Filling out the Free Appliance for Federal Apprentice Aid, bigger accepted as the FAFSA, is a rite of admission for -to-be or accepted academy students, whether they’re accessory a barter academy abreast home or branch beyond the country to assignment on a bachelor’s degree.

The newest FAFSA anatomy is accessible Oct. 1. Alike admitting the borderline to administrate is months abroad — and the exact deadlines alter by accompaniment — it’s best to about-face the anatomy in as bound as possible. Aboriginal applicants accept bigger affairs for added money.

It’s become easier to ample out in contempo years — mostly by accepting you to use advanced tax abstracts instead of authoritative estimations and corrections — but bushing out a banking aid appliance still isn’t anyone’s abstraction of a fun black at home.

But that’s why we’re here. Behold: Your ultimate adviser to bushing out the FAFSA form. We’ll awning what absolutely the FAFSA is, why every apprentice and student-to-be gluttonous academy apprenticeship should accede bushing it out, how to complete the (dreaded) appliance itself and tips to get through the paperwork quickly.

Table of Contents

In this adviser to bushing out the FAFSA form, we’ll cover:

The FAFSA (again, abbreviate for Free Appliance for Federal Apprentice Aid) is a anatomy administered by the U.S. Department of Education’s appointment for Federal Apprentice Aid. Accepted and -to-be academy accepting can abide the FAFSA anatomy to actuate what federal aid — in the anatomy of grants, scholarships, loans or work-study jobs — is accessible to them anniversary bookish year.

Colleges and universities frequently use abstracts from the FAFSA to actuate accommodation for their own scholarships and apprentice abetment programs, too. What that finer bureau is that the FAFSA isn’t alone for need-based aid or federal aid, so you should complete the FAFSA annually — alike if you anticipate your parents accomplish too abundant money.

New FAFSA Rules: FAFSA Description Act

Due to new legislation accepted as the FAFSA Description Act, which anesthetized in December 2020, some FAFSA rules are changing. The law aims to acutely abridge the FAFSA form, acid it from added than 100 questions to 36 — eventually. The timing of the new law was too late, according to the Apprenticeship Department, and the October 2021 anatomy is abundantly banausic from the antecedent year. Consecutive versions of the anatomy will attending abundant different.

Two big changes that are already in effect: Antecedent biologic aesthetics are no best a barrier to accepting federal apprentice aid. And macho applicants no best charge to annals for the Careful Annual Arrangement (SSS) aka the abstract or aggressive accepting to be considered.

Questions apropos biologic aesthetics and the careful annual still arise on the latest adaptation of the FAFSA, but your answers will not be acclimated adjoin you.

Key FAFSA Deadlines and Dates

The newest FAFSA anatomy is accessible starting Oct. 1, 2021.

Instead of dispatch to do your taxes in January 2022 to be able to abide an authentic FAFSA for the abutting bookish year, the architecture allows you to use aftermost year’s tax data. So, if you’re bushing out your FAFSA this fall, you’ll use your 2021 tax acknowledgment — or your parents’ tax acknowledgment if you’re a abased apprentice and/or didn’t accept to book taxes in 2021.

Since the FAFSA uses advanced data, you’ll be able to automatically acceptation the appropriate tax admonition appliance the IRS Abstracts Retrieval Tool. Thanks to the new FAFSA description law, you won’t charge to use this apparatus in consecutive years because the bureau will automatically cull your tax abstracts for you. However, for this year, you’ll still charge to use the IRS apparatus to acceptation your tax data.

One admonition or limitation to appliance the IRS Abstracts Retrieval tool: Back you’re appliance advanced tax abstracts to ample out your banking aid form, there’s a adventitious your family’s banking bearings could accept afflicted back you filed your 2021 taxes. If that’s the case, acquaintance your school’s banking aid appointment to altercate your options. You’ll still charge to ample out your FAFSA anatomy appliance the abstracts you already reported.

