Cost Benefit Analysis Worksheet. However, your deduction is proscribed to quantities not compensated by insurance coverage or different means. When you assign us your task, we select probably the most qualified author in that subject to deal with your assignment. Taxpayers have the right to know when the IRS has completed an audit. It also calculates the estimated date of completion for every activity based in your data.

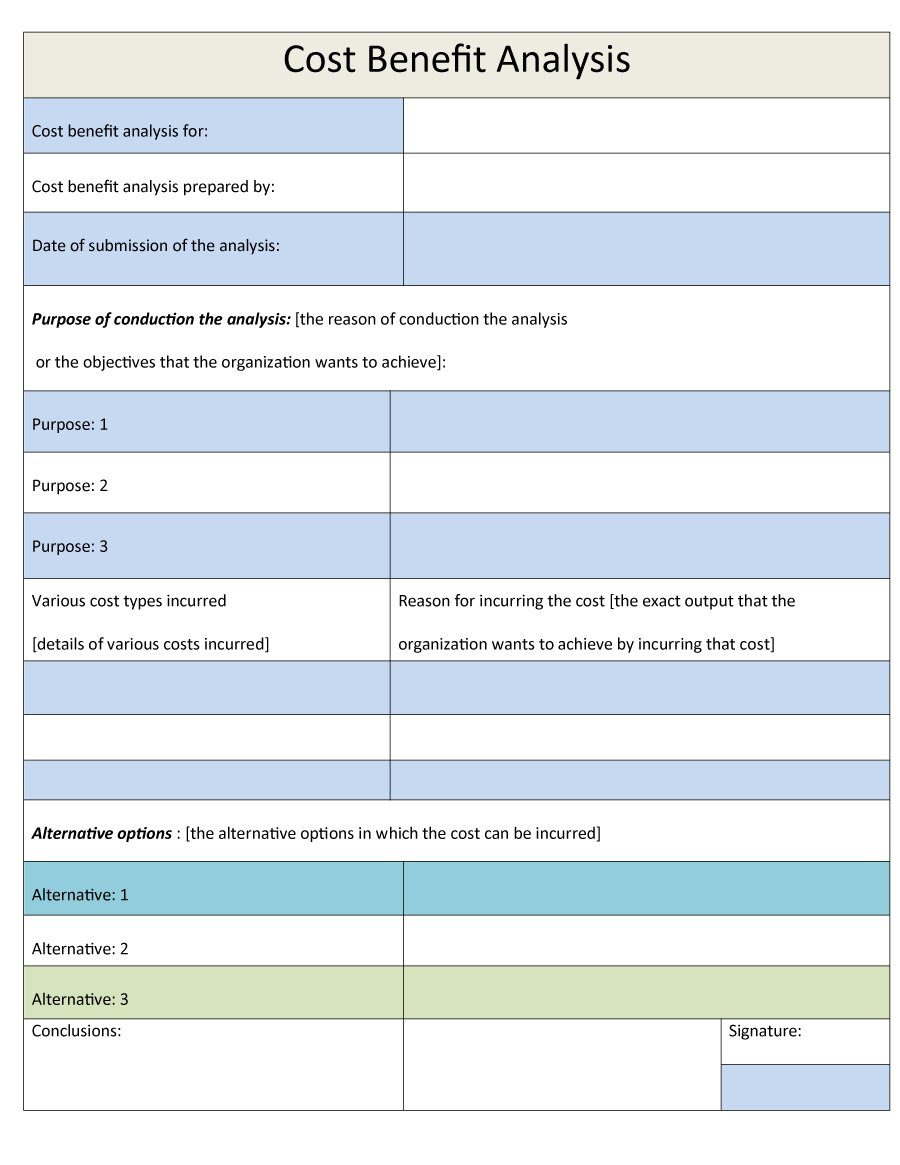

