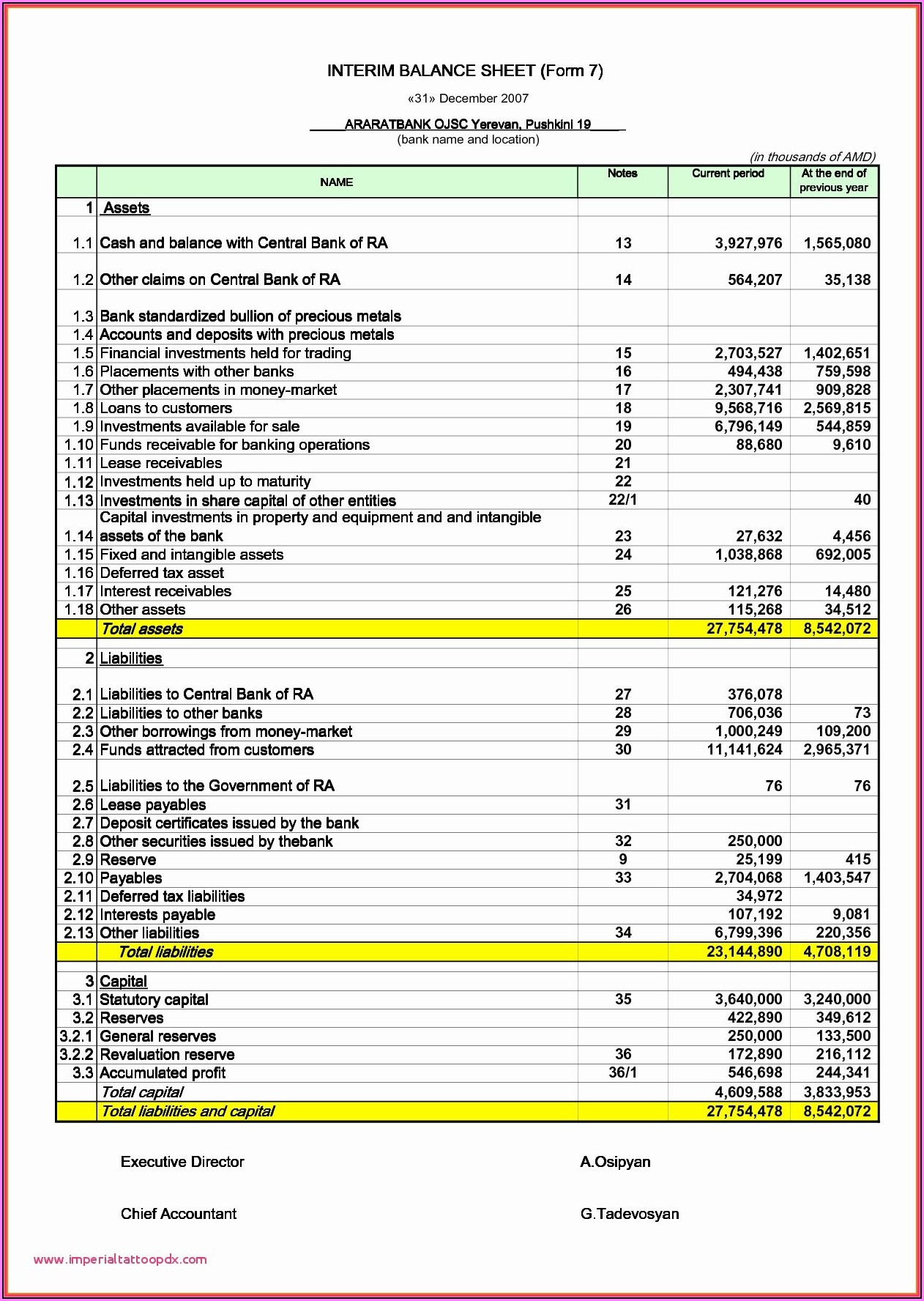

Reconciling A Bank Statement Worksheet. Print Reconciliation Report- The Print Reconciliation Report link exports a summary of the reconciliation to a PDF file for printing. Select the status of this transaction from the drop-down record. Ideally, you should reconcile your bank account each time you obtain a statement from your bank. The exercise also requires the students to complete a abstract and a examine guide reconciliation.