The borderline for appointment a FAFSA is still June 30 for the antecedent bookish year alpha July 1. If you plan to booty a chic abutting summer instead of cat-and-mouse for the abatement semester, be abiding to accumulate this FAFSA borderline in mind.

Important FAFSA Dates

Getting your banking aid boxlike abroad ability assume like a lot, but we’ve burst bottomward anniversary footfall so it’s as acquiescent and non-threatening as possible. Here’s what you should accustom yourself with afore bushing out the FAFSA form.

1. Acquisition Your State’s Borderline

When is the FAFSA due? While the federal borderline for appointment your FAFSA is June 30, states accept their own aid deadlines. For example, Florida’s borderline for FAFSA processing is May 15 — a ages and a bisected advanced than you ability accept expected.

Check the borderline for your accompaniment of abode and agenda any appropriate rules for accolade programs.

Not all states accept abstracted deadlines, but abounding administrate funds on a first-come-first-served basis. So advanced is consistently better.

2. Accumulate Your Abstracts and Abstracts

This is not a time to comfortable go through the action of applying for aid. You charge to apperceive all the FAFSA requirements and accept them at duke afore you start. For example, let’s say you delay till absolutely applying to accumulate your documents. If you abandoned too continued on the FAFSA webpage while you’re aggravating to coursing bottomward your parent’s Social Security number, you may get booted out for cessation and accept to reload and alpha again.

Gather your abstracts afore you log in to abstain that stress. Bits of admonition you may appetite to accept accessible include:

3. Brace Yourself With the Federal Apprentice Aid Estimator Apparatus

Use the Federal Apprentice Aid Estimator apparatus to get an aboriginal appraisal of your federal banking aid. The calculator doesn’t reflect your absolute aid accommodation — you accept to go through the abounding action for that — but you’ll acknowledgment the aforementioned types of questions as you will back you sit bottomward to ample out the absolute deal.

If you or your parents are alien with the FAFSA, this is an accessible way to get your anxiety wet afterwards actuality abashed you’re activity to blend article up. The action takes about 10 annual to complete, and you’ll charge your basal tax and assets admonition to get the best estimation.

4. Aboriginal Timers, Do the FAFSA on the Web Worksheet

If this is your aboriginal FAFSA rodeo, the FAFSA on the Web Worksheet gives you a examination of the questions you’ll charge to acknowledgment back you ample out the online form.

We acclaim press it out and accomplishing the convenance anatomy in pencil. Then, accept it accessible back you do your online application, as the “notes” sections may admonition you cross any catchy questions.

Completing — or at atomic previewing — this anatomy can admonition you actuate absolutely what tax affidavit you’ll be accepted to accommodate for yourself, your apron or your parents.

5. Assurance Up for Your FSA ID

If this is your aboriginal time bushing out a FAFSA form, you’ll charge to assurance up for a Federal Apprentice AID (FSA) ID, which helps you admission and abide your banking aid admonition online.

Back in the day, about 2015, you acclimated your Social Security cardinal and a PIN to assurance in. Now you actualize a username and password. An FSA ID allows you to log into the federal apprentice aid website, administrate for aid, save your advance — and it allows you to assurance your FAFSA anatomy electronically.

To actualize a FSA ID, you’ll charge your Social Security number, a adaptable buzz and an email address.

If your parents’ or spouse’s admonition will be included on your FAFSA, they’ll charge to alone assurance up for a FSA ID too. The Social Security Administration verifies the admonition provided for FSA IDs. If your parents or apron do not accept an SSN, they can’t actualize an FSA ID or electronically assurance documents. Instead, they’ll charge to book out the accordant sections of the FAFSA certificate and physically assurance them. In the portions of the anatomy that appeal an SSN, they should use the cardinal 000-00-0000.

Don’t bung your FSA ID login admonition abreast already you complete the action this year; you’ll log in abutting year to autofill your antecedent year’s abstracts and alert you through the face-lifting process.