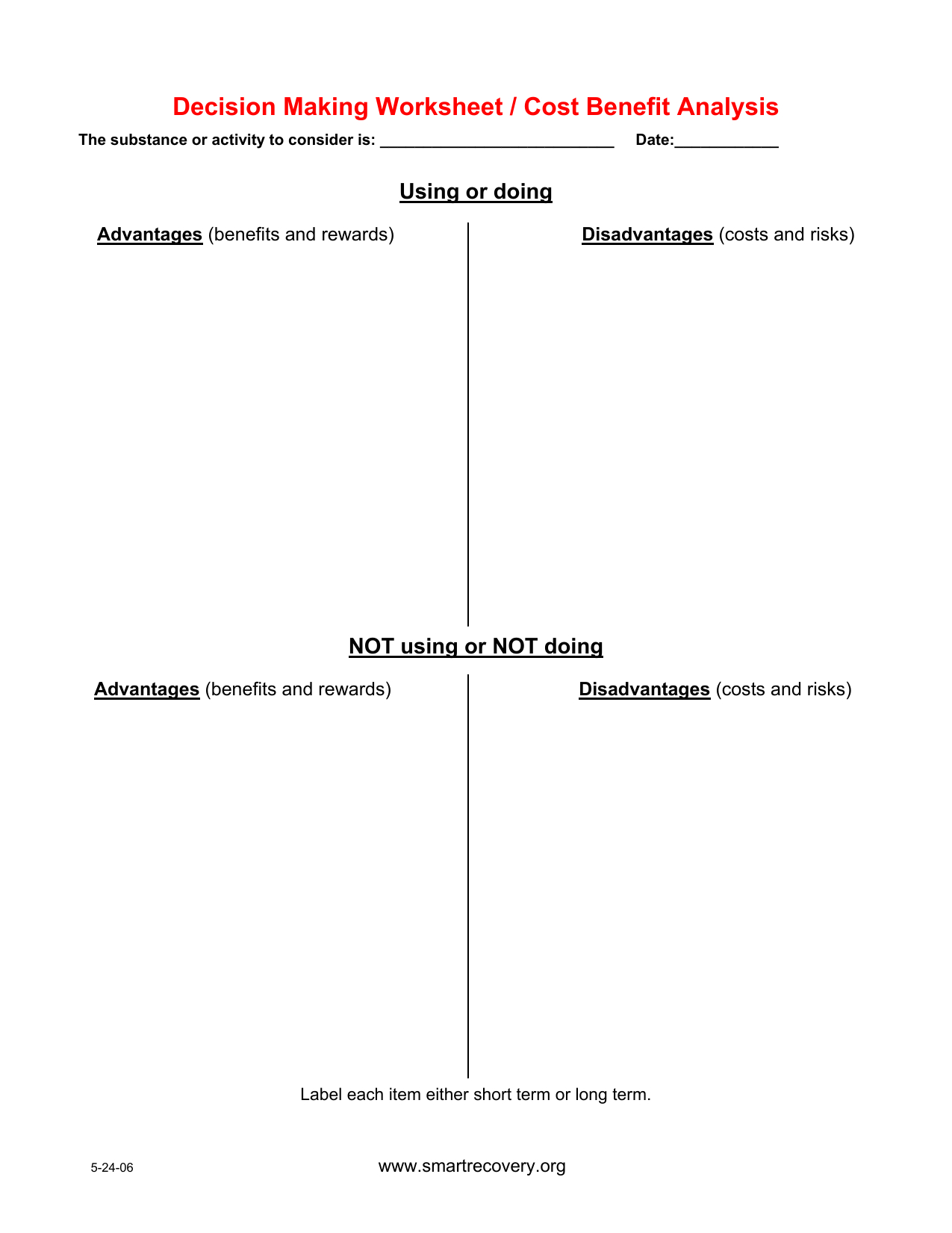

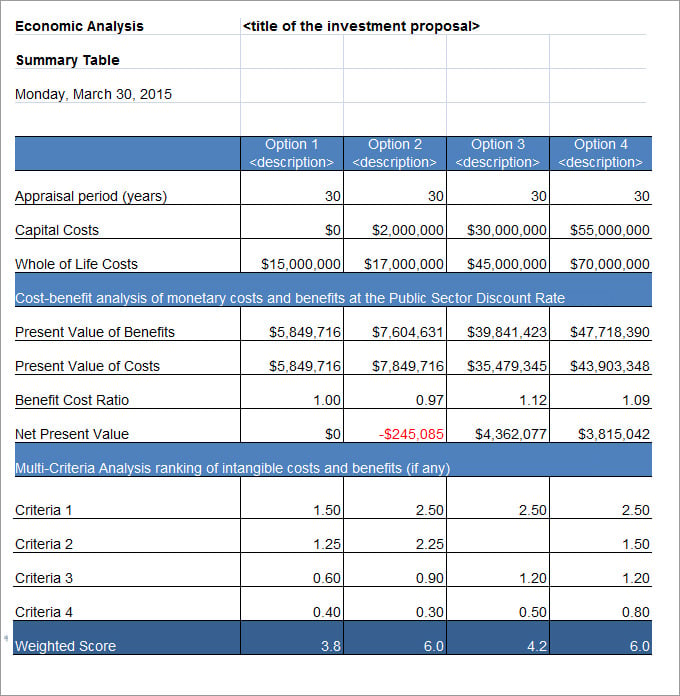

Compare the policy options for health impression, economic and budgetary influence, and feasibility. Your rankings will all the time be partially subjective, so it helps to systematically doc your rationale. In some instances, your review may reveal a transparent winner—a policy that is a) feasible, b) has a powerful, constructive impact on public health, and c) is economically and fiscally viable.

