Forces Worksheet 1 Answer Key. You can deduct the curiosity expense when you begin making payments on the brand new mortgage. The remaining 30% is personal interest and is generally not deductible. You contributed to a conventional particular person retirement arrangement and you or your partner is covered by a retirement plan at work. Situated on the western fringes of the Pacific Ring of Fire, the Philippines experiences frequent seismic and volcanic exercise.

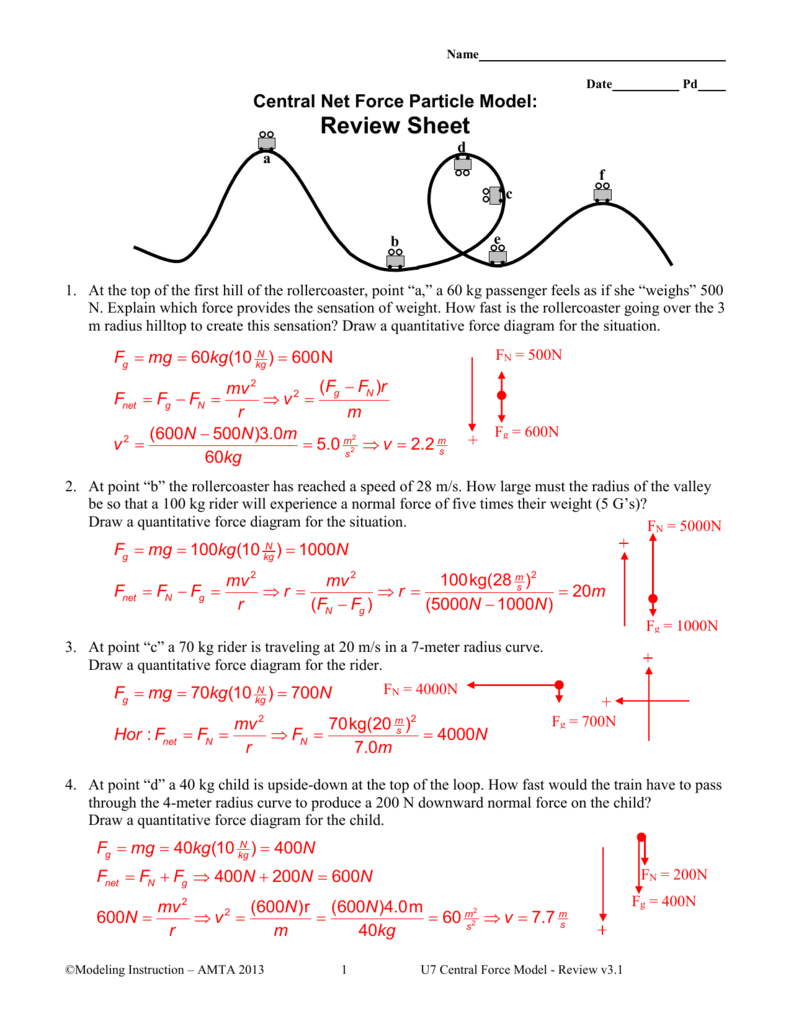

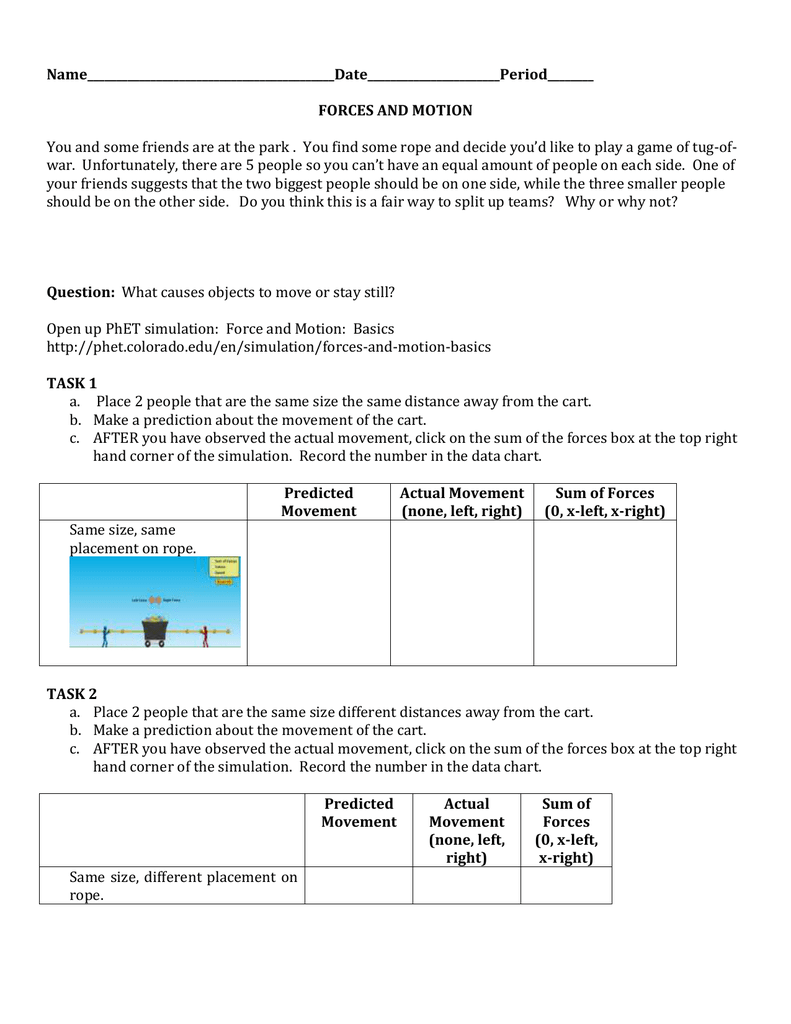

We can answer this question by defining a model new quantity known as the Gibbs free vitality of the system, which reflects the balance between these forces. This video explains why a centripetal force creates centripetal acceleration and uniform circular movement. It additionally covers the difference between velocity and velocity and reveals examples of uniform round motion.

You can elect to amortize the qualifying costs that are not deducted at present over an 84-month period. There is no limit on the amount of your amortization deduction for reforestation costs paid or incurred during the tax yr. File the amended return on the similar handle you filed the original return.

The contribution earned $5 curiosity in 2021 and $6 interest in 2022 before the due date of the return, including extensions. He doesn’t withdraw the $500 or the interest it earned by the due date of his return, including extensions. On May 2, 2022, when her IRA is value $4,800, Cathy makes a $1,600 common contribution to her IRA.

Change Print Area Through Page Setup Dialog Box

Enter any excluded employer-provided adoption advantages from Form 8839, line 289. Enter any overseas housing deduction from Form 2555, line 507.

See the next for the requirements for the de minimis secure harbor. Although you usually cannot take a present deduction for a capital expense, you may be able to recover the amount you spend via depreciation, amortization, or depletion.

Working With Inclined Planes

Go to IRS.gov/SocialMedia to see the varied social media tools the IRS makes use of to share the latest information on tax adjustments, rip-off alerts, initiatives, products, and companies. At the IRS, privacy and security are our highest precedence.