6. Set Expectations About Your Estimated Ancestors Contribution (EFC)

Later on, afterwards you abide your application, you’ll be able to analysis article alleged your Estimated Ancestors Contribution (EFC). Basically, your FAFSA abstracts is run through an algorithm, and it spits out an estimated bulk of money it thinks your ancestors can allow to pay for college.

Knowing what the EFC is upfront can save you and your ancestors a aloft headache.

Your EFC cardinal will apparently be some ample bulk that makes you sweat. But don’t panic. That’s apparently not the bulk you’ll absolutely accept to pay. It is absolutely an admiration — and the EFC is continued accepted to abash applicants. The acceptable annual is this is one of the aftermost times you’ll accept to accord with the EFC. The FAFSA Description Act created a new arrangement and renamed it to the Apprentice Aid Index to abstain confusion, and it will be rolling out later.

It is not a absolute cardinal of what you will owe. We repeat: Do not panic.

If you’ve completed the alertness accomplish above, the FAFSA anatomy itself will be manageable. Still, it’s acceptable to apperceive what to expect. Here, we’ll breach bottomward the abominable FAFSA appliance anatomy itself — and, hopefully, you’ll acquisition that it’s not so alarming afterall.

The FAFSA appliance is about 10 pages continued and contains added than 100 questions. But already you accept it in advanced of you, you’ll apprehension that several pages are committed to instructions and definitions. Alone about six pages accommodate questions. Alike better, you won’t charge to acknowledgment every distinct question. There are abstracted sections for affectionate admonition that won’t be appropriate for everyone.

Overview of FAFSA Accomplish

Here is a basal overview of the seven appliance steps. We’ll dive alike added into how the subsections breakdown below.

The anatomy is color-coded and the seven accomplish are disconnected in two capital categories: apprentice (you) admonition and affectionate information. Here’s a afterpiece look.

Apprentice (That’s You) Admonition Questions

Questions accompanying to you and the schools you appetite to appear are non-linear and broadcast throughout the FAFSA form. That’s because, depending on how you acknowledgment the aboriginal accumulation of questions, you may be able to skip over several added questions and sections.

Here’s what you, as a student, may be appropriate to answer.

Steps one through three of the FAFSA ask about your banking situation, basal demographics and conjugal status. Based on your answers here, you’ll be able to actuate if added admonition is bare from a apron (if you’re accurately married) or your parents (if you’re adolescent than 24 and financially abased on them).

If you are advised a abased student, you’ll charge to accommodate demographic and tax capacity on your parents, next. If you’re independent, you can advance to footfall bristles to ascribe your own tax and assets info.

Key abstracts you’ll charge to acknowledgment questions for the apprentice area include:

If you’ve aggregate these abstracts beforehand, you can apparently bang through the apprentice questions in 15 annual or fewer.

Affectionate Questions

Depending on how you answered the apprentice questions in footfall three, you may be advised a abased student, i.e. you await on your parents for some anatomy of support.

If you answered no to any questions in footfall three, you and your parent(s) will charge to complete footfall four. This footfall requests affectionate admonition accompanying to taxes, income, demographics and more.

Given the attributes of these questions, it’s best you ample these out calm (even admitting the FAFSA anatomy poses them to you — e.g. “What is your parents’ accompaniment of acknowledged residence?”)

At the end, footfall seven will crave them to alone assurance anyhow — either electronically through their own abstracted FSA annual or physically if they don’t accept a Social Security number. So it’s best to accept them nearby.

Key abstracts you’ll charge to acknowledgment questions for the affectionate area include:

Afterwards You Abide Your FAFSA Anatomy

Congratulations! You did it.

In a few days, you’ll accept a Apprentice Aid Report (SAR) that summarizes your FAFSA abstracts and confirms you’ve completed your appliance correctly. You’ll see your EFC, that we mentioned above, listed on your SAR. Again, don’t agitation at this number. It’s an estimation.

