Day And Night Worksheet. This public-private partnership, between the IRS and tax software program suppliers, makes approximately a dozen brand-name business software merchandise and e-file obtainable for free. Talk about daytime and nighttime differences and pair this craft with day and night basic ideas, activities and extra crafts. If you bought an automated extension of time to file Form 1040, 1040-SR, or 1040-NR by submitting Form 4868 or by making a cost, enter the amount of the cost or any quantity you paid with Form 4868. In June of 2017, I left the classroom to develop the Living in GRATITUDE Today Movement.

Attend a public meeting on August three and fill out a web-based survey by August 31 to give input on how the City and neighborhood can finest scale back wildfire threat. We do not take the problem of plagiarism rightly. As a company we strive as a lot as potential to make sure all orders are plagiarism free.

Cutting the paper may cause issues in processing your return. Don’t attach correspondence or other items except required to do so.

Why Im Grateful Worksheet

Focus on the “Haves.” Instead of serious about what you might be missing, think about what you have. Write down a minimum of three things you would possibly be grateful for each evening.

You didn’t take the minimal required distribution out of your IRA or other qualified retirement plan by April 1 of the 12 months following the yr you reached age 72. You may be charged a penalty equal to 50% of the social security and Medicare or RRTA tax due on ideas you obtained however didn’t report again to your employer..

Writing Middle Starter Kit! Printables

Generally, tax returns and return info are confidential, as stated in Code part 6103. However, Code part 6103 allows or requires the Internal Revenue Service to reveal or give the data shown in your tax return to others as described in the Code. We may disclose your tax info to the Comptroller General of the United States to permit the Comptroller General to evaluate the Internal Revenue Service.

Complete the worksheet that applies to you or let the IRS figure the credit score for you. You can solely use your 2019 earned income if it is greater than your 2021 earned income..

Instructor Planner

Your employer will figure and acquire the RRTA tax. Fill in Form 6251 instead of using the worksheet should you claimed or received any of the next objects. Enter the deductible expenses related to earnings reported on line 8k from the rental of personal property engaged in for revenue.

You purchased 10,000 shares of ABC Mutual Fund frequent inventory on July 8, 2021. ABC Mutual Fund paid a money dividend of 10 cents a share.

Refunds

You might have the ability to take this credit by completing and attaching Form 5695 should you paid for any of the following during 2021. Took a full-time, on-farm training course given by a college or a state, county, or local government agency.

This is particularly true for kids and using gratitude to boost resilience, enhance wellbeing, and encourage a optimistic outlook on life. Firstly, present an evidence to the category about feeling grateful and have a dialogue. Then, have the scholars close their eyes and visualize somebody they’ve been kind to or helped, and to recall how this made them really feel as nicely as what the opposite particular person mentioned or did.

Health insurance coverage premiums paid or reimbursed by the S corporation are proven as wages on Form W-2. Any reimbursements you received for these bills that weren’t reported to you in box 1 of your Form W-2.

