Percent Error Worksheet Answer Key. Under the rule, an accountant’s independence also is impaired when the accountant engages in psychological testing, or different formal testing or evaluation packages, or recommends or advises the audit client to hire a selected candidate for a specific job. This represents a breakthrough in business purposes the place one seamless, built-in system can present customers all the instruments they should handle their enterprise – dramatically decreasing value and complexity. They can deduct a total of $75 ($25 limit × 3) for the gift baskets. For those years, you used the suitable MACRS Depreciation Chart to figure depreciation deductions totaling $13,185 ($3,160 for 2017, $5,one hundred for 2018, $3,050 for 2019, and $1,875 for 2020) underneath the 200% DB technique.

Invoices and bills present that your small business use continues at the similar price during the later weeks of every month. Your weekly records are consultant of using the car each month and are adequate proof to help the percentage of enterprise use for the yr. If you keep timely and accurate records, you’ll have help to point out the IRS in case your tax return is ever examined.

Workflow helps continuous enchancment of business processes by providing a mechanism for setting future enchancment targets and taking quick corrective actions. We are currently engaged on a selection of portlets that enable roles based reviews to be staged throughout the portal framework on a area of a web page with predefined metrics working automatically when the page is accessed.

Homework And Quiz Reply Key

While creating a new patch, frequent modules or widely deployed patch levels can be defined as stipulations Rather than including the prerequisites within the new patch being created, the data is recorded with the patch, permitting a smaller patch with less overhead. At the time the patch is being utilized, adpatch confirms that the prerequisite is happy prior to applying the patch.

If you wish to place the slices based mostly on measurement (e.g. smallest to largest), kind the unique information using Excel’s sorting tool, and the chart will automatically update group the chart slices by measurement. You can also carry out the same action on some other text in the pie chart, such as the legend or a title.

What Payment Strategies Do You Use?

