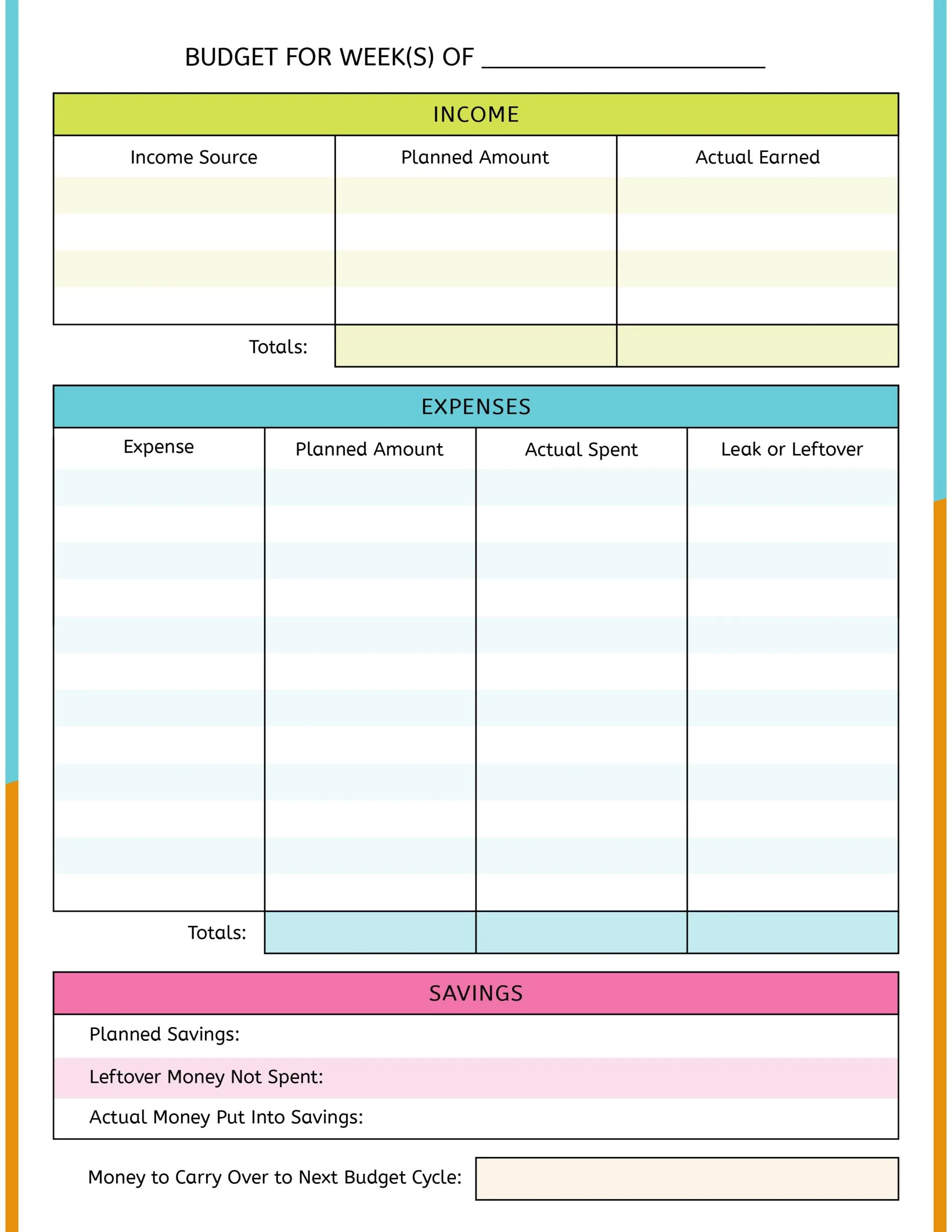

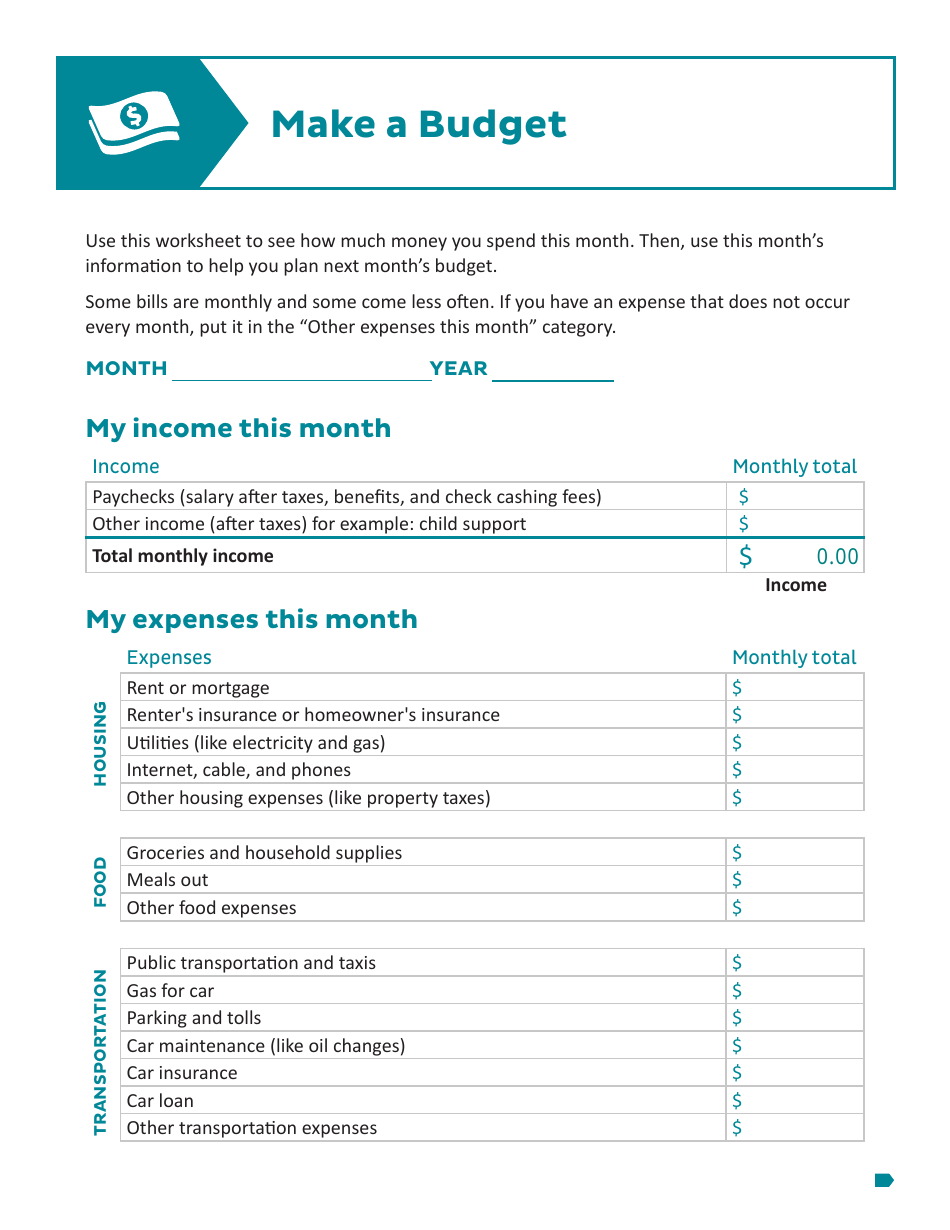

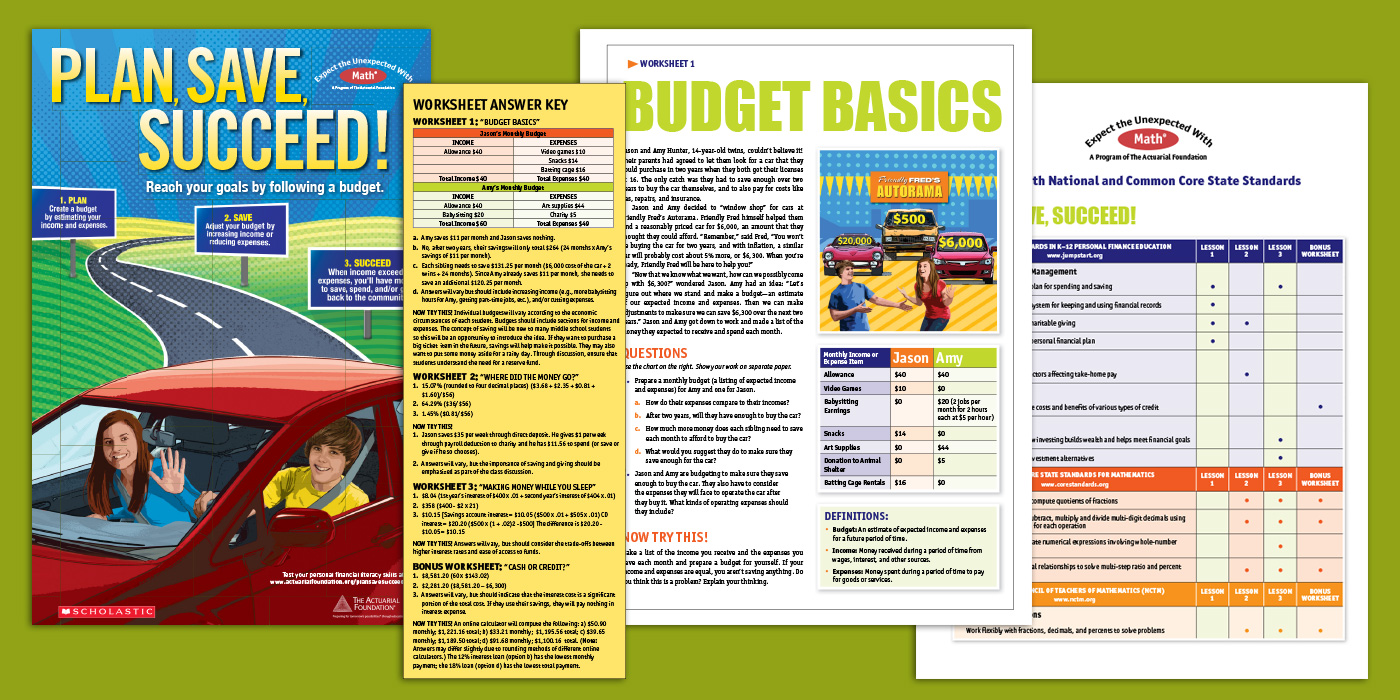

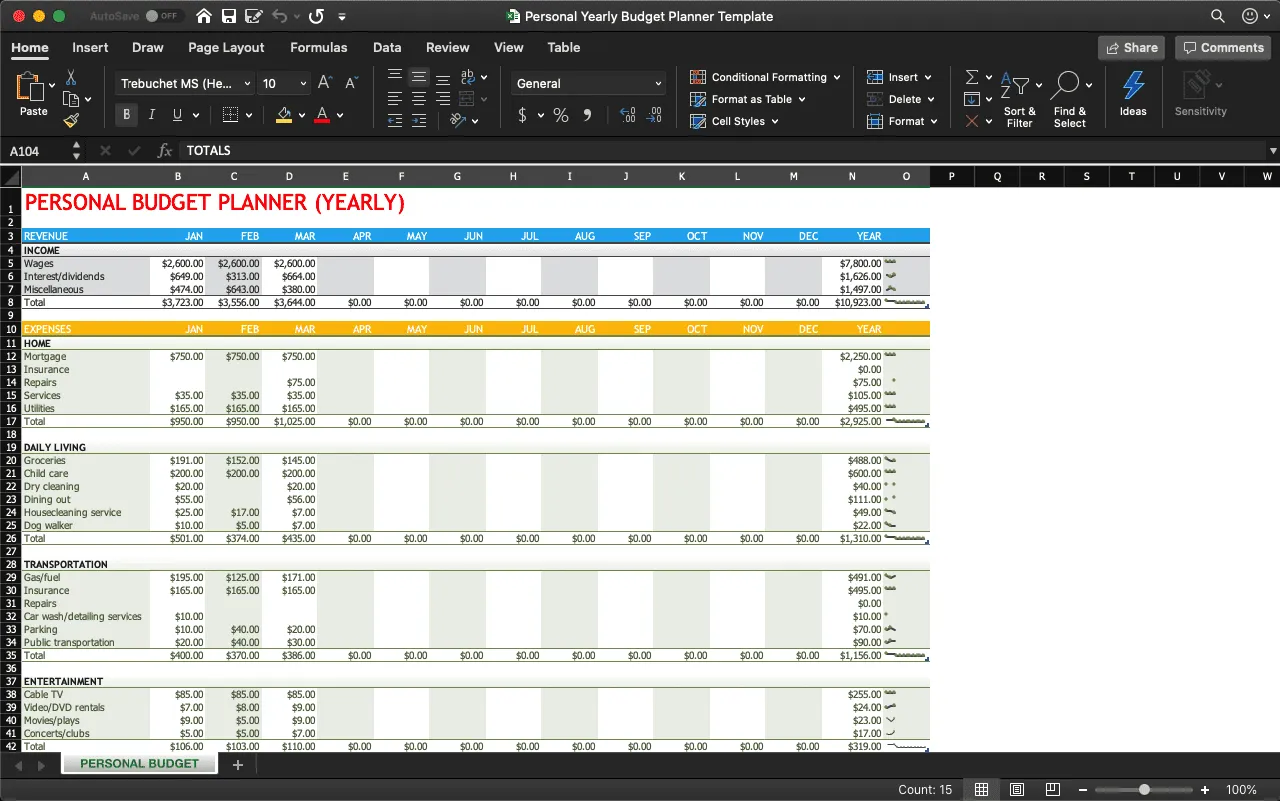

Printable The Student Budget Worksheet Answers

Prefect The Student Budget Worksheet Answers. If you hope to secure these outstanding photos regarding The Student Budget Worksheet Answers, press keep button to store these photos in your laptop. There’re prepared for download, If you like and want to have it, simply click keep badge on the page, and it’ll be instantly saved to your computer. Finally If you hope to grab unique and recent graphic related