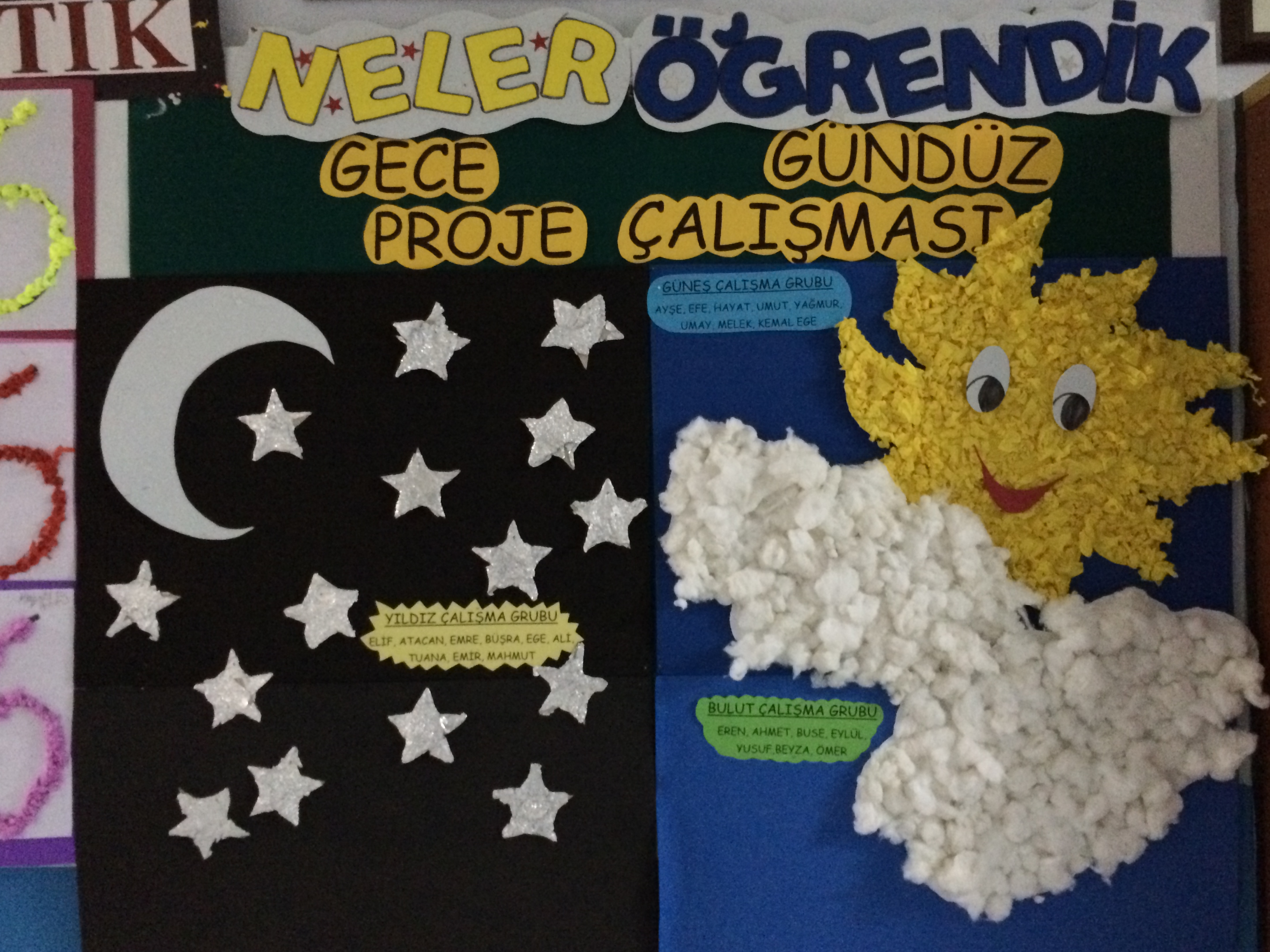

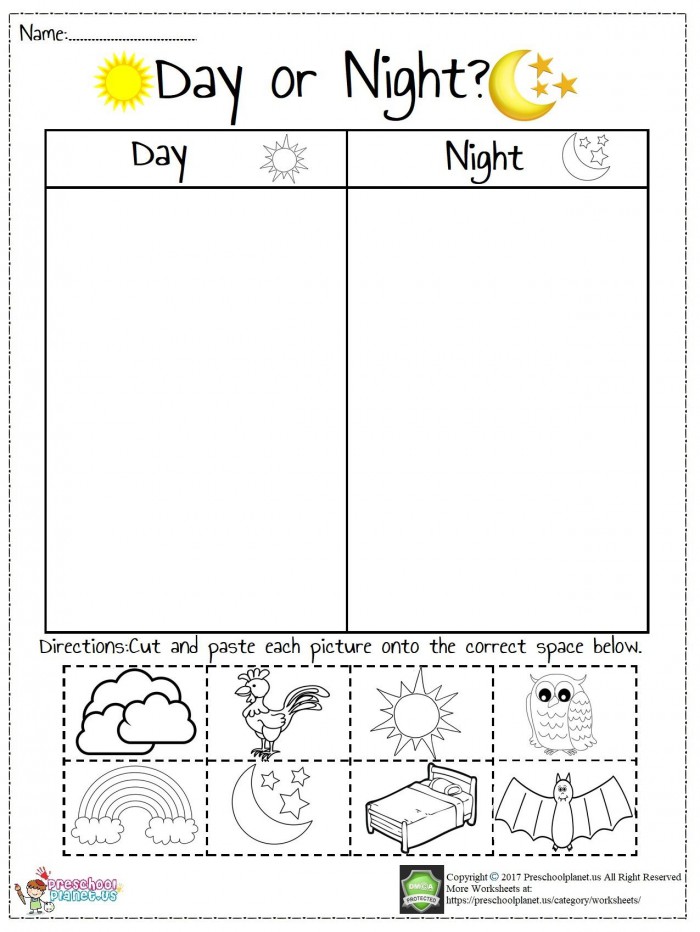

Day And Evening: Cut And Paste Sorting Exercise

Line 8kIncome from the rental of non-public property if you engaged within the rental for profit however weren’t within the business of renting such property. Lines 35a Through 35dAmount Refunded to YouEffect of refund on advantages. Line 19Nonrefundable Child Tax Credit and Credit for Other DependentsForm 8862, who must file.