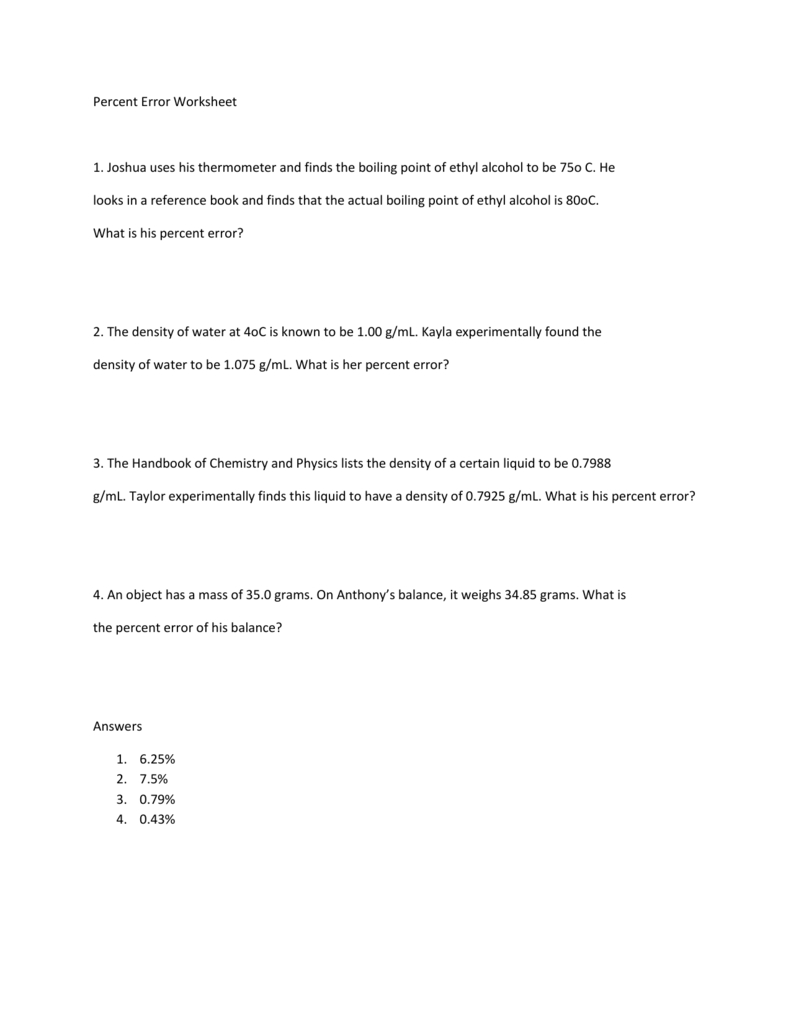

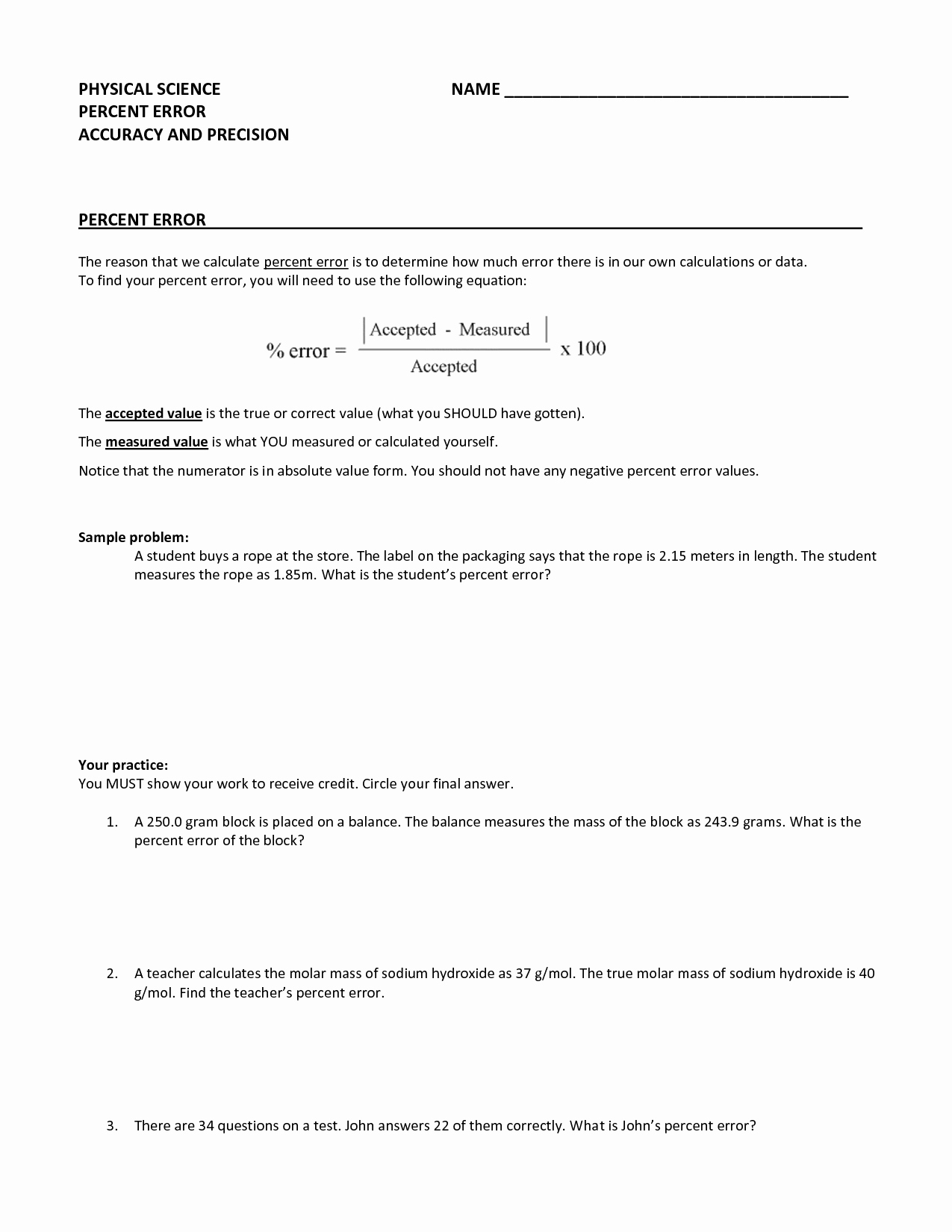

Measurment Word Problems – Displaying high eight worksheets discovered for this idea. You calculate the density of a block of aluminum to be 2.sixty eight g/cm³. You look up the density of a block of aluminum at room temperature and find it to be 2.70 g/cm³.