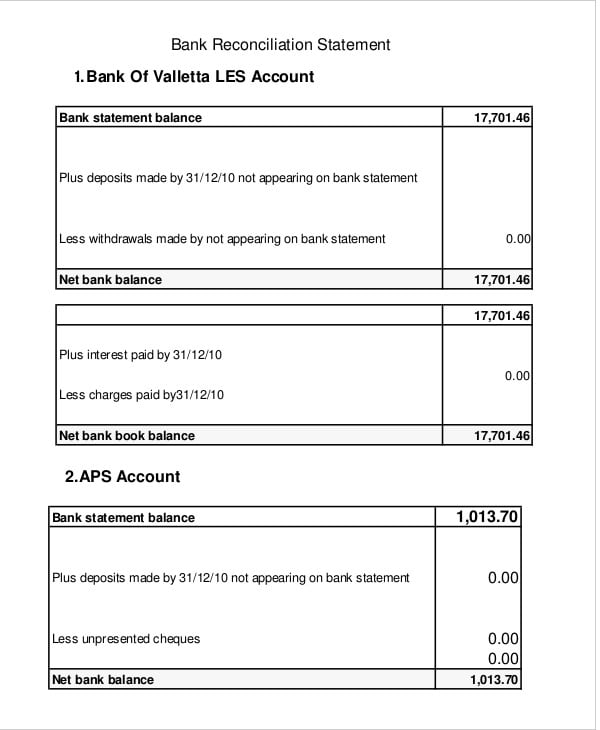

Match the deposits within the business data with these in the bank assertion. Button when all bank transactions are matched and the deposit, withdrawal and ending balances are equal. Now, the “adjusted financial institution balance” on the reconciliation worksheet is the identical as the stability proven in the check register of $57,843.00.

