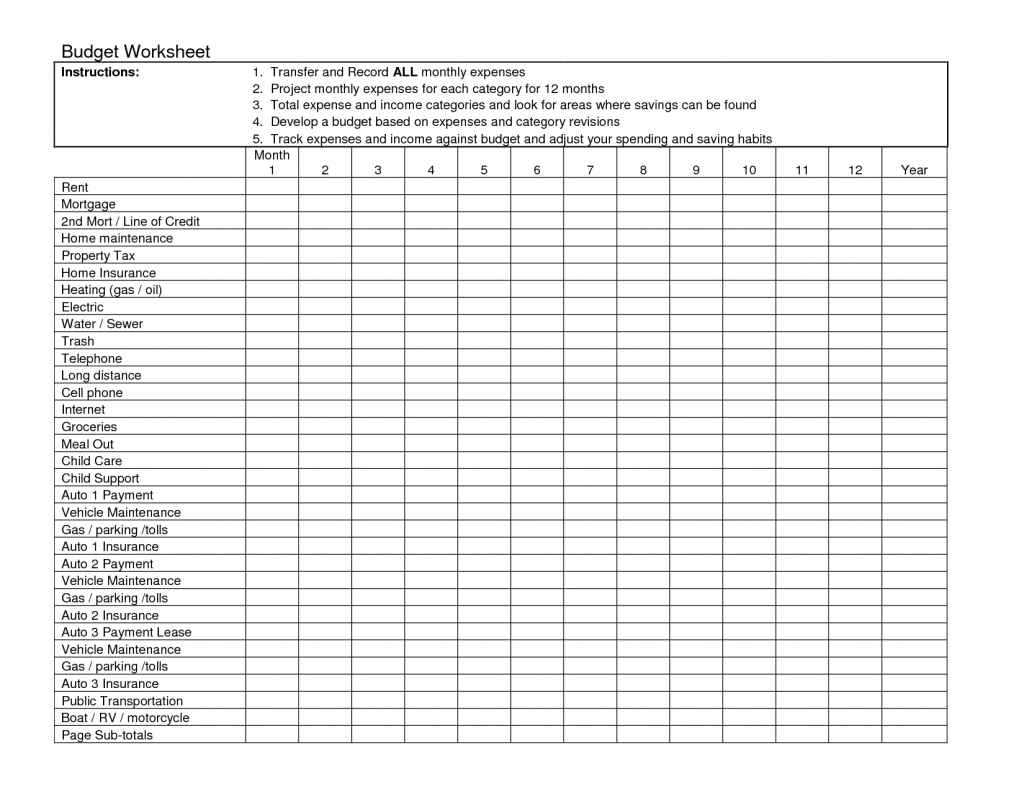

Home Daycare Tax Worksheet. He spends the vast majority of his time administering anesthesia and postoperative care in three local hospitals. If you utilize the usual meal and snack rates, you should maintain information to substantiate the computation of the total quantity deducted for the value of food supplied to eligible children. If you’re claiming the usual deduction, enter all the true property taxes paid on the home by which you carried out business in column of line 15. Business taxes could be a sophisticated subject, however with endurance and somewhat planning, it won’t be as bad as you think.

They are topic to the deduction limit for that yr, whether or not you live in the identical house throughout that yr. If you do not or can not elect to make use of the simplified technique for a house, you’ll determine your deduction for that residence utilizing your precise expenses. You will also need to determine the share of your own home used for enterprise and the restrict on the deduction.

Where To DeductSelf-Employed PersonsExpenses Deductible Without Regard to a Business Connection Using precise expenses to determine the deduction. While this isn’t a “deduction” so to talk, maintaining track of these hours is SO IMPORTANT for decreasing your tax liability!

Daycare Business Equipment

You cannot deduct bills for the business use of your home incurred during any a half of the yr you did not use your own home for enterprise purposes. For instance, when you begin utilizing part of your house for enterprise on July 1, and also you meet all the exams from that date until the tip of the year, contemplate only your bills for the final half of the year in figuring your allowable deduction.

She follows the directions to complete the remainder of Part II and enters $1,756 on strains 34 and 36. She then carries the $1,756 to line 30 of her Schedule C .