This amount should be proven in field eleven of Form 1099-DIV. A registered domestic associate in Nevada, Washington, or California must usually report half the mixed neighborhood income of the person and his or her domestic companion.

When you face these conditions, don’t despair. You can use EaseUS Data Recovery Wizard to help you restore the misplaced Excel file, even though it has been permanently removed. In this article, you’ll be able to be taught to undo deleted sheet in Excel and get well permanently deleted Excel document with information recovery software.

Enter any tax on accumulation distribution of trusts. Enter any Section 72 excess benefits tax.

One is closing the Excel file with out saving to revive the deleted worksheet, and the other is clicking the save button to maintain all the changes but lose the chance to undo deleted information. It’s tough to resolve as each alternative will pressure you to surrender one thing. Accidentally deleted a worksheet in Excel?

“I’ve screwed everything up, so I don’t need to have this”. The original beliefs about yourself, shaped in childhood or up to now, such as I can’t do anything proper, I’m a screw up, I’m not good enough, something’s mistaken with me… and I’m unfit. 2) Our own habits; failures, losses, regrets and disappointment in ourselves.

When one aspect of the Earth faces the Sun, it’s daylight. On the alternative facet of the Earth it is evening.

When I was a highschool instructor, my college students have been required to write down down 20 issues they had been grateful for that had been unique to the month. Slowly however absolutely, lots of them saw the advantages.

Taxpayers can find information on IRS.gov in the following languages. If you or somebody you understand must file past due tax returns, use Tax Topic 153 or go to IRS.gov/Individuals for assist in filing those returns.

You must additionally notify the trustee or custodian of your account of the year to which the deposit is to be applied (unless the trustee or custodian will not settle for a deposit for 2021). If you don’t, the trustee or custodian can assume the deposit is for the yr during which you’re submitting the return. For example, when you file your 2021 return throughout 2022 and don’t notify the trustee or custodian in advance, the trustee or custodian can assume the deposit to your IRA is for 2022.

Once they’ve worked out which classification the animal belongs to, they might need to paste the animal in the correct column. These worksheets could be laminated and held together with a hoop.

Cash wages include wages paid by check, money order, and so forth. But don’t rely amounts paid to an employee who was under age 18 at any time in 2021 and was a student.

The free revision is offered inside 7 days after the assignment has been delivered. We supply free revision until our consumer is happy with the work delivered.

Reduce the quantity on your Schedule D , line 18, by your capital gain excess.4. Include your capital acquire excess as a loss on line sixteen of your Unrecaptured Section 1250 Gain Worksheet in the Instructions for Schedule D . You are filing Schedule D, and Schedule D, lines 15 and 16, are both greater than zero.

Many people will solely must file Form 1040 or 1040-SR and none of the numbered schedules, Schedules 1 via three. However, in case your return is extra sophisticated , you will need to complete one or more of the numbered schedules.

If you’re getting ready a return for somebody who died in 2021, if that particular person was otherwise eligible to obtain the RRC, you can claim the RRC for that individual on their return. Reminder—If you have a qualifying child, complete and fasten Schedule Earned Income Credit. Reminder—If you’ve a qualifying child, full and connect Schedule EIC.

You can attach Form 9000 to your Form 1040 or 1040-SR or you’ll have the ability to mail it individually. Self-employed people could claim these credit for the period beginning on April 1, 2021, and ending September 30, 2021. For extra info, see the instructions for Form 7202 and Schedule 3, line 13h.

Income from the rental of personal property when you engaged in the rental for revenue however weren’t in the enterprise of renting such property. Enter on line 8j any earnings from the train of stock choices not in any other case reported on Form 1040 or 1040-SR, line 1. You might be claimed as a dependent by another person in 2020.

In the evening, our facet of Earth is rotating away from the Sun. This is when we see the sunset, which marks the beginning of a new night time. This day-night cycle takes a full twenty-four hours to complete.

This app is a bit cheaper than the Gratitude Journal app, but it may be simply as useful. It also permits the consumer to create a every day gratitude entry with space for the one factor you’re most grateful for. You also can share your gratitude on social networks, edit and add filters to your gratitude entries, and add frames to photos.

Check the suitable field on your spouse. However, in case your partner died on February 12, 2021, your spouse isn’t considered age sixty five. ITINs assigned before 2013 have expired and must be renewed if you want to file a tax return in 2022.

Enter your jury duty pay should you gave the pay to your employer as a result of your employer paid your salary while you served on the jury. Skip strains 6 and seven, enter -0- on line eight, and go to line 9.Yes.

TAS works to resolve large-scale issues that affect many taxpayers. If you know of considered one of these broad issues, please report it to TAS at IRS.gov/SAMS.