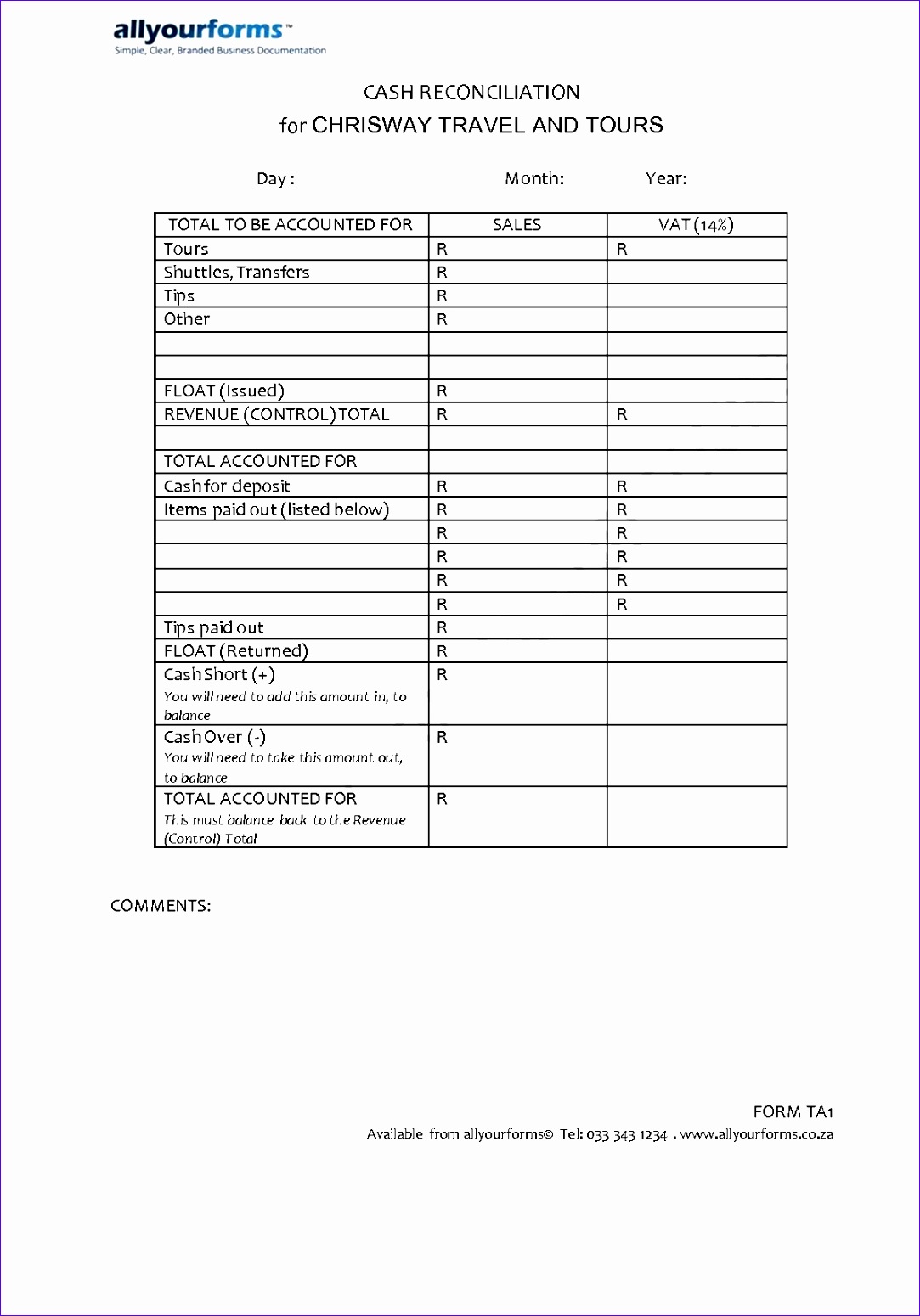

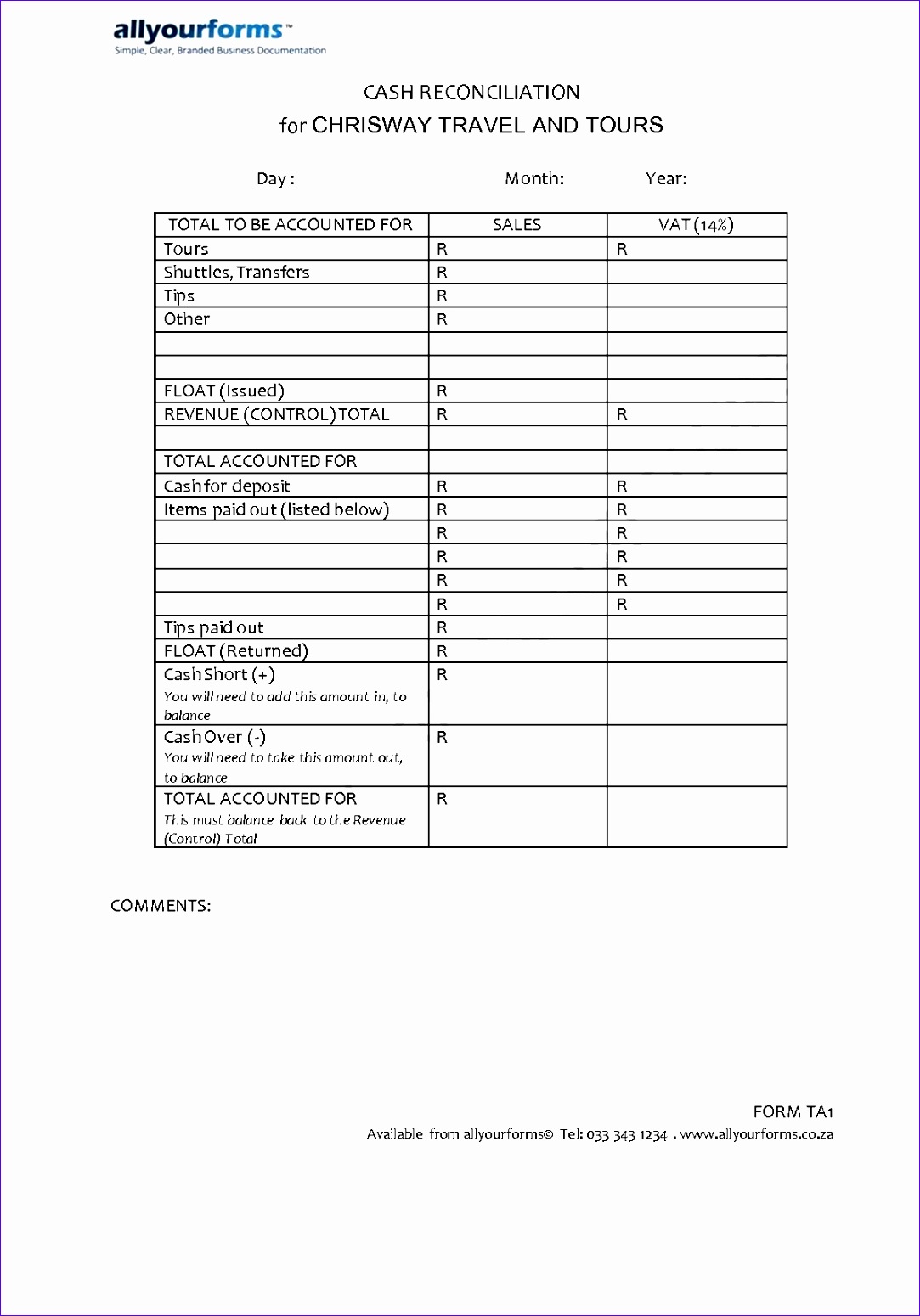

Reconcile deposits per cash receipts journal and disbursements per money disbursements journal for period to… Bank Account- This pull-down menu allows you to choose which checking account the reconciliation is for.

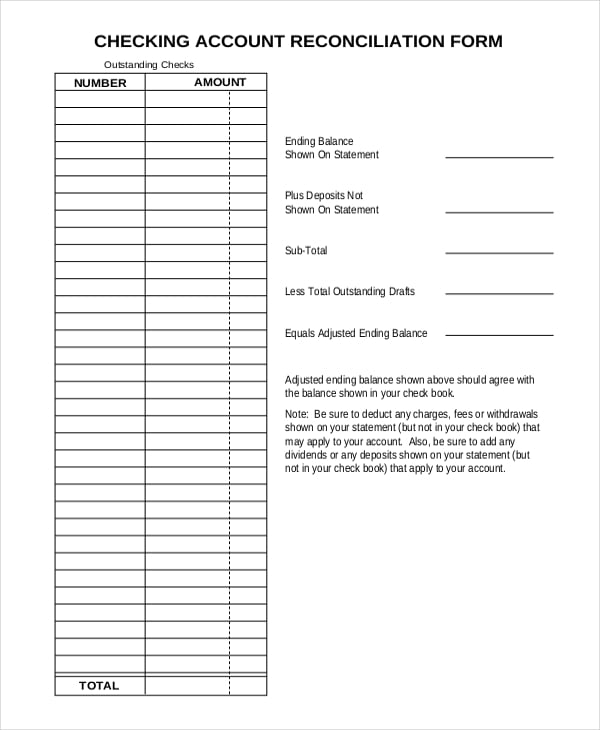

Checking Account Reconciliation Worksheet

On June twenty ninth, Case Farms issued examine #233 for $8,933 that has not but cleared the financial institution. Il texas volunteer utility by checking this field i comply with the consent for criminal records verify and the phrases and conditions of this software.

Enter within the bank reconciliation module the ending cash balance famous on the bank assertion. The company may have recorded some deposits that were not recorded by the bank.

How To Do Financial Institution Reconciliation?

When the transactions are reconciled, each the money journal and the source transaction’s reconciliation shall be updated with this date. If a matched document has been reconciled, the system-assigned reconciliation index number shows.

The system will ignore any entry in this field for these varieties of transactions. Multiple cash transactions can be chosen to match transactions in a set. However, only a single bank transaction could be selected.

Checking Accounts Unit

Transactions with more flexibility should be manually reviewed, whereas transactions from the inflexible rule units can usually be processed without evaluate. A system-assigned number that represents each distinct matched set. This permits the transactions being reconciled together to be simply reconciled.