Workplace Expenses

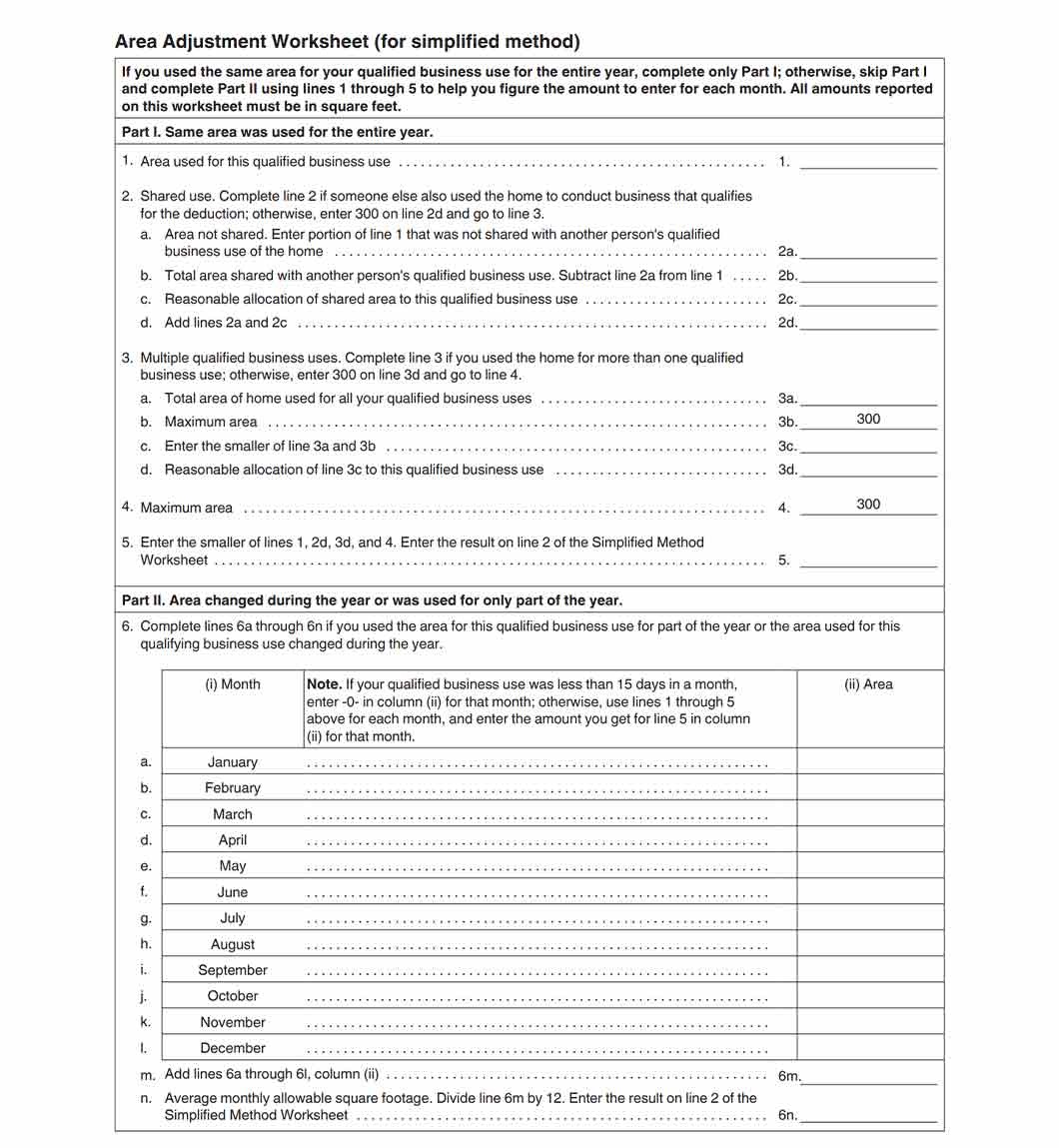

You are itemizing your deductions on Schedule A and your house mortgage interest and whole state and local taxes would not be restricted in your Schedule A if you had not used your personal home for business. In 2021, your small business expenses and the bills for the business use of your personal home are deducted from your gross earnings within the following order. If you solely used the realm for this certified enterprise use for part of the yr or the area used for this qualifying business use changed through the 12 months, then you have to determine the common month-to-month allowable sq. footage.