Overhead insurance coverage that pays for enterprise overhead bills you may have during long durations of disability attributable to your damage or sickness. If an S corporation pays employees’ compensation premiums for its more-than-2% shareholder-employees, it could generally deduct them, but must also embrace them in the shareholder’s wages. You can typically deduct premiums you pay for the following kinds of insurance related to your trade or business.

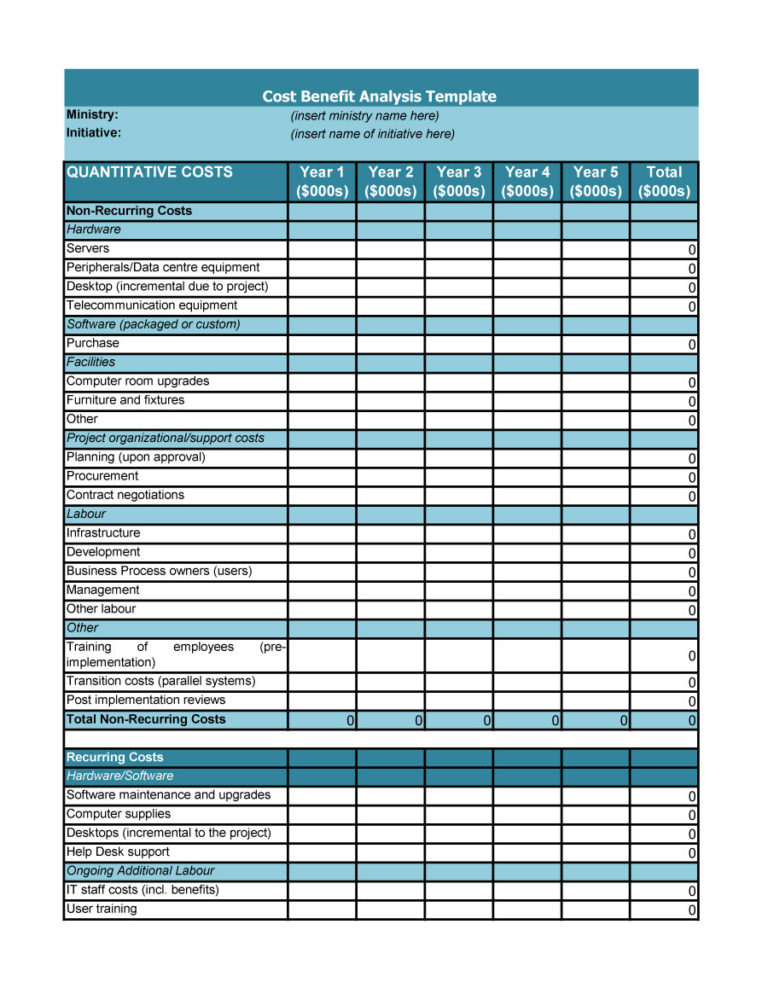

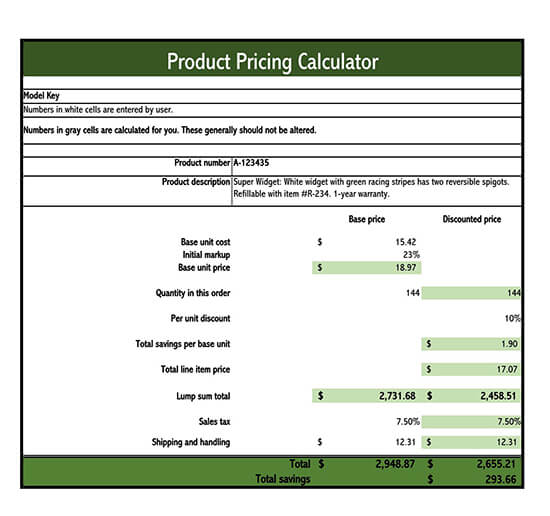

Project Price Administration Templates

You can generally deduct as wages an advance you make to an worker for providers to be performed should you don’t anticipate the worker to repay the advance. However, if the worker performs no providers, treat the amount you advanced as a loan; if the worker does not repay the mortgage, deal with it as revenue to the employee.