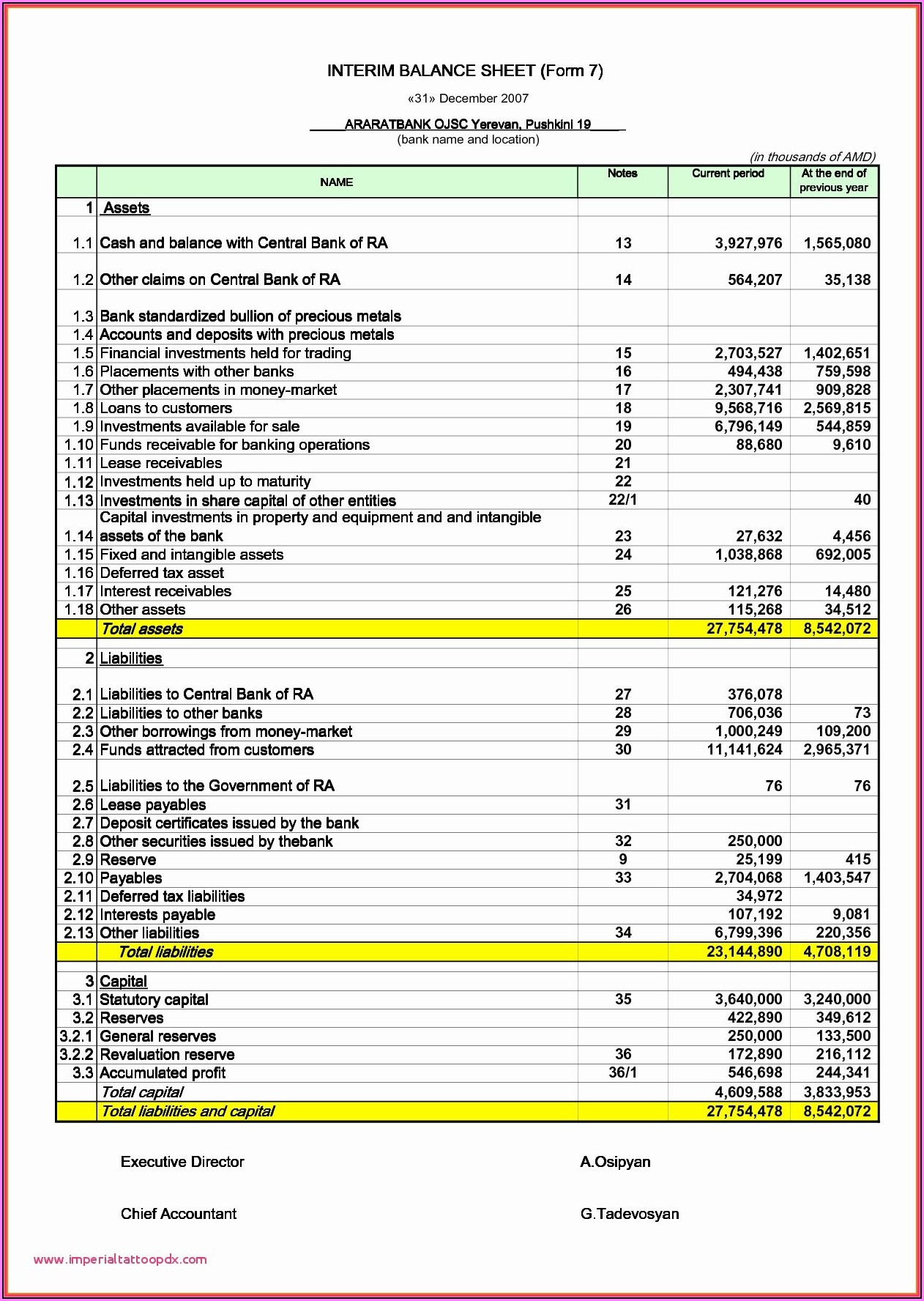

Once the balances are equal, businesses need to arrange journal entries for the changes to the stability per books. The subsequent step is to regulate the cash balance within the business account. If only one checking account exists within the financial institution group, then the account will display mechanically.

Bank Statement Reconciliation Worksheet

This field is used to identify the worksheet from other statements. In many cases this is a sequential quantity entered by the user. Will act as a filter by which cash transactions are loaded into the worksheet.

This area can only be accessed in case you are adding a brand new cash detail line. If you click this button after matching has occurred, any remaining unmatched pairs might be discovered and matched. Type up to sixty four alphanumeric characters for the outline of this reconciliation worksheet.

If you are including a new transaction, this field is required. Type or query to pick the GL account number for this transaction. The standing of Voided isn’t legitimate through the reconciliation course of.

This may occur when a verify has a Posting Date of the earlier month in Escapia, but was not on the previous month’s bank assertion, and subsequently has not been reconciled. This is like writing a examine and that recipient doesn’t cash it until the following month.