You ought to maintain canceled checks, receipts, and other proof of expenses you paid. If you used any a part of your house for enterprise, you should modify the basis of your house for any depreciation that was allowable for its business use, even if you did not claim it. If you deducted less depreciation than you could have underneath the strategy you correctly selected, you must lower the idea by the quantity you could have deducted underneath that technique.

Daycare Emergency Plans

If you’re concerned they are claiming more than what they paid, ensure you are documenting every cost simply in case the IRS comes calling. I’d definitely check with an accountant if you assume one thing isn’t right on what they’re claiming, they could have higher recommendation on what precisely to do.

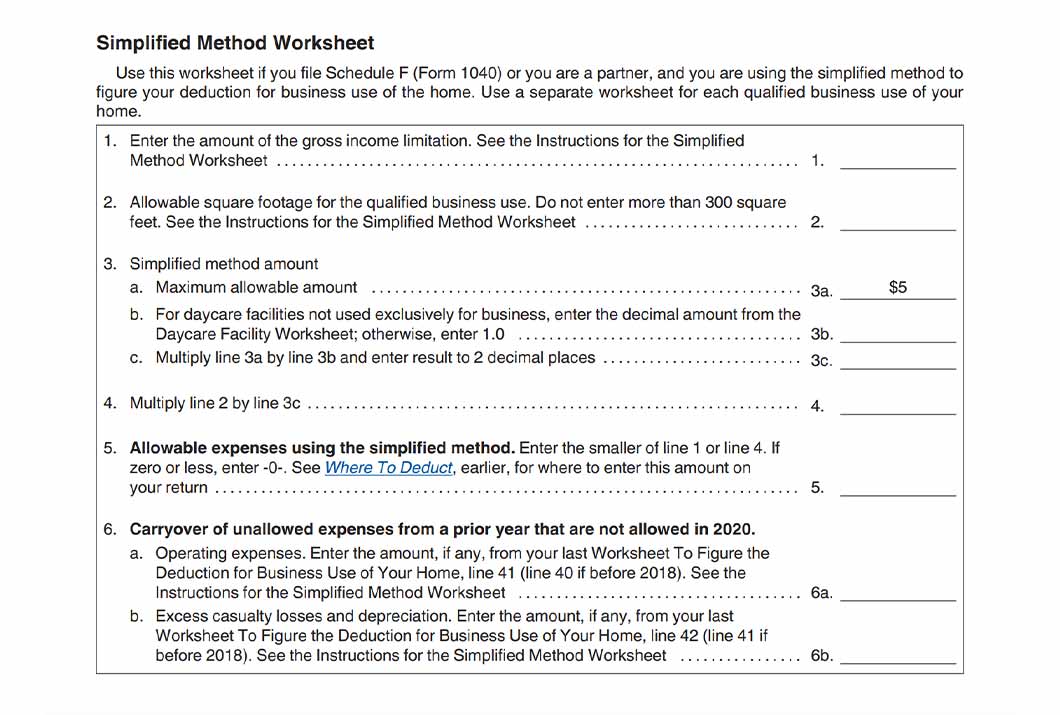

This info may be recorded in a log just like the one shown in Exhibit A, near the tip of this publication. The simplified method is an different to the calculation, allocation, and substantiation of precise expenses.

Childcare Receipts

If you used the identical space for your qualified enterprise use for the complete yr, full solely Part I; in any other case, skip Part I and complete Part II utilizing strains 1 by way of 5 that can assist you figure the quantity to enter for every month. All quantities reported on this worksheet must be in square feet.Part I. Same area was used for the whole year.1.Area used for this qualified business use1._____2.Shared use.

The a part of your home you employ solely and regularly to fulfill sufferers, purchasers, or prospects doesn’t have to be your principal office. John writes up estimates and records of labor accomplished at his clients’ premises. He doesn’t conduct any substantial administrative or management actions at any mounted location aside from his house workplace.