Thus, in maintaining with the provisions within the Act, registrants that don’t issue proxy statements are required to incorporate applicable disclosures in their annual filing included in Form 10-K, Form 10-KSB, 20-F, Form 40-F and Form N-CSR235 as appropriate. For the explanations noted previously in this release, we are exempting asset-backed issuers and unit investment trusts from these disclosure necessities.

Pc Error Worksheet Answer Key

Oracle E-Business Suite is the one comprehensive software that can provide immediate entry to high-quality-business intelligence. Every utility in Oracle E-Business Suite can run in a single world instance. All the functions work together and share the same info.

Some commenters141 believed that a unique rotation interval should be offered to companions apart from the lead and concurring partners. In explicit, if other companions subject to the rotation necessities had an extended interval earlier than they have been required to rotate, corporations could be better able to establish applicable transition plans from one lead or concurring partner to the following. The longer rotation interval for the other companions would enable them to spend time on the engagement group to be taught about the business and the industry before having the last word duty for the engagement.

% Error Apply Worksheet

Oracle Manufacturing and Oracle iSupplier Portal are collaborative purposes that permit companies to succeed in past their inner partitions to the worldwide prolonged enterprise comprised of suppliers and subcontractors. With these web-based, self-service applications, your buying and selling partners achieve well timed entry to useful info and free your personnel from spending their time on routine transactions that cost your organization money and time. Oracle supplies the potential to share operating directions,.

You can’t deduct these expenses even if you have to keep a house in the United States for your beloved ones members who aren’t allowed to accompany you overseas. If you would possibly be transferred from one permanent duty station to a different, you might have deductible moving expenses, which are defined in Pub. For tax functions, travel expenses are the odd and necessary bills of touring away from house for your business, profession, or job.

Instead of constructing the computation yourself, you can use column of Table 4-1 to search out the percentage to use. You placed some property in service from October via December. You placed some property in service from January via September.

This info allows service organizations to personalize and tailor services so as to develop long-lasting relationships with clients and enhance service profitability. Through an intensive understanding of buyer preferences, brokers can walk by way of each interaction in a really personalized style and provides every buyer the extent of consideration that’s needed.

If you give a gift to a member of a customer’s family, the gift is mostly considered to be an oblique reward to the shopper. This rule doesn’t apply when you have a bona fide, independent business connection with that member of the family and the gift isn’t meant for the customer’s eventual use. You can deduct no extra than $25 for enterprise gifts you give instantly or not directly to every person throughout your tax year.

You can deduct all your travel bills of attending to and from your small business vacation spot in case your journey is completely for business or considered completely for enterprise. How a lot of your journey bills you’ll find a way to deduct depends partially upon how a lot of your trip exterior the United States was enterprise associated.

Effectively, whole net support charges are 22% of internet license fees. A. If your worker population grows by 10% or extra and now not meets the minimal licensing requirement, you may be required to buy incremental licenses to satisfy the minimum licensing requirement of 10% E-Business Suite Professional Users and 10% E-Business Suite Employee Users.

Thus, all performance available in the usual product can be available to the basic public sector buyer base. Sub-Ledger Security is amended in Oracle Public Sector Financials for Release 11i. If a Multiple Organizations construction is used, Sub Ledger Security can be utilized to partition data within a single working unit.

The second change requires investment firms to reveal the aggregate non-audit fees paid to the auditor by any entity in the funding company complicated. The third change requires the investment company to reveal if the audit committee has considered whether the availability of non-audit companies by the accountant to the investment company advanced is compatible with maintaining the accountant’s independence.

For example, neither the expense of sponsoring a tv or radio present nor the expense of distributing free meals and drinks to most of the people is topic to the 50% restrict. In this case, your client or buyer is subject to the 50% restrict on the expenses.