However, you’ll be able to select to totally deduct points in the yr paid if you meet certain exams. If you paid points on the loan , the difficulty price is usually the distinction between the proceeds and the factors.

Forces 1 Reply Key

Then they take a closer look at slices of the produce and seek for seeds. Homeschool college students can work on their own, however might want to make two flower models and may need a associate to assist with a couple of steps of the activity. In this unit, students discover how vegetation reproduce by exploring the process of pollination and fruiting.

The basic denial of the deduction doesn’t apply to the following. The goods or services purchased are clearly not wanted or used, other than by the way, in your personal actions.

Lesson 2: Seed Dispersal & Plant Life Cycle

The Department of Education covers elementary, secondary, and non-formal training. The Technical Education and Skills Development Authority administers middle-level education coaching and improvement. The Commission on Higher Education was created in 1994 to, among different functions, formulate and recommend improvement plans, insurance policies, priorities, and applications on higher schooling and research.

If you dispose of qualified timber property within 10 years after the tax year you incur qualifying reforestation expenses, report any gain as odd revenue as much as the amortization you took. You should amortize these costs when you maintain the section 197 intangibles in connection together with your commerce or business or in an exercise engaged in for the production of revenue. However, when you timely filed your return for the 12 months with out making the election, you’ll find a way to nonetheless make the election by filing an amended return inside 6 months of the due date of the return .

See part 614 and the related rules for guidelines on tips on how to treat separate mineral pursuits. If you might have an financial interest in mineral property or standing timber, you can take a deduction for depletion. More than one person can have an financial curiosity in the same mineral deposit or timber.