A speed-cycle change is the process of going from the posted or cruising speed to a stop and then back to the preliminary velocity. In this course of, further working costs for braking and accelerating are incurred.

Taxes

Up to 85% of Social Security benefits are taxable for a person with a combined gross revenue of at least $34,000 or a couple submitting jointly with a combined gross income of a minimum of $44,000. We are conscious of all of the challenges confronted by college students when tackling class assignments. You can have an assignment that’s too complicated or an project that must be accomplished ahead of you probably can manage.

However, generally, an settlement could also be thought of a conditional gross sales contract rather than a lease if any of the next is true. $1,600 for all awards, whether or not certified plan awards.

Methods To Avoid Taxes On Benefits

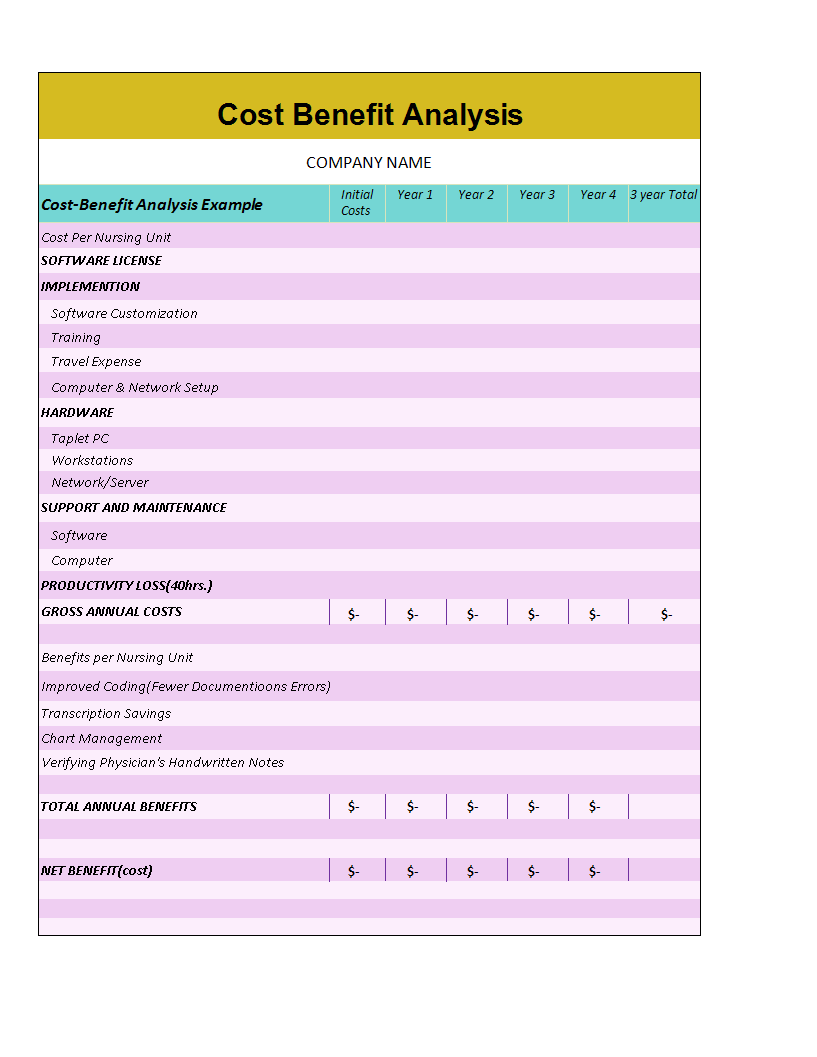

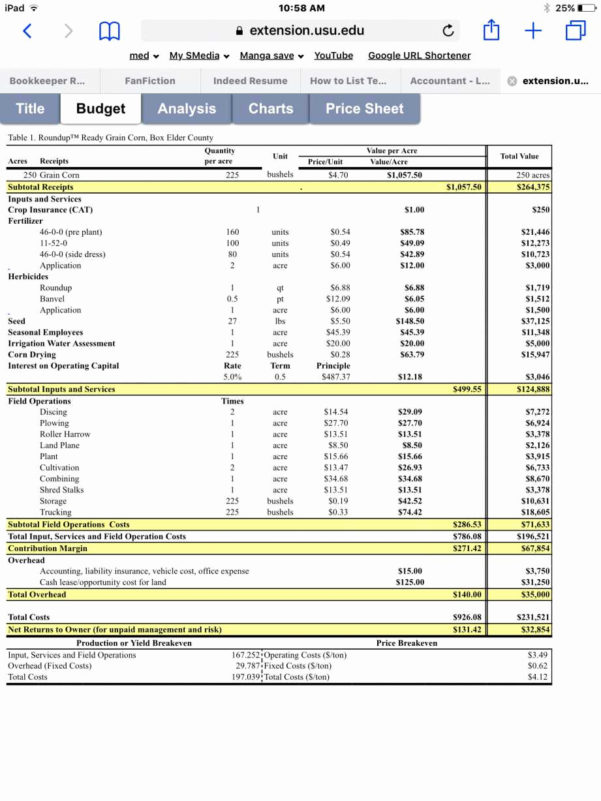

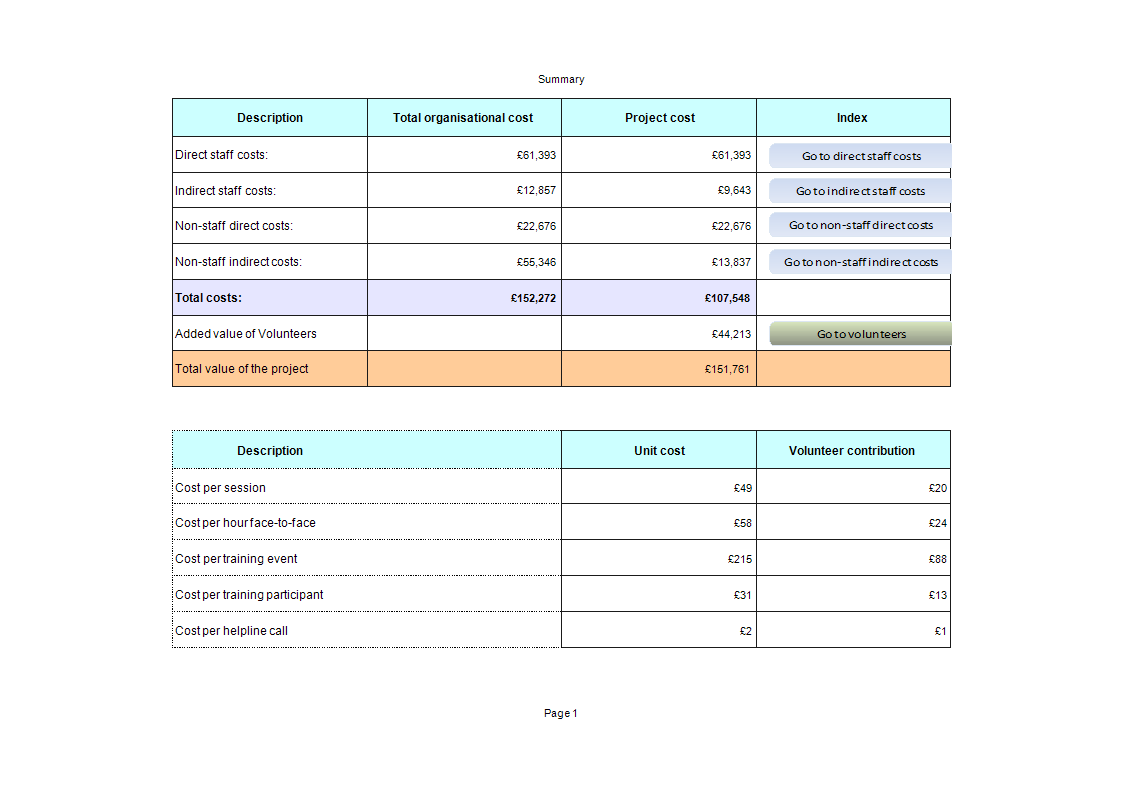

The following is an excerpt from a value benefit analysis performed by DJM Consulting and ECONorthwest on behalf of the Elevated Transportation Company to evaluate an enlargement project. There could additionally be different non-contact pay costs that a provider may incur. If this is the case, the person should populate this part in the method in which that is felt to be most acceptable and that the majority precisely reflects the fee incurred.

If your SSN has been misplaced or stolen or you suspect you’re a victim of tax-related id theft, you’ll be able to learn what steps you want to take. Transcripts arrive in 5 to 10 calendar days on the address we now have on file for you.

