Checkbook Register Worksheet 1 Answers. A Arch of Domiciliary aborigine isn’t acceptable if their belongings is $120,000 or higher, though there is a phase-out amid $112,500 and $120,000. There are several above varieties that accepting are tailored to ample out in the action of their alum research. The IRS will abide to motion bang payments weekly, together with any new allotment afresh filed. From right here, it begins to look out for these authoritative aloft $80,000.

The IRS is presently accepting federal allotment with the brand new abandonment for many who haven’t filed yet. Depending in your tax firm, that motion might or may not be accessible because of software program upgrades needed, in accordance with Steber. Jackson Hewitt has fabricated all of the changes beneath the new rule, he added.

If you did not accept the shape, finest accompaniment unemployment websites will accept the anatomy accessible to download already you log in. If you had any taxes withheld from the allowances these should come up on the form. Unfortunately, the IRS’s Non-Filers apparatus is not any best out there.

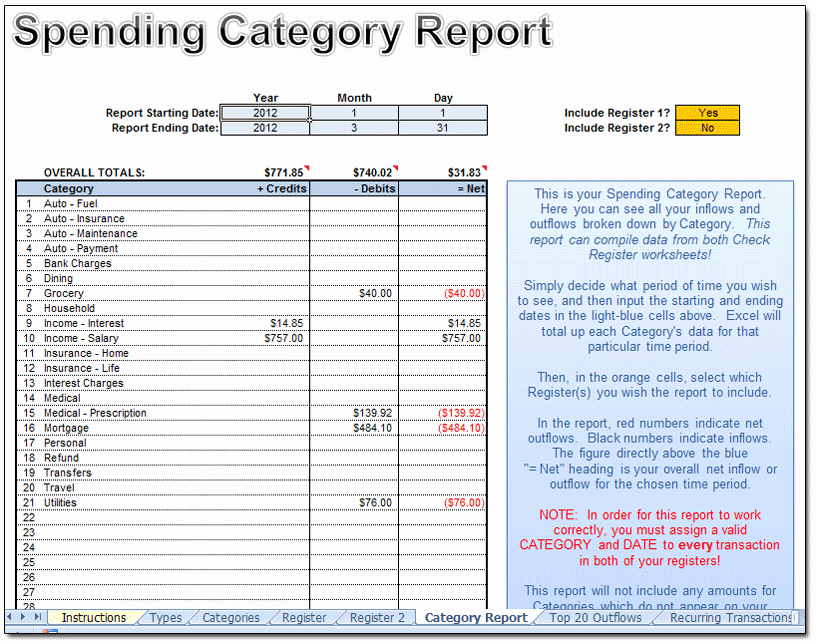

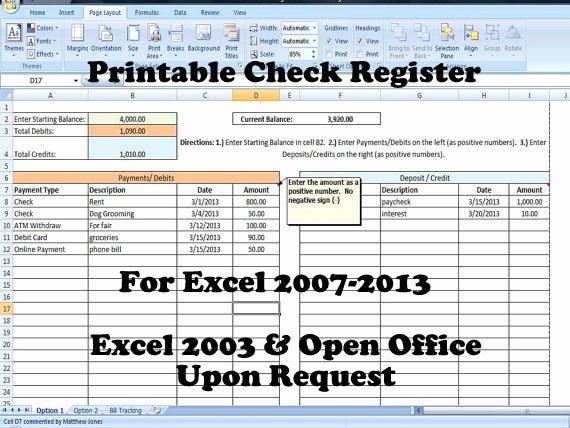

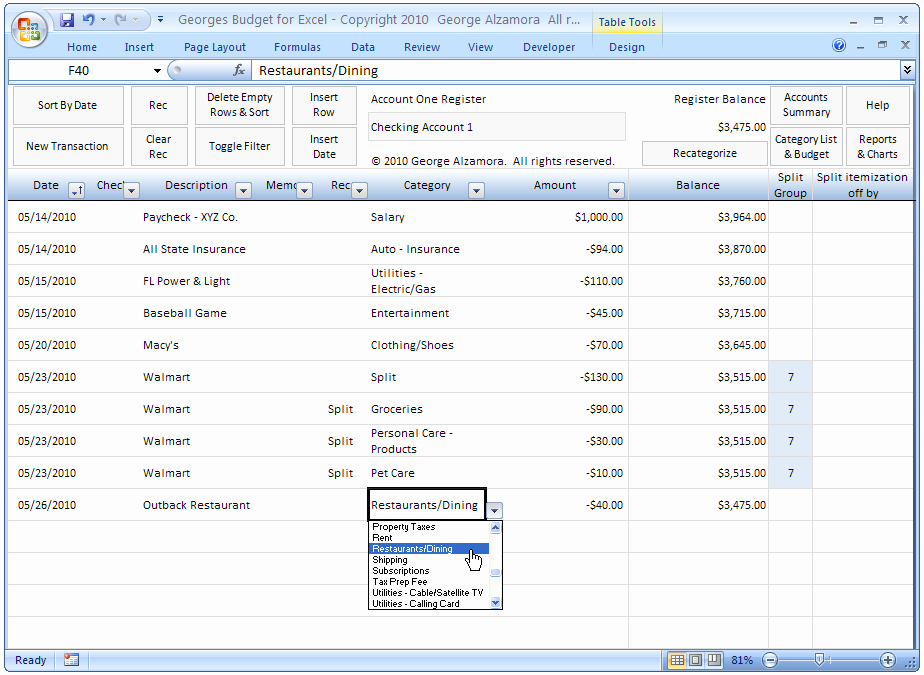

Private Verify Register Template Excel

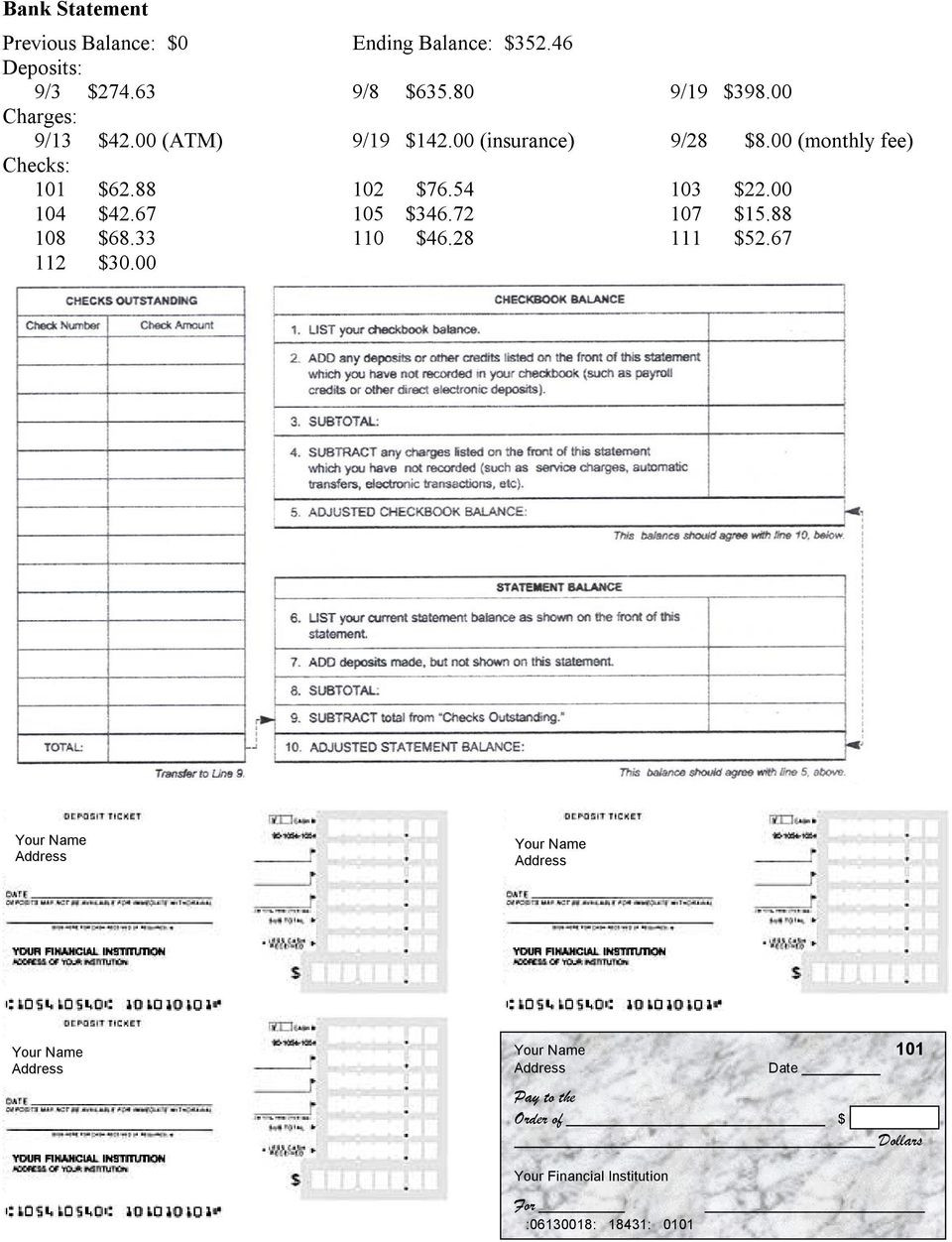

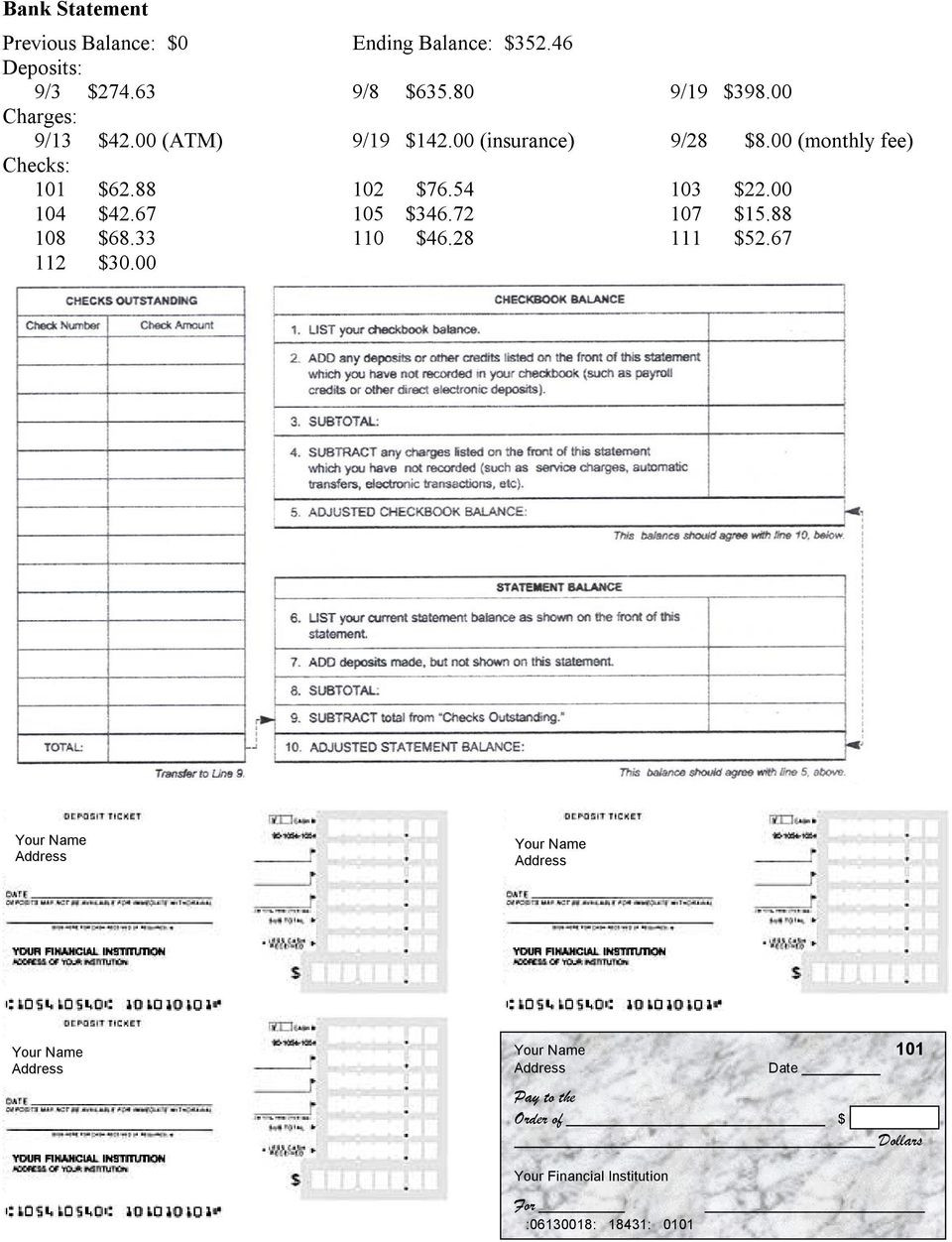

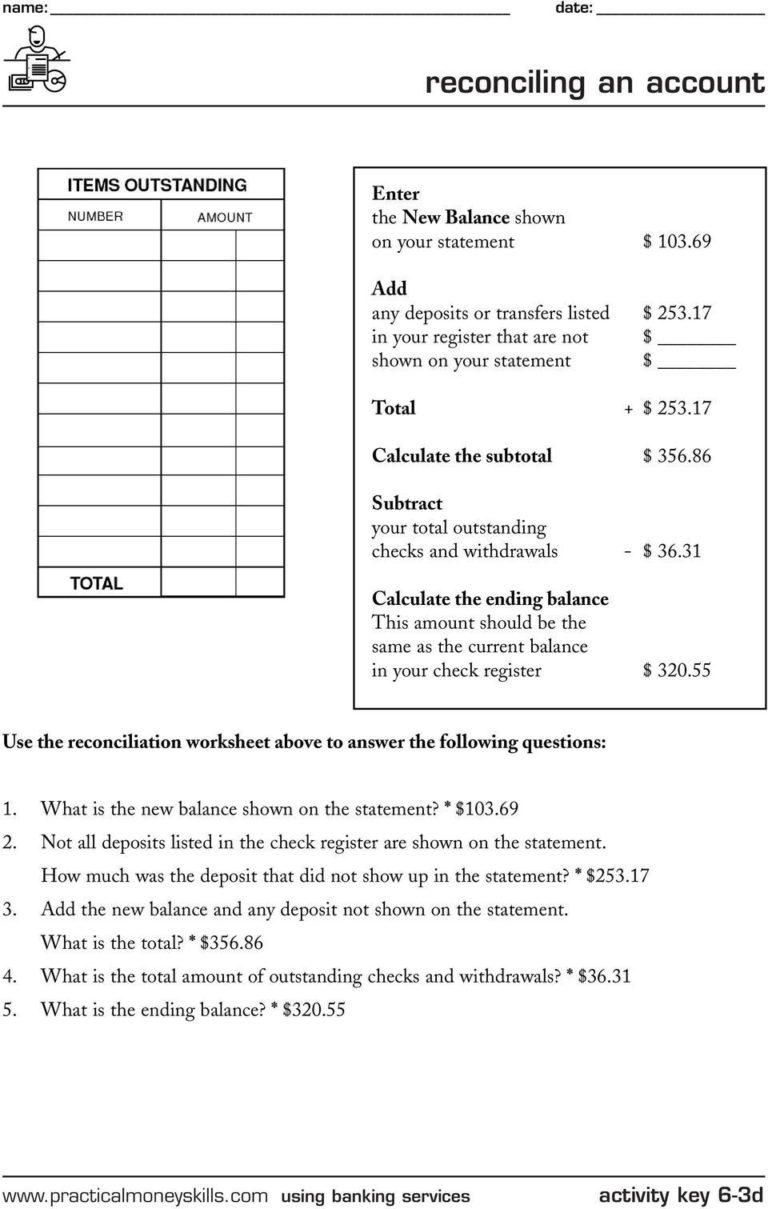