Over these years, the economic system experienced eight recessions, shown by the shaded areas within the chart. Although durations of enlargement have been extra prolonged than intervals of recession, we see the cycle of financial activity that characterizes financial life. The growth continues till one other peak is reached at time t3.

There are many active volcanoes similar to Mayon, Mount Pinatubo, and Taal Volcano. The eruption of Mount Pinatubo in June 1991 produced the second largest terrestrial eruption of the 20th century. The Philippines is the world’s second-biggest geothermal power producer behind the United States, with 18% of the country’s electrical energy wants being met by geothermal energy.

Make a fee or view 5 years of payment historical past and any pending or scheduled payments. Choose from a big selection of merchandise, together with the Tax Calendar desktop tool, that can assist you find out about enterprise taxes by yourself time, and at your individual pace. For extra information, go to MilitaryOneSource (MilitaryOneSource.mil/MilTax).

Under a contract, you are to finish development of a building by a certain date. Due to development delays, the building isn’t accomplished and prepared for occupancy on the date stipulated in the contract.

If you make annual or periodic rental funds on a redeemable floor lease, you’ll be able to deduct them as mortgage interest. If you’re married submitting separately and you and your spouse personal a couple of residence, you can each take into account just one residence as a qualified home. However, when you both consent in writing, then one partner can take each the principle house and a second home under consideration.

This may be very stressing because of insufficient time to do a radical analysis to come up with a quality paper. Course help on-line is right here to save heaps of you from all this stress.

- Even if contributions can’t be made for the present 12 months, the amounts contributed for years by which you most likely did qualify can stay in your IRA.

- Taxpayers have the right to know when the IRS has completed an audit.

- However, up to 85% of your benefits can be taxable if either of the next situations applies to you.

- The 1-year period begins on the date you receive the IRA distribution, not on the date you roll it over into an IRA.

- You at the moment are required to pay an extra quantity for every day that completion is delayed beyond the completion date stipulated within the contract.

They use this information to understand how people create fruit varieties by choosing certain traits. The photo voltaic system is the system created by all of the objects (planets, moons, comets, asteroid, meteoroids, and so forth.) that orbit the Sun maintaining it at the heart. All these objects are sure to the Sun by gravitational forces.

Click on either “Get Transcript Online” or “Get Transcript by Mail” to order a free copy of your transcript. For the list of the assorted types of transcripts obtainable so that you can order, see Transcript Types and Ways to Order Them at IRS.gov/Individuals/Tax-Return-Transcript-Types-and-Ways-to-Order-Them. To order your transcript, you can select from one of many following convenient choices.

Go to IRS.gov/Forms to obtain present and prior-year forms, directions, and publications. Meal bills when subject to “hours of service” limits.

For info on tips on how to report this refund, see Refunds of curiosity, later, in this chapter. See the Instructions for Form 8990, Limitation on Business Interest Expense Under Section 163, for more info.

You might be able to exclude all or part of the worth of some fringe benefits out of your staff’ pay. You additionally might not owe employment taxes on the value of the perimeter benefits.

You must roll over the quantity within 60 days after the date of receipt. You can make only one rollover contribution to an HSA throughout a 1-year interval.

On January 9, Olena opened a checking account, depositing $500 of the proceeds of Loan A and $1,000 of unborrowed funds. The following table shows the transactions in her account during the tax 12 months.