with The Student Budget Worksheet Answers, divert follow us on google help or save the site, we try our best to provide daily up grade in the same way as fresh and new shots. Hope you like keeping right here. For many up-dates and latest news roughly The Student Budget Worksheet Answers pics, keep busy lovingly follow us upon tweets, path, Instagram and google plus, or you mark this page upon book mark section, We attempt to give you update periodically later than fresh and new pics, like your browsing, and find the ideal for you.

When a query is executed, a standing bar shows the current total question duration. Click on a database or schema to explore the database objects contained inside. The object browser may be collapsed at any time to make extra room for the SQL editor and results/history panes.

The worksheet could also be integrated into the filing package, or could solely be a software for the filer to figure out the worth, but without requiring the worksheet to be filed. Overall, analysis in early childhood training reveals that worksheets are recommended primarily for assessment functions. Worksheets shouldn’t be used for teaching as this is not developmentally applicable for the schooling of young college students. Worksheets are essential as a outcome of those are particular person activities and oldsters also need it. With evolving curricula, dad and mom might not have the required schooling to information their students via homework or provide further help at house.If you are looking for The Student Budget Worksheet Answers, you’ve arrive to the right place. We have some images approximately The Student Budget Worksheet Answers including images, pictures, photos, wallpapers, and more. In these page, we next have variety of images available. Such as png, jpg, vivacious gifs, pic art, logo, black and white, transparent, etc.