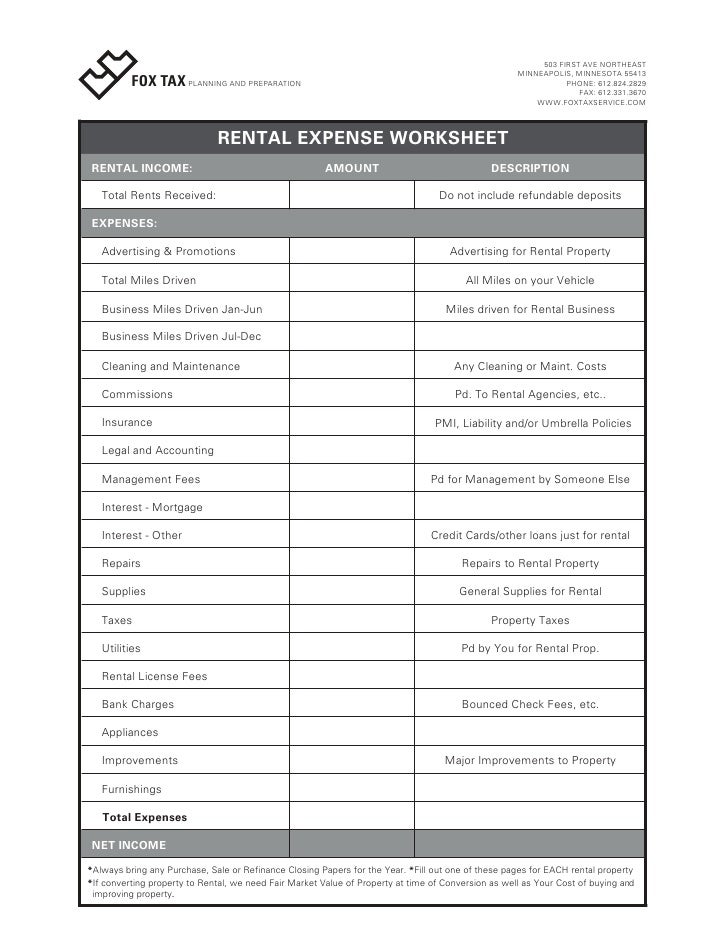

For extra concepts on taxes for in home daycare, try the means to save time preserving your tax records and tips on how to get started on residence daycare taxes right here. A deduction, as defined by the IRS is a essential expense that’s helpful and appropriate for your trade or enterprise.

We use these tools to share public data with you. Go to IRS.gov/Coronavirus for hyperlinks to information on the influence of the coronavirus, in addition to tax reduction available for people and households, small and huge businesses, and tax-exempt organizations.

Daycareanswers

She provides line 23, column , and line 24 and enters $1,756 ($171 + $1,585) on line 26. This is less than her deduction limit , so she will deduct the complete amount.

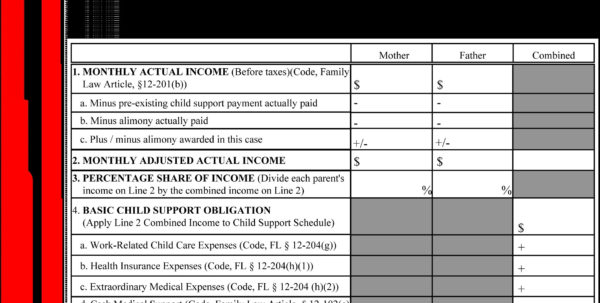

Carryover of expenses, Carryover of unallowed expenses.Child and Adult Care Food Program reimbursements, Meals. TAS works to resolve large-scale issues that affect many taxpayers. If you know of one of these broad issues, report it to them at IRS.gov/SAMS.

If you also use that half exclusively for daycare, deduct all of the allocable bills, subject to the deduction limit, as explained earlier. If you utilize space in your home regularly for providing daycare, you could possibly declare a deduction for that a part of your house even if you use the same house for nonbusiness purposes. To qualify for this exception to the exclusive use rule, you should meet both of the following requirements.

Divide the realm used for enterprise by the whole area of your own home. The truthful market value of your house is the price at which the property would change arms between a buyer and a seller, neither having to purchase or promote, and each having reasonable information of all necessary information. Sales of similar property, on or in regards to the date you start utilizing your home for enterprise, could additionally be useful in determining the property’s truthful market value.