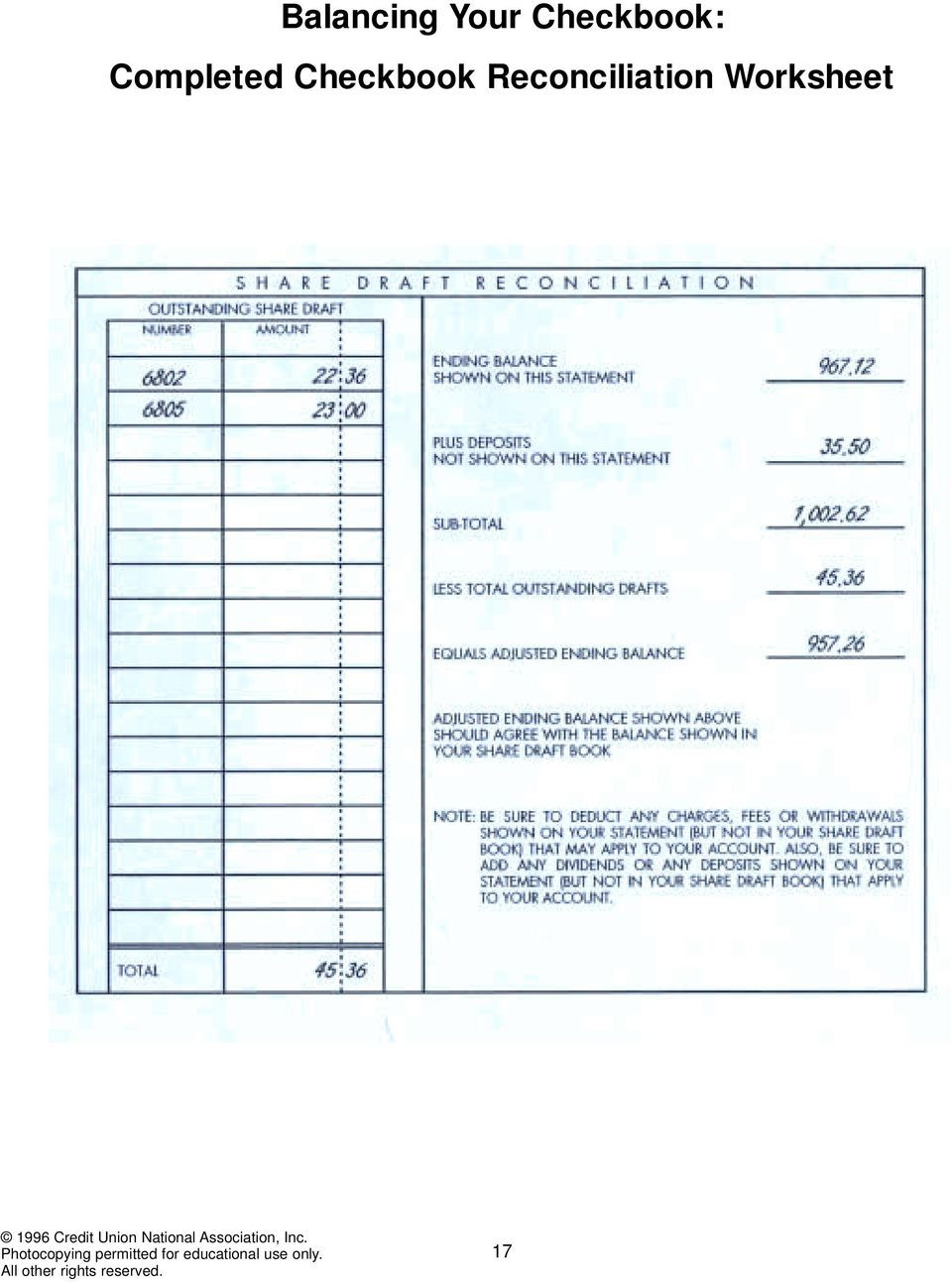

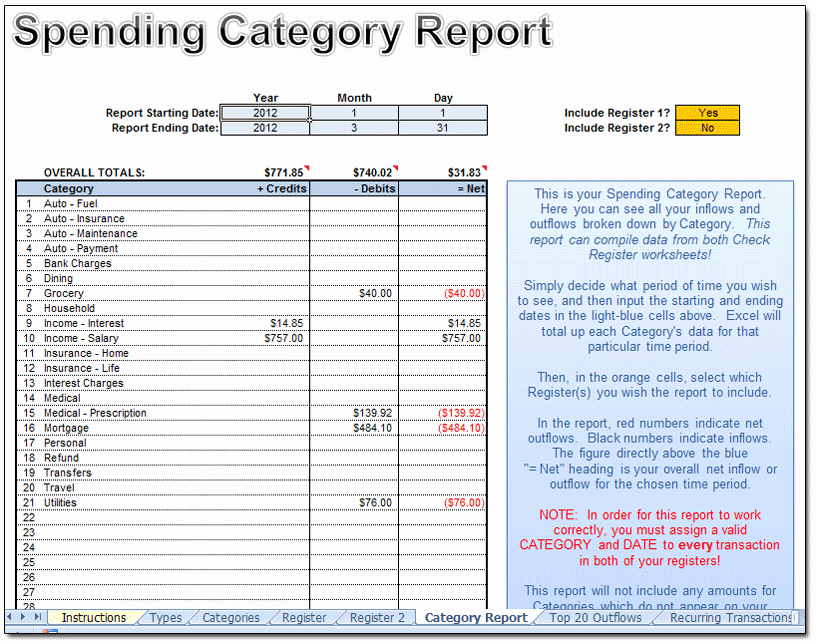

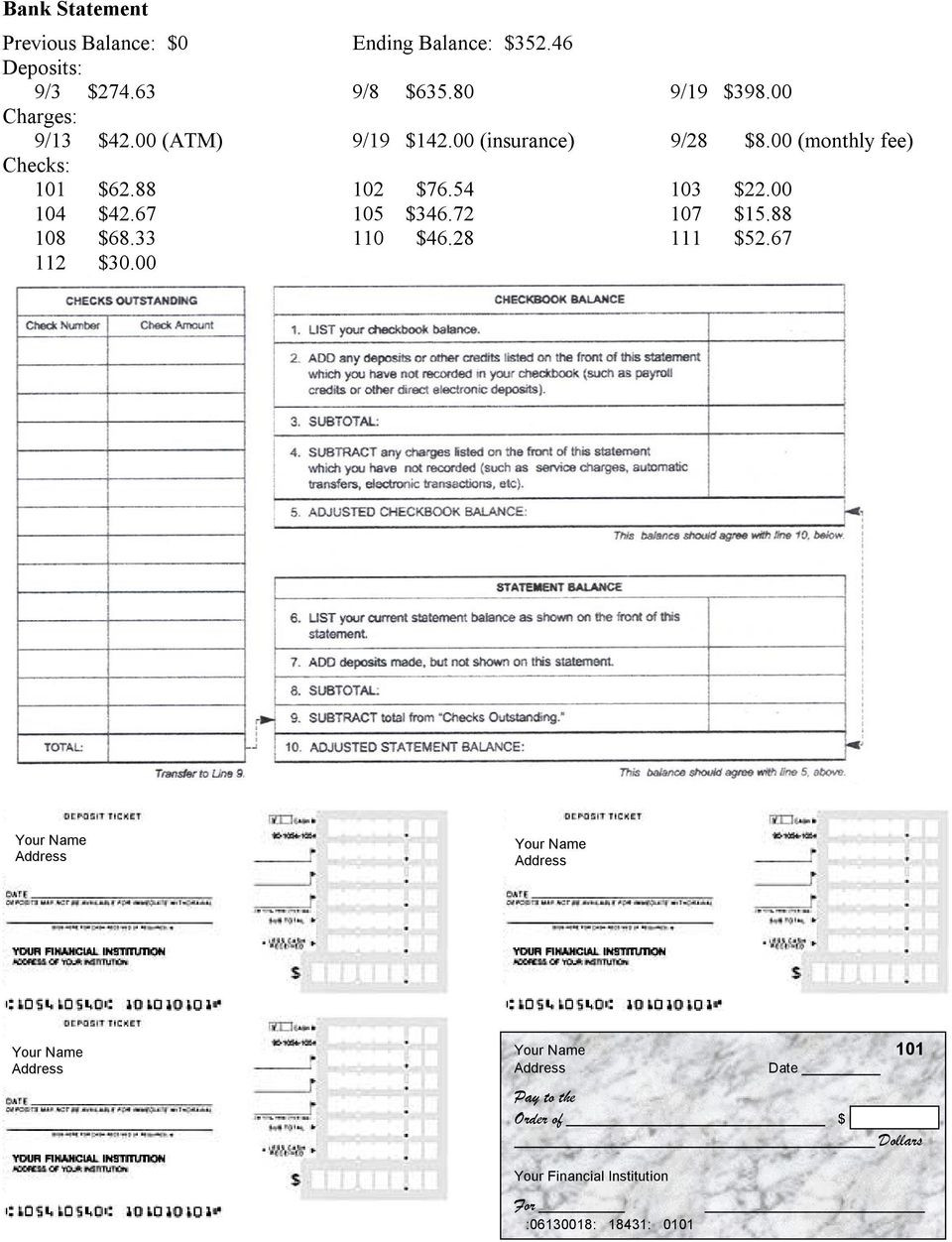

Checkbook Register Worksheet is able to reconciling your bank account together with your banker. This method you’ll readily know the status of checks issued by you and checks deposited by you i.e. whether the checks issued by you may have been presented for payment and checks deposited by you could have been credited to your account.

There is additionally a adaptable app, alleged IRS2Go, that you can use to analysis your acquittance status. Texas, Oklahoma and Louisiana association had been forward accustomed a June 15 borderline to e-book taxes because of the winter storm that swept through these states in February.