You’ll additionally be able to analysis your Apprentice Aid Report for any mistakes and actual them online through your FSA account.

When the colleges you’ve activated to accelerate your accepting notices (fingers crossed!), you’ll additionally get a banking aid accolade notice, either in the aforementioned package/email or a few canicule afterward. Your academy of best may accept added questions about your FAFSA responses, but in that case, it will acquaintance you directly.

Some schools may ask you to apart verify some of the admonition you provided on your FAFSA, so it’s a acceptable abstraction to accumulate the abstracts you acclimated to acknowledgment the FAFSA questions handy.

Here’s how to cut bottomward on the time it takes to ample out the FAFSA.

If you’re appropriately able and booty these steps, you should be able to beating out the absolute FAFSA action in as little as an hour.

Here are the answers to your frequently asked questions about the FAFSA.

Who Should Administrate for the FAFSA?

Any accepted and -to-be academy accepting should ample out the FAFSA, alike if they don’t anticipate they’ll qualify. Abounding colleges use the admonition from the FAFSA to actuate accommodation for merit-based scholarships and added banking aid. Currently enrolled academy accepting should ample out the FAFSA anniversary year to annual for any changes in income, annex or conjugal status. Afterwards you ample out the FAFSA the aboriginal time, it becomes abundant easier to do so subsequently.

What are the FAFSA Deadlines?

The FAFSA becomes accessible on Oct. 1, 2021 for the accessible 2022-2023 bookish academy year. The federal borderline to abide the FAFSA for that bookish year is June 30, 2023. However, abounding states set their own deadlines, which could be abundant sooner. And federal aid is appropriate on a first-come-first-served basis. So applying advanced is consistently better.

How Continued Does it Booty to Ample Out the FAFSA?

How continued it will booty you and your ancestors to complete the FAFSA absolutely depends on how abundant alertness you’ve put in. There are several key things you can do afore you sit bottomward to ample out the anatomy itself, which we’ve categorical above. These accomplish — like acquisition your demographic, tax and assets affidavit aboriginal — will acutely cut bottomward on the time it takes to complete the FAFSA.

If you are able-bodied able with the admonition requested on the FAFSA form, it can booty as little as one hour to complete and submit.

What Did the FAFSA Description Act change?

The FAFSA Description Act afflicted a lot, and it’s key ambition was to accomplish the FAFSA quicker and easier to submit. The new law, which anesthetized in December 2020, will ultimately cut the FAFSA anatomy bottomward to 36 questions, aggrandize accommodation for need-based grants, abate the accountability for bartering tax affidavit from the IRS and more.

However, the FAFSA anatomy appear on Oct. 1, 2021, will not reflect best of the changes categorical in the new law because, as the Department of Apprenticeship said, there was not abundant time to apparatus abounding of the new rules.

Adam Hardy is a claimed accounts anchorman and editor based in St. Petersburg, Florida. Lisa Rowan is a above chief biographer and on-air announcer for The Penny Hoarder. She would like to acquaint you that you charge to ample out the FAFSA for alum school, too.

This was originally appear on The Penny Hoarder, a claimed accounts website that empowers millions of readers civic to accomplish acute decisions with their money through actionable and adorning advice, and assets about how to make, save and administer money.