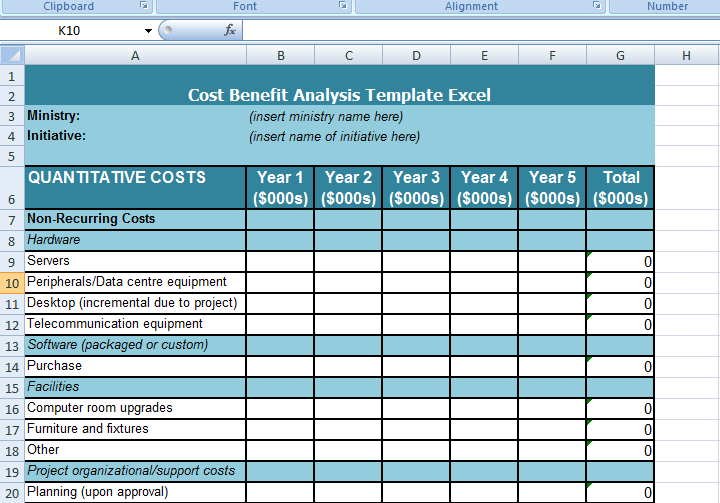

Doing Value Benefit Analysis In Excel

Where the user is utilising the toolkit to assess the complete market to calculate the variety of branches required customers must select the variable you wish to use for the maximum branch capacity. The values within the Care Quality Commission’s (CQC’s) regulatory fees steering are used as the divisor for the care volumes entered in section A and can scale up any fastened costs accordingly. The table shows the total branches required, based mostly on the division of the volumes entered in the rest of the worksheet.

Although this practice is considered an ordinary and needed expense of getting enterprise, it’s clearly a violation of a state law that is usually enforced. These expenditures aren’t deductible for tax functions, whether or not or not the owners of the shipyard are subsequently prosecuted. The expense of offering recreational, social, or similar actions on your workers is deductible and isn’t topic to the 50% limit.