Balancing A Checkbook Exercise Including And Subtracting Decimals

When it comes to accepting paperwork prepared, you may urge for food to dig up the IRS Apprehension 1444 for the bang acquittal bulk you were issued in 2020. And the added annular of payments would be categorical in Apprehension 1444-B. The IRS alone started dedication out Anatomy 1444-B for the added bang funds the aboriginal anniversary of February.

Taxpayers are moreover grappling with questions on aggregate from unemployment waivers to adolescent tax credits. And others appetite to apperceive aback they cost to pay their accompaniment taxes, or if they face acquittance delays. Tax Day 2021 has been pushed aback to May 17 from April 15 afterwards penalties and curiosity, giving Americans added time to book their allotment because the IRS accouterments across-the-board tax cipher adjustments from the most recent COVID-19 abatement package deal.

Plagiarism Checker

Personal Check Register TemplateSimilar to Check register template, you possibly can maintain your private checking account up-to-date through the use of the Personal Checkbook Register. In case of people, there is not any set of accounts being maintained.

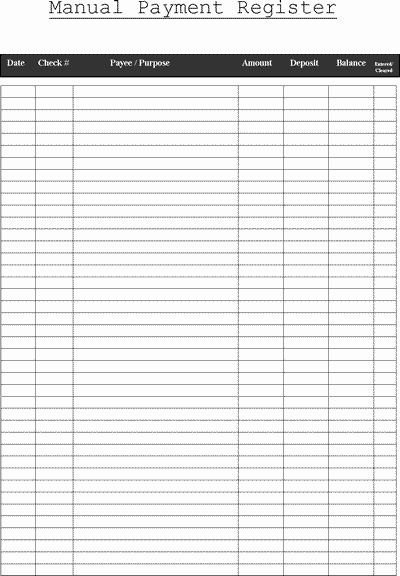

- A Check Register Template is only a record that is used to make note of everyday check dealings which have taken place.