Or your system administrator for more information). To entry this button, a rule set have to be indicated for the selected financial institution group.

If there might be an undocumented reconciling merchandise, evaluate the financial institution reconciliation process steps simply noted. If there’s nonetheless an undocumented variance, return to the financial institution reconciliations for the preceding durations and see if the variance arose in a previous period. If so, investigate the earlier intervals to locate the distinction.

Payments and Checks- This section is the whole quantity of all Checks entered in Escapia in the course of the Book Start Dateand Book End Date. Statement Date- This is the date that the Bank Statement ends. Usually this is the last day of the month, however, some banks may have a special day because of weekends and holidays.

This pdf will assist you to perceive the broad idea 1. Check field is selected), financial institution and cash transactions for which the transaction date occurs earlier than the closing date display.

If you’re including a model new cash element line, this subject is overwritten with the bank transaction date of the matched bank detail line. You can sort or query to pick a special bank statement to be reconciled.

Balances have to be zero so as to carry out the reconciliation. Start a new business with BizFilings’ interactive guides that can help you choose the best kind of enterprise, incorporate, and plan & put together for enterprise success. Our solutions for regulated financial departments and establishments help customers meet their obligations to exterior regulators.

For most farms and ranches, this act normally takes place between the bank statement and the checkbook register or monetary accounting software such as Quicken or QuickBooks. Outstanding checks are those which have been written and recorded in cash account of the enterprise but haven’t yet cleared the bank account. This usually happens when the checks are written in the previous couple of days of the month.

You can even routinely clear checks primarily based on a bank file. Adjust the money balances within the business account by adding curiosity or deducting monthly expenses and overdraft charges.

If you’ve earned any interest on your bank account steadiness, they should be added to the money account. This is a complete unit on checking accounts together with vocabulary, writing a verify, completing a deposit slip, completely different endorsements, reconciling a financial institution statement.

Users are allowed at discover any reconciliation record, regardless of the bank account. The amount may be overwritten if the bank quantity is totally different than the system amount and the original transactions are not to be modified. Select just one line of the matched set; all different strains with the same match index might be mechanically chosen.

Print Reconciliation Report- The Print Reconciliation Report link exports a abstract of the reconciliation to a PDF file for printing. After reconciling the financial institution is completed, Escapia recommends that this report is exported to a PDF and both saved or printed out, after which kept on report for future reference. Search- This is used to refresh the data in bank reconciliation based mostly on the Book Start Date and Book End Date.

The bank transactions are imported automatically allowing you to match and categorize numerous transactions at the click of a button. This makes the bank reconciliation process environment friendly and controllable. At the tip of this course of, the adjusted bank balance on the reconciliation worksheet should match your check register or financial software program balance.

The amount of financial institution transaction withdrawals on the worksheet for prior bank statements that have been marked as matched. During this review process of your verify register denote what checks and deposits that appear on the bank assertion. Most check registers have a column that allows you to write in a checkmark to signify that the transaction has cleared.

If any checks recorded by the bank as having cleared are listed incorrectly by the financial institution, contact the bank and ship them documentation of the error. This difference between the recorded quantities of the financial institution and the corporate will stay till such time as the bank adjusts its records.

Most users only have one checking account in Escapia, nonetheless it’s attainable to have extra. If you do have a number of financial institution accounts, confirm the right account for reconciliation is selected.

Enter any outstanding adjustments as of the tip of the month you might be reconciling. If it’s not, you might need to look via transactions in Escapia to search out the quantity that’s within the distinction.

In the meantime, the distinction will be a reconciling item. This subject is required if you’re adding a direct verify or vouchered fee. If you might be creating a model new unallocated billing receipt, type or query to select the matter quantity.

This could also be due to a not adequate funds situation, or as a outcome of the bank doesn’t settle for overseas checks. These deposits shall be reconciling gadgets until such time as the corporate can persuade the bank to deposit them or finds another way to convert the deposited checks to money. It can also require the reversal of these deposited items within the information of the corporate.

What is bank reconciliation assertion with example?

Bank Reconciliation is a process that gives the reasons for differences between the financial institution assertion and Cash Book maintained by a business. Not solely is the method used to find out the variations, but additionally to bring about modifications in related accounting data to keep the records updated.

Type the quantity of the transaction that’s to be reconciled. Bank transactions show the person transaction’s reference quantity.