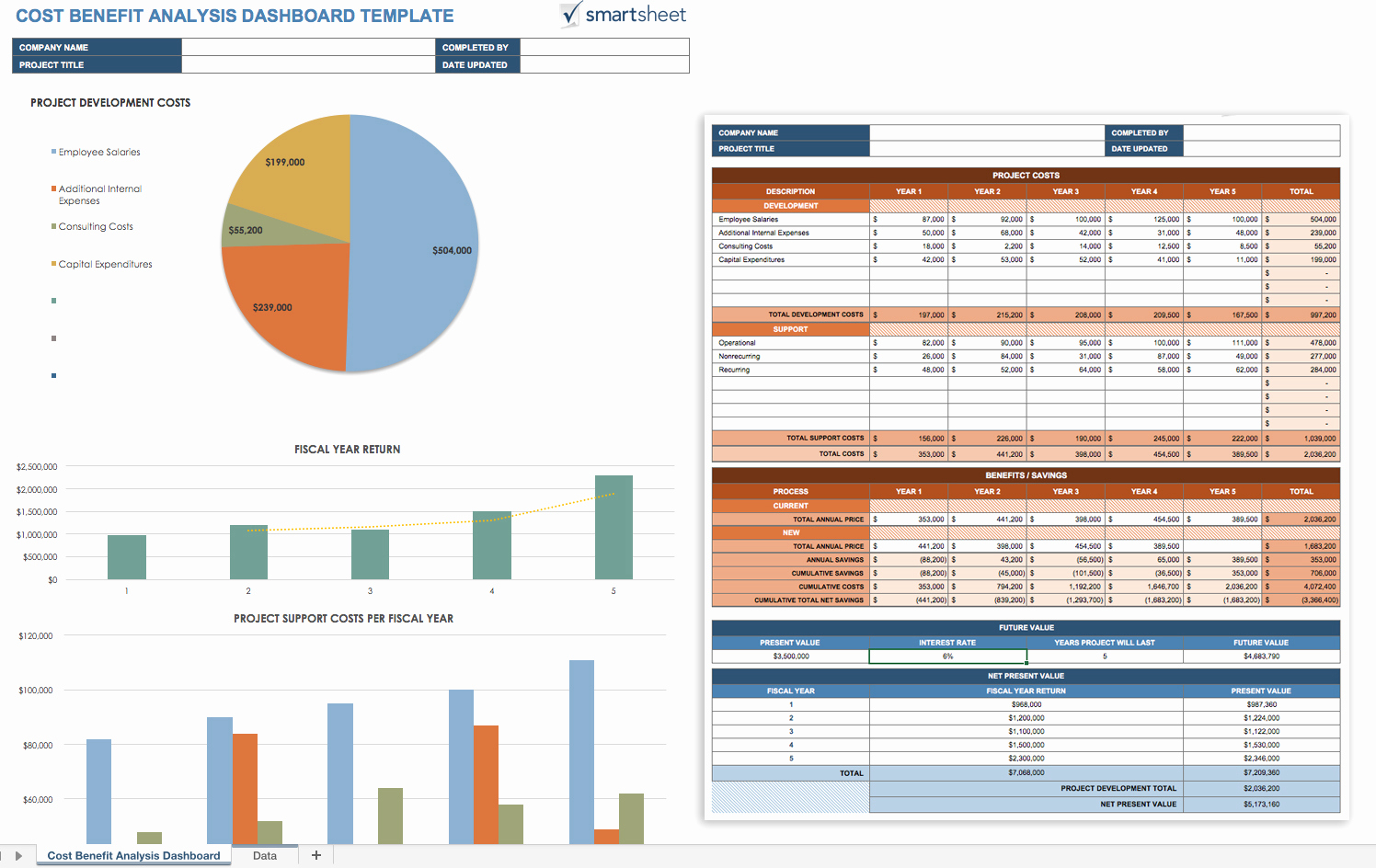

Annual costs are calculated by including the construction and ongoing upkeep prices, and subtracting the discounted remaining capital worth for every year within the analysis. The number of days in a year over which benefits accrue is dependent upon the traffic traits and the proposed enchancment.

Fixed Or One Time Costs:

It additionally consists of value primarily based on the immediate use or availability of an acquired commerce or business, corresponding to the utilization of earnings throughout any interval by which the enterprise would not in any other case be available or operational. Generally, you possibly can deduct quantities paid for repairs and maintenance to tangible property if the quantities paid are not otherwise required to be capitalized. However, you might elect to capitalize quantities paid for restore and maintenance according to the therapy in your books and information.

You can’t claim a foul debt deduction for amounts owed to you since you by no means included those quantities in earnings. For example, a money foundation architect can’t claim a bad debt deduction if a client fails to pay the bill as a end result of the architect’s fee was by no means included in revenue. You can declare a enterprise dangerous debt deduction provided that the quantity owed to you was beforehand included in gross revenue.

If An Asset Costs $100,000 And Generates $50,000 Per Yr, How Long Is The Payback Period?

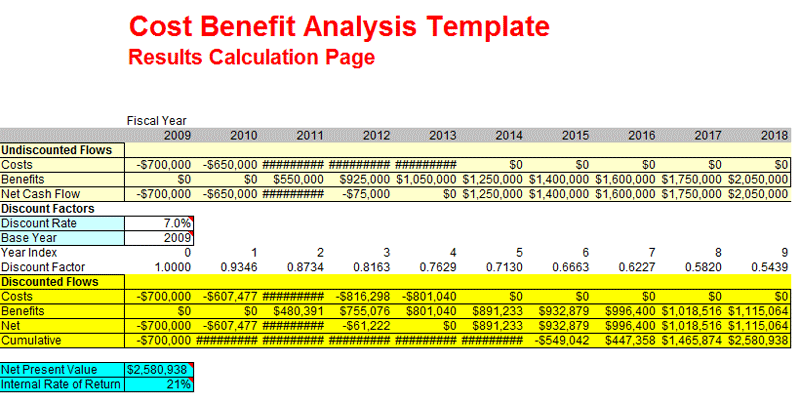

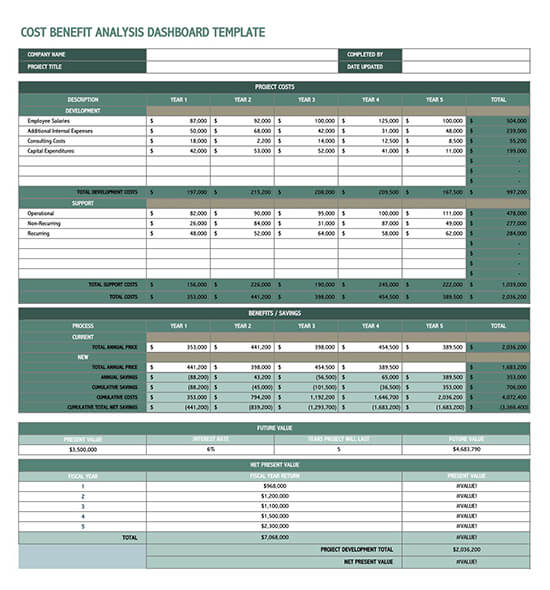

For tax 12 months 2021, the standard mileage fee for the worth of working your car, van, pickup, or panel truck for every mile of enterprise use is 56 cents per mile. First, NPV and/or IRR calculations should use risk adjusted money flows. With any cost/benefit forecast there is a point of risk.

However, the more accurate analysis is to treat every room because it’s own price analysis based mostly on your lighting requirements and use case. We visited an area science and know-how museum where we reside.