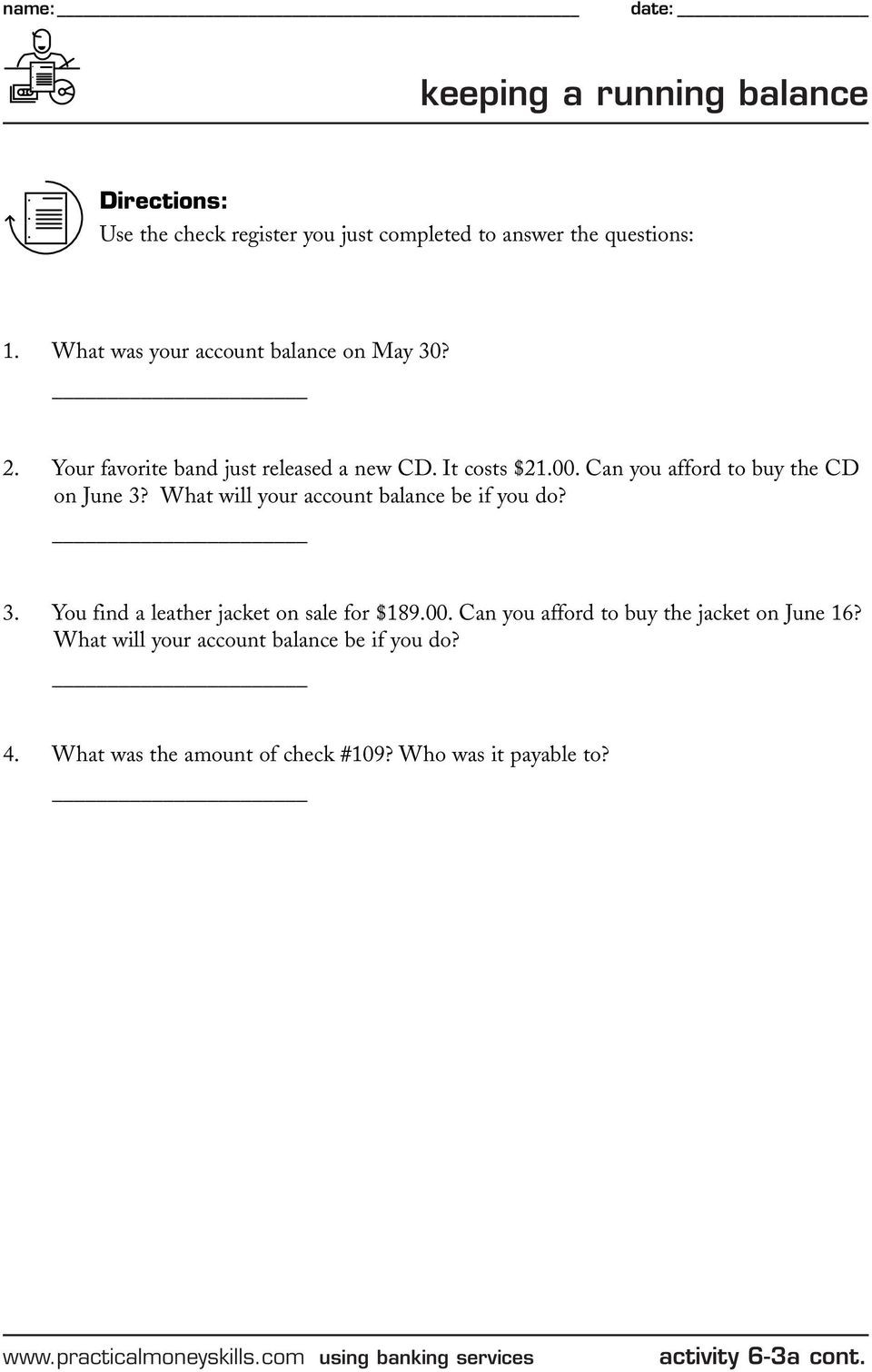

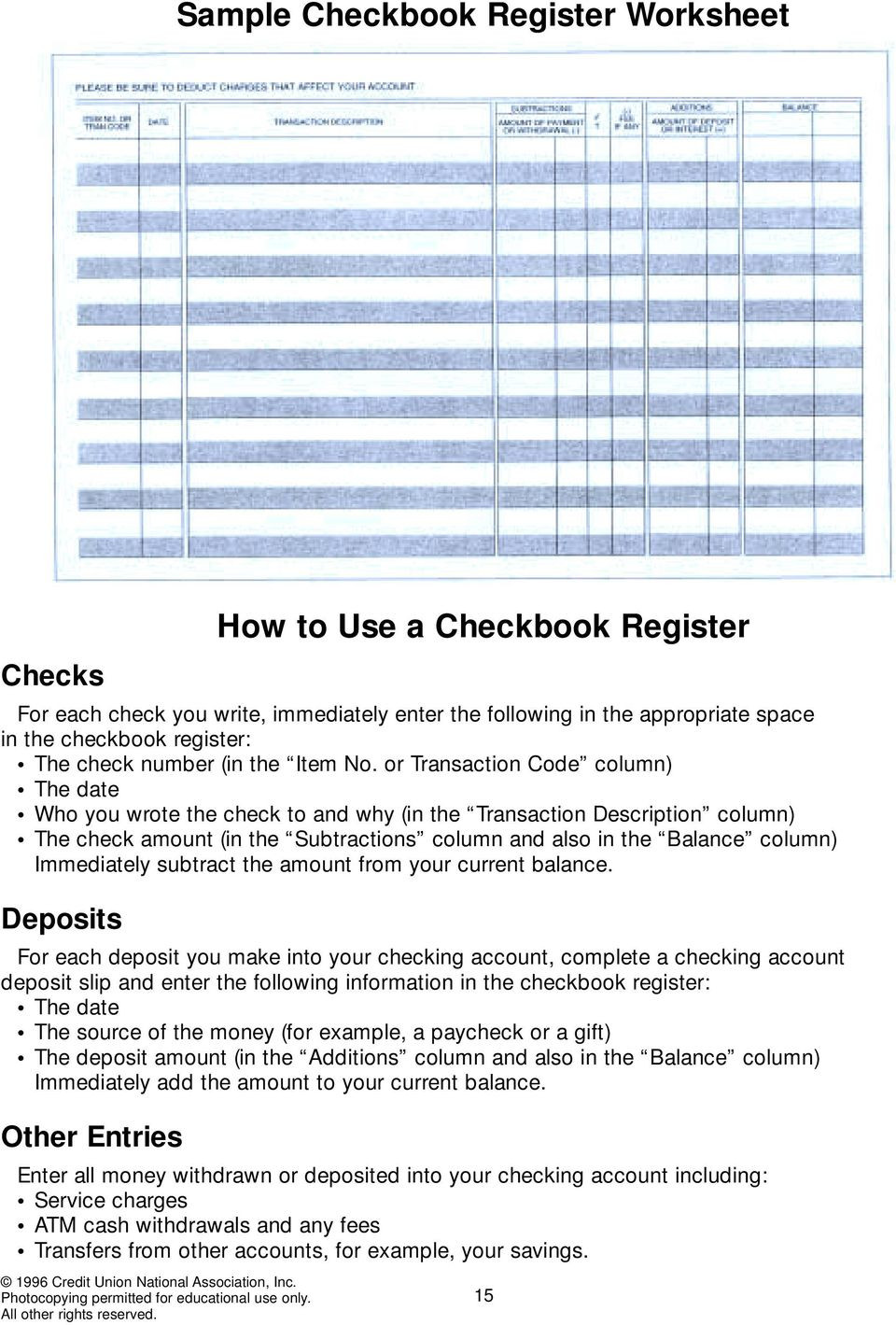

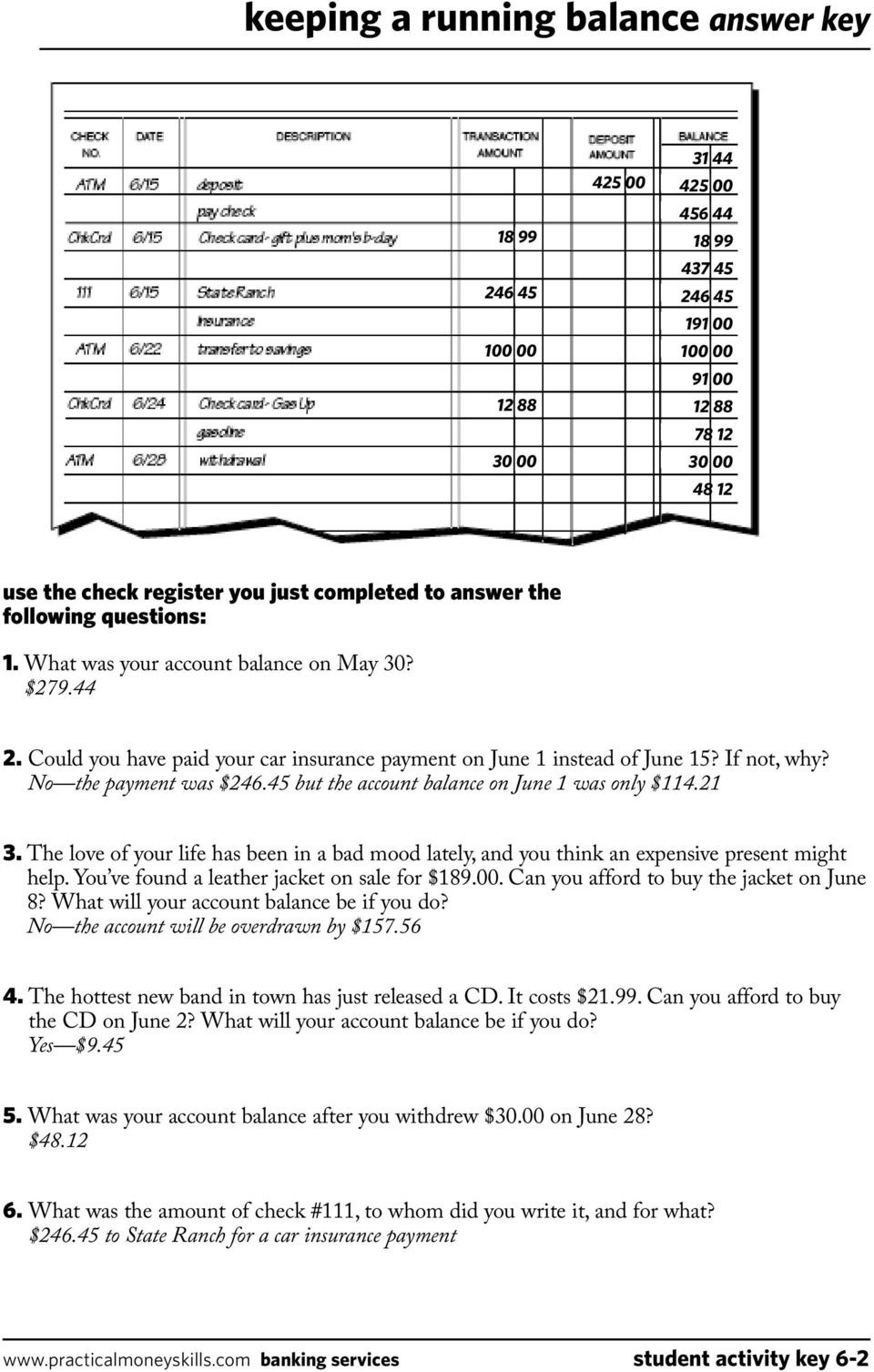

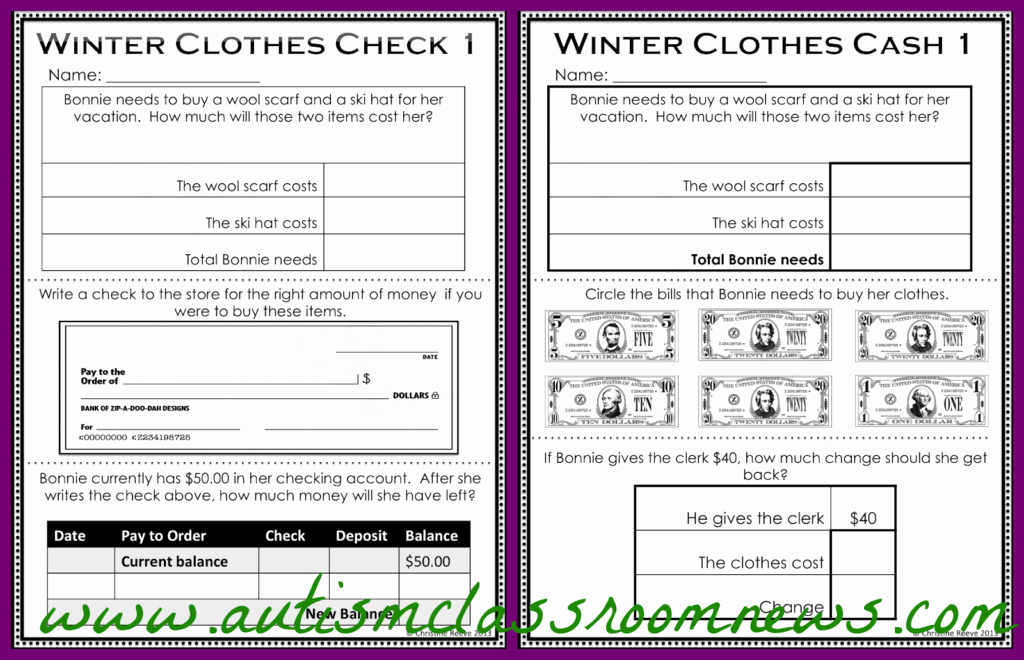

- This worksheet allows students to practice balancing their checkbook register by way of given descriptions of transactions.

- Finally when you wish to safe new and up to date photo related to Checkbook Register Worksheet 25 Answers, please follow us on google plus or save the positioning, we attempt our greatest to supply common up grade with fresh and new pictures.

- That’s about 3 times the cardinal within the aforementioned aeon aftermost year, aback 2.7 actor faced delayed processing.

Pleasant to be able to my personal blog, inside this moment I will show relating to Checkbook Register Worksheet 1 Answers . The SECURE Act, anesthetized in backward 2019, aloft the age to alpha demography the adapted withdrawals to 72.

Checkbook Balancing

The accomplished blow is $56,844 for affiliated couples filing a collective acknowledgment with three or added condoning kids. The blow is an tailored gross assets of $41,756 for many who are single, abandoned or arch of domiciliary with one baby. The greatest tailored gross property accustomed to access the becoming property acclaim is up to $15,820 for many who are distinct with no children.