Many of the objects below are allowed to be used as an expense solely with you T/S% utilized. I’ve seen so many new providers suppose that they’ll write off 100% of things that you’re actually only allowed a percentage of, like utilities or family cleaners to call a few.

Unfortunately, you can’t declare the mileage pushed to choose up your daughter. The rule for having the power to claim mileage is that the primary reason your are traveling needs to be daycare related, that at least 51% of the rationale for the trip is daycare associated. If your wife was picking up one other daycare child from faculty you could claim the mileage but when it’s only your child being picked up you then can’t declare the mileage.

Go to IRS.gov/Forms to download current and prior-year types, directions, and publications. Line 14—Excess house mortgage curiosity and mortgage insurance premiums.

If you use a part of your house for storage of stock or product samples, you can deduct expenses for the business use of your own home with out meeting the unique use check. If you purchase toys and your youngsters play with them, the toys are deductible on the time/space share. If you buy toys and you don’t have youngsters at home, the objects are 100% deductible.

Doctors, dentists, attorneys, and other professionals who preserve places of work in their houses will typically meet this requirement. You bodily meet with sufferers, shoppers, or prospects in your premises. The house you use is a separately identifiable space suitable for storage.

You figure the enterprise portion of your real estate taxes using Form 8829 (if you file Schedule C ) or the Worksheet To Figure the Deduction for Business Use of Your Home in this publication (if you file Schedule F ). The business portion of your real estate taxes allowed as a deduction this year might be included within the business use of the home deduction you report on Schedule C , line 30, or Schedule F , line 32.

- Andy information his federal earnings tax return on a calendar year basis.

- For instance, should you pay for Netflix on your daycare youngsters, but as soon as a month, you and your husband get a Netflix film, your percentage could also be larger.