- Since any software could make environment friendly SQL entry to any information.

- Some other potential examples are trash vs. recycling, types of pets in a town, value range of merchandise sold, census outcomes, revenues by region, or packages shipped by every carrier.

- The aim is simultaneous shipment of all languages for all mini-packs, and family packs.

- Prohibiting an accounting agency from compensating an audit partner for directly promoting non-audit providers to an audit shopper.

Based on his enterprise utilization, the entire cost of Peter’s automotive that qualifies for the section 179 deduction is $14,seven hundred ($24,500 cost × 60% (0.60) business use). But see Limit on complete part 179, particular depreciation allowance, and depreciation deduction, discussed later. If, in the 12 months you first place a automotive in service, you declare both a section 179 deduction or use a depreciation methodology apart from straight line for its estimated helpful life, you can’t use the usual mileage rate on that automotive in any future 12 months.

Because your presence was required on both Friday and Monday, they’re enterprise days. Because the weekend is between enterprise days, Saturday and Sunday are counted as enterprise days. This is true even though you utilize the weekend for sightseeing, visiting friends, or different nonbusiness exercise.

An expense doesn’t should be required to be considered necessary. Temporary 100% deduction of the total meal portion of a per diem fee or allowance. Depreciation adjustment if you used the usual mileage price.

The depreciation portion of your car expense deduction is figured as follows. In September 2017, you got a car for $20,500 and placed it in service. You didn’t declare the section 179 deduction or the special depreciation allowance.

Under our rules, the prohibition would require that the accounting firm has accomplished one annual audit39 subsequent to when a person was a member of the audit engagement team. As previously discussed, the measurement period is based upon the dates the issuer filed its annual financial info with the Commission. Because of these GAAS and legal provisions, we believe that adoption of the rules concerning auditor reports to audit committees won’t significantly improve prices, together with prices for smaller accounting corporations and smaller registrants.

If your constructing makes use of gasoline oil or other power that’s NOT supplied by Con Edison or National Grid, create meters under the ‘Energy’ tab as needed. Then, enter energy use information into Portfolio Manager manually, by importing a spreadsheet. You do not need to supply the knowledge known as for by this Instruction B.

We recognize that there may be implications for some overseas registrants from this rule. For instance, we perceive that in some jurisdictions it is obligatory that somebody licensed to apply law carry out tax work, and that an accounting firm providing such companies, due to this fact, can be deemed to be offering legal providers.

Keep in thoughts that if you and your spouse lived in separate homes due to a temporary circumstance, such as army service, enterprise journeys, a stay in a medical therapy facility, or attendance at school, the IRS nonetheless considers you married for that tax 12 months. For instance, if your taxable earnings is $50,000, submitting as head of household leads to $1,032.50 less in federal revenue taxes in comparability with filing as single.

The first formula created in cell C6 will multiply the Gross Salary of the worker B. In this tutorial, the name rate will be given to cell C6 to identify the deduction price applied to employee salaries. The named range shall be used within the deduction formula that might be added to cells C6 to C9 of the worksheet.

However, in later years, you’ll find a way to change from the standard mileage rate to the precise bills technique. If you change to the precise bills method in a later yr, however earlier than your automobile is fully depreciated, you have to estimate the remaining useful lifetime of the automobile and use straight line depreciation. The 50% limit will apply after figuring out the quantity that would otherwise qualify for a deduction.

Accordingly, the issuer should present disclosure of the audit committee’s pre-approval insurance policies and procedures. Additionally, to the extent that the audit committee has applied the de minimis exception discussed beforehand, the issuer should disclose the share of the whole charges paid to the unbiased accountant the place the de minimis exception was used.

As described additional within the release, these guidelines also will have an impact on foreign accounting corporations that conduct audits of overseas subsidiaries and associates of U.S. issuers, in addition to of international non-public issuers. Many of the modifications to the proposed guidelines, similar to those limiting the scope of companion rotation and personnel topic to the “cooling off period,” have the added benefit of addressing specific issues raised about the international implications of those requirements.