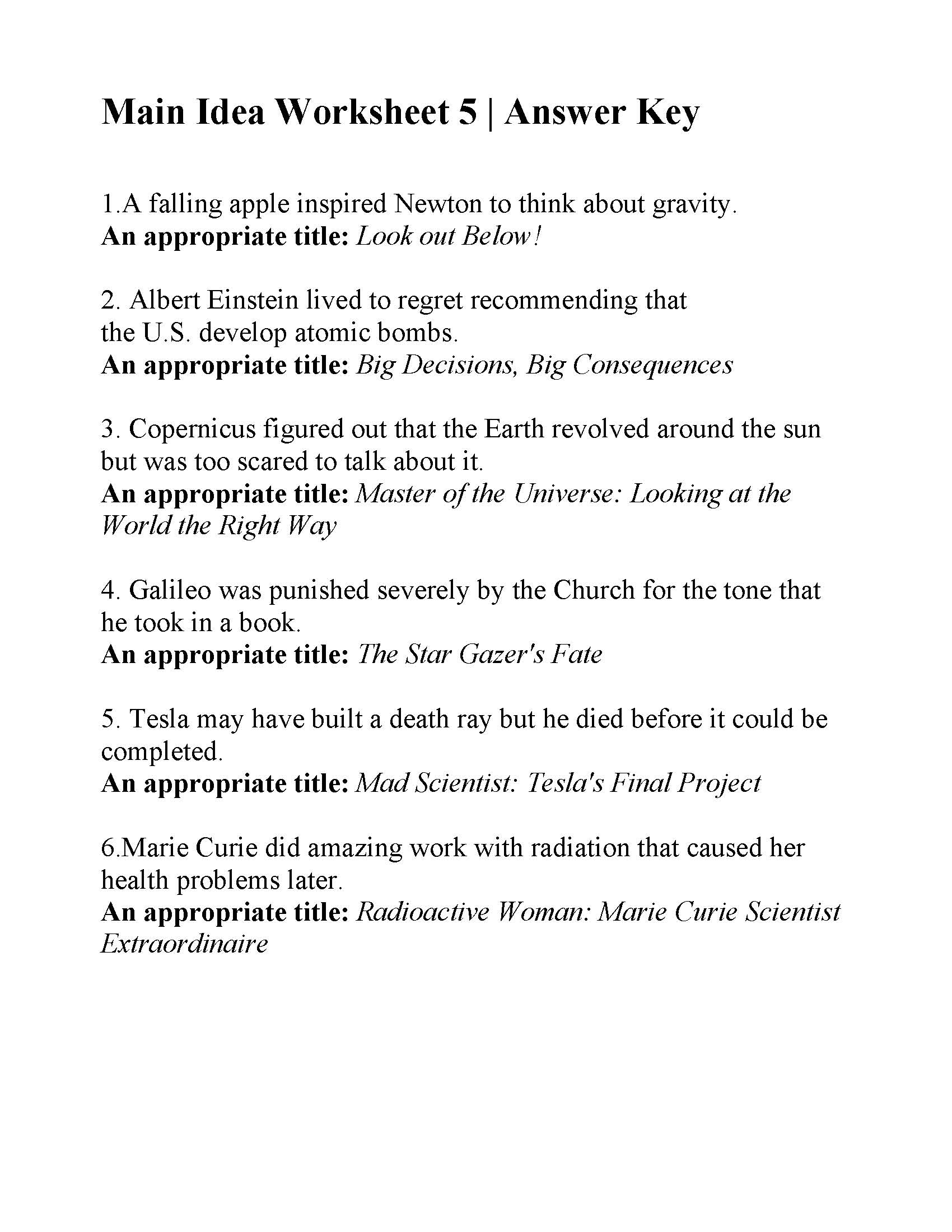

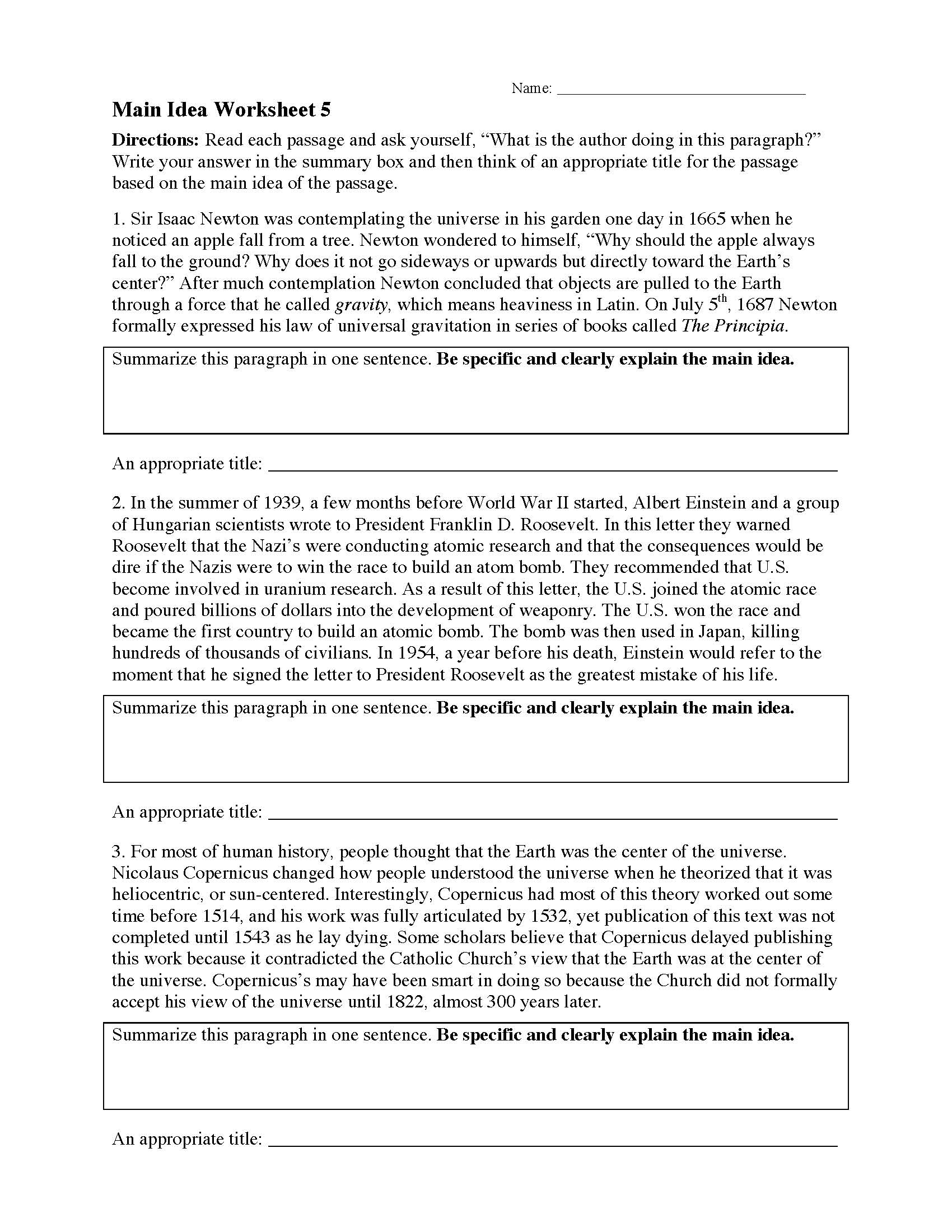

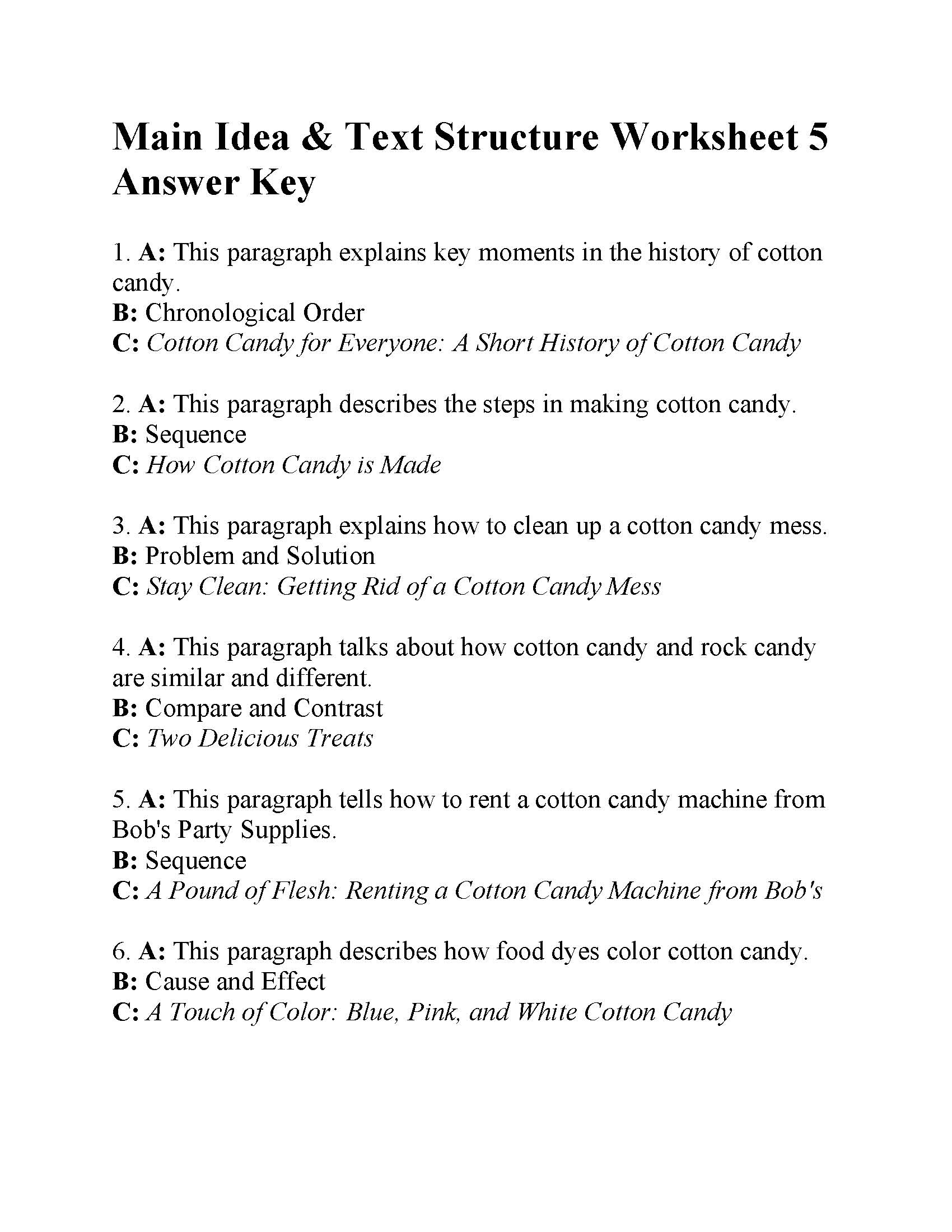

Main Idea Worksheet 25. Encouraged to be able to the website, with this period I am going to explain to you concerning Main Idea Worksheet 25.

Why don’t you consider image previously mentioned? is actually in which wonderful???. if you’re more dedicated thus, I’l t provide you with several image once again down below:

So, if you like to receive all these wonderful graphics related to Main Idea Worksheet 25, simply click save icon to download the graphics to your laptop. They are ready for transfer, if you want and want to own it, simply click save symbol in the page, and it will be directly saved in your notebook computer.} Finally if you desire to receive unique and recent picture related with Main Idea Worksheet 25, please follow us on google plus or bookmark this blog, we try our best to provide regular update with fresh and new images. Hope you love keeping here. For most up-dates and recent news about Main Idea Worksheet 25 graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to offer you update periodically with all new and fresh images, enjoy your exploring, and find the perfect for you.

Here you are at our website, contentabove Main Idea Worksheet 25 published . Today we are pleased to declare we have found an awfullyinteresting topicto be reviewed, that is Main Idea Worksheet 25 Some people trying to find info aboutMain Idea Worksheet 25 and definitely one of them is you, is not it?