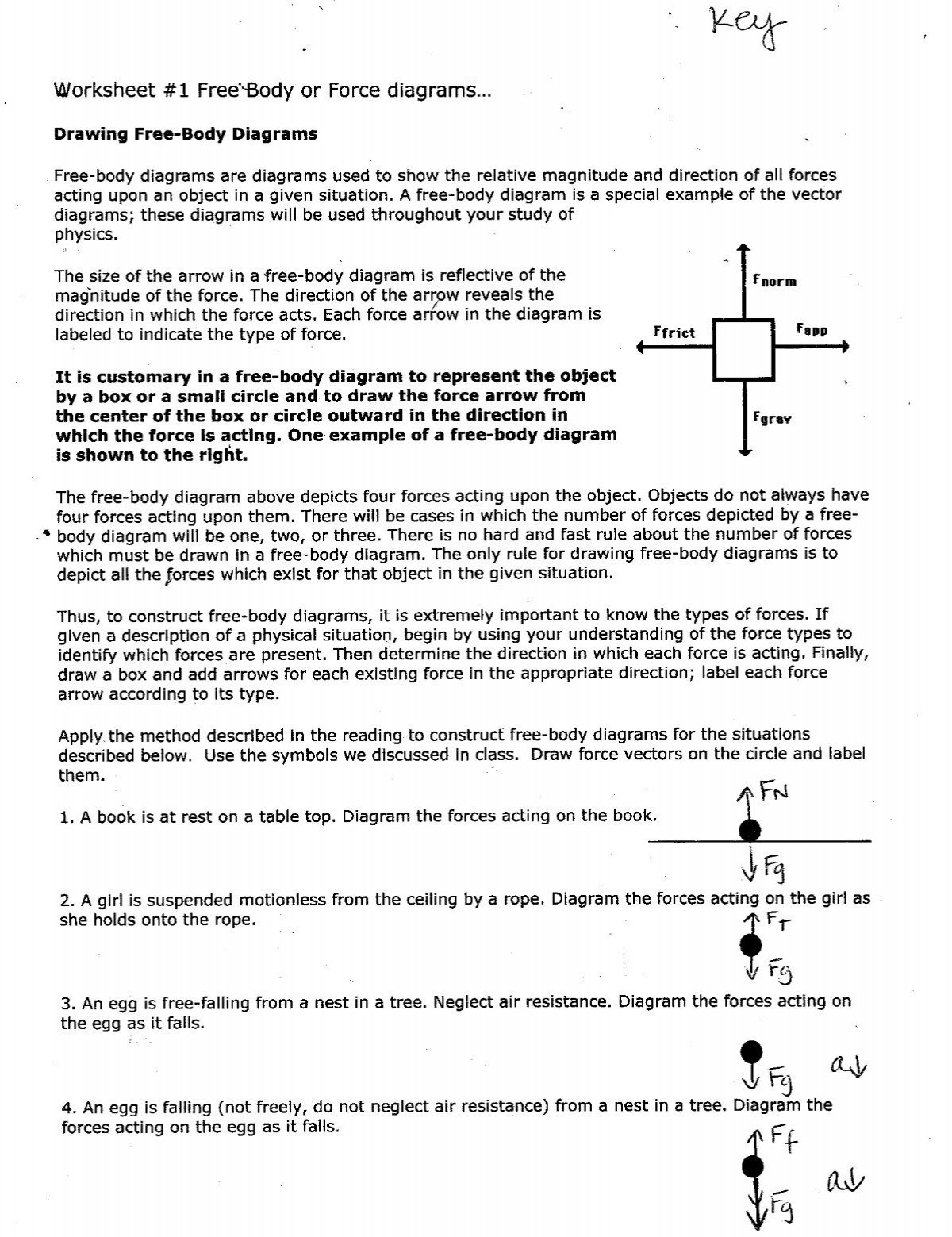

Recall from the earlier chapter that friction is a drive that opposes motion, and is around us on an everyday basis. Friction permits us to move, which you’ve found if you have ever tried to stroll on ice.

Anyone paid to organize tax returns for others ought to have a thorough understanding of tax issues. For extra info on how to determine on a tax preparer, go to Tips for Choosing a Tax Preparer on IRS.gov. This is the total quantity of Part B, Part C, and/or Part D Medicare premiums deducted out of your railroad retirement annuity payments shown in your Form RRB-1042S.

You amortize this a half of the adjusted foundation over the intangible’s remaining amortization interval within the palms of the transferor. Nonrecognition transfers embody transfers to a corporation, partnership contributions and distributions, like-kind exchanges, and involuntary conversions.

A SEP is a written association that enables your employer to make deductible contributions to a standard IRA set up so that you just can receive such contributions. Generally, distributions from SEP IRAs are topic to the withdrawal and tax guidelines that apply to traditional IRAs.

For instance, you are an eligible particular person, age forty five, with self-only HDHP coverage. On June 18, 2021, you make a qualified HSA funding distribution.

During the design, building and redesign phases, students take a look at their rockets as many times as needed to refine the rockets to permit them to travel the farthest distance, or keep in the air the longest. Students explore movement, rockets and rocket motion whereas helping Spacewoman Tess, Spaceman Rohan and Maya in their explorations. First they learn some primary information about automobiles, rockets and why we use them.

If you receive monthly statements showing the closing stability or the common steadiness for the month, you can use both to figure your common steadiness for the 12 months. You can deal with the balance as zero for any month the mortgage wasn’t secured by your qualified home.