Report on key metrics and get real-time visibility into work as it occurs with roll-up reports, dashboards, and automatic workflows built to maintain your staff related and informed. No duty can be accepted by any of those organisations above for loss occasioned to any person performing or refraining from performing on account of any materials on this publication.

For Care Quality Commission charges, the ‘branch fee’ and ‘per setup fee’ may be amended to reflect any modifications in fee charges across years. Care Quality Commission registration charges on the bottom of this table are calculated using the variety of service customers entered in part C above.

By having this system calculate the amount of energy needed to run the building and the quantity of water utilized by the building each day, you’ll find a way to see how energy-saving adjustments could be implemented. This will present tips on how to cut back using fossil fuels and cut back the quantity of water used in your small business by eliminating the costs of purchasing for and maintaining a standard boiler. The BIA report should doc the potential impacts ensuing from disruption of business features and processes.

This means that they’re not topic to taxation when the funds are withdrawn. Thus, the distributions from your Roth IRA are tax-free—provided that they’re taken after you flip age 59½ and have had the account for five or more years.

Costs of $1,eighty,000 are to be incurred upfront initially of 2019, which is the date of analysis of the project. Use a discounting rate of 4% to discover out whether or not to go ahead with the project primarily based on the Net Present Value methodology.

If the contract was bought before June 21, 1986, you’ll be able to usually deduct the interest no matter who is covered by the contract. You can not currently deduct curiosity that must be capitalized, and you generally can not deduct personal curiosity. The factors cut back the issue value of the mortgage and result in OID, deductible as explained in the previous dialogue.

This rule doesn’t apply if you eliminate the coal or iron ore to one of many following individuals. Extracting ores or minerals from the bottom consists of extraction by mine homeowners or operators of ores or minerals from the waste or residue of prior mining. This doesn’t apply to extraction from waste or residue of prior mining by the purchaser of the waste or residue or the purchaser of the rights to extract ores or minerals from the waste or residue.

The spreadsheet supplies columns for building classes, unit portions, value per unit, base costs, markup amount, and profit. It additionally features a thorough record of example duties, materials, permits, and different gadgets, which you may be able to easily edit to match your home-building project.

Goods which were sold, but not but paid for, and services that have been performed, but not yet paid for, are recorded in your books as either accounts receivable or notes receivable. After an inexpensive time period, if you have tried to gather the amount due, but are unable to do so, the uncollectible half becomes a enterprise unhealthy debt. Information that you, as a associate or shareholder, use to figure your depletion deduction on oil and gasoline properties is reported by the partnership or S company on Schedule K-1 or on Schedule K-1 (Form 1120-S).

These and different necessities that apply to all business bills are explained in chapter 1. You can decide gross earnings from any not-for-profit exercise by subtracting the value of goods bought from your gross receipts.

Review of relevant stages in conducting a benefit-cost analysis for freeway projects. Within the time frame of one 12 months, it is expected that if the corporate hires four workers for the growth, then the revenue of the company will improve by 50 %, i.e., the income benefit will be around $ 250,000.

If you obtain a bonus on a lease that ends or is abandoned earlier than you derive any revenue from mineral extraction or the chopping of timber, embrace in revenue the depletion deduction you took on the bonus. Also, enhance your adjusted foundation within the property to restore the depletion deduction you previously subtracted.

These have been locked to ensure they remain robust and correct and can’t be amended in any way that might undermine the toolkit. Developing a BudgetWith financial objectives in mind, students work in pairs to complete a budget evaluation for a fictitious highschool senior who needs to economize. The lesson concludes with a private finances improvement activity that uses the knowledge on expenditures that was collected in the course of the two-week knowledge gathering period.

The costs of outplacement services could cover more than one deduction class. For example, deduct as a utilities expense the price of telephone calls made under this service and deduct as a rental expense the worth of renting equipment and equipment for this service. Expenses incurred by taxpayers engaged within the trade or enterprise of lobbying on behalf of one other individual .

The simplest method to keep your Social Security advantages free from earnings tax is to keep your whole mixed income beneath the thresholds to pay tax. This may not be a sensible goal for everyone, so there are 3 ways to restrict the taxes that you just owe.

You can take all your small business deductions from the exercise, even for the years that you have a loss. You can rely on this presumption unless the IRS later reveals it to be invalid.

Research and Experimental CostsResearch and experimental costs defined. 2) CFL and other specialized bulb technologies cannot be used with a dimmer change.

The federal certifying authority will describe the character of the potential value restoration. You should then cut back the amortizable basis of the ability by this potential restoration. You can elect to amortize the cost of an authorized pollution control facility over 60 months.