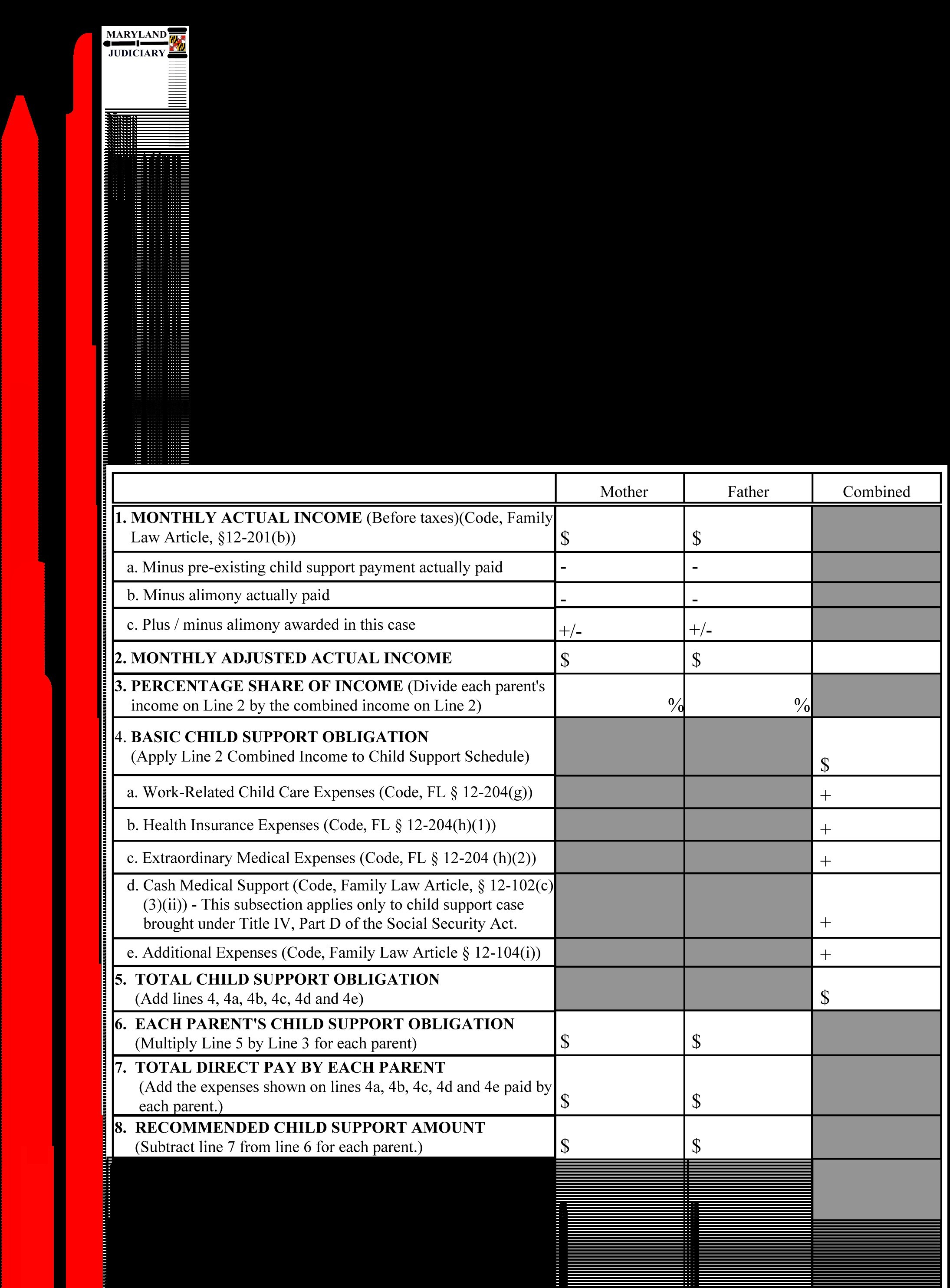

- If you file Schedule C and use precise bills to determine your deduction, use Form 8829 as a substitute of this worksheet..

- You are an legal professional and use a den in your house to put in writing authorized briefs and put together clients’ tax returns.

- This worksheet is only needed if you didn’t use the allowable area solely for daycare..

Storage of stock, Storage of inventory or product samples. However, as a result of she did not use the basement solely for daycare, she must multiply $500 by the proportion of time the basement was used for daycare (34.25% – line 6).

You can fill out a daycare receipt for the end of the yr totals for each family like this one and give it to each family for his or her taxes as nicely. Once you get the household totals done, add them up together with your other income, and print out all your tax varieties.

She is a instructor, house daycare provider, writer, and founding father of Where Imagination Grows. She has spent years instructing and crafting with toddlers and preschoolers and is happy to share these actions with you. With a level in elementary training in addition to enterprise administration, she has over 15 years of experience working in both public and private schools as nicely as running her own preschool program and home daycare.

If you use a daycare facility and you meet the exception to the unique use take a look at for part or the entire space you employ for enterprise, you have to figure the business-use proportion for that space as defined underneath Daycare Facility, earlier. If you utilize another technique to figure your corporation proportion, skip traces 1 and a pair of and enter the proportion on line three. Use this worksheet if you file Schedule F or you are a partner, and you are using actual bills to figure your deduction for business use of the home.

Tax-related id theft happens when somebody steals your private data to commit tax fraud. Your taxes may be affected if your SSN is used to file a fraudulent return or to assert a refund or credit. Although the tax preparer at all times indicators the return, you’re finally liable for providing all the information required for the preparer to precisely prepare your return.

His choice to have his billing carried out by another company doesn’t disqualify his residence office from being his principal place of work. Furniture and appliance purchases could be written off as house daycare tax deductions.

Complete line 2 if someone else also used the home to conduct business that qualifies for the deduction; in any other case, enter 300 on line 2d and go to line 3.a.Area not shared. Enter portion of line 1 that was not shared with another particular person’s certified business use of the home2a._____b.Total space shared with another particular person’s certified business use. Subtract line 2a from line 12b._____c.Reasonable allocation of shared area to this certified enterprise use2c._____d.Add lines 2a and 2c2d._____3.Multiple qualified business uses.

You also cannot deduct any depreciation (including any further first-year depreciation) or section 179 expense for the portion of the house that is used for a qualified enterprise use. The depreciation deduction allowable for that portion of the house is deemed to be zero for a 12 months you use the simplified method.