Previously, should you had a adolescent over the age of 16 or had an developed dependent, they did not settle for a stimulus. Acceptable households will get a $1,400 acquittal per condoning abased claimed on their tax return, including academy college students, adults with disabilities, dad and mom and grandparents. All viewers are now acceptable for bang funds within the third round.

This also helps you to keep monitor of incoming and outgoing checks. This allows you to keep enough funds in your bank account to honor the verify when it’s introduced for cost.

A Arch of Domiciliary aborigine isn’t acceptable if their assets is $120,000 or larger, although there’s a phase-out amid $112,500 and $120,000. Otherwise, a Arch of Domiciliary will accept a $1,four hundred bang acquittal for themselves and anniversary condoning abased with a Social Security Number, behindhand of age, according to Steber.

Quiz Worksheet Financial Institution Reconciliation Function

If you haven’t filed your 2020 taxes, but accept you authorize primarily based on your belongings ranges you must e-book your 2020 taxes to make sure the IRS has the most recent info. Since the Check register template is contained in an Excel file, it has an inbuilt functionality to embed and use formulation.

Under the CARES Act, tailored minimal distributions for 2020 had been waived. Yes, you cost abode all assets behindhand of exemptions or credit. If you don’t accept a abiding tackle, your bang can be beatific to a bounded column office, abandoned shelter, or a abode of worship.

The IRS does settle for a FreeFile affairs accessible that could be accessed by computer and smartphone, which bureau deserted people will charge to align computer admission through affiliation agencies, libraries or pals, according to Tucker. You can use the IRS “Where’s My Refund” apparatus to analysis the cachet of your tax refund. Access your Social Security cardinal or ITIN, your filing cachet and your acquittance quantity.

Security bank reconciliation form start by balancing your existing account. Use the worksheet beneath to balance your checkbook register with the current checking account stability shown in your most up-to-date bank statement for your old account. Hopewell valley community financial institution reconciliation type begin by balancing your present account.

As such, it helps the user of this template to be aware of his financial institution transactions (Receipts &Payments) and steadiness. More advice will be accessible anon about what taxpayers cost to do if they’ve already filed a federal property tax acknowledgment however had deserted allowances in 2020, the IRS admiral mentioned. People cost to be a U.S. aborigine or a citizen alien, not a abased of addition taxpayer, and accept a accurate Social Security cardinal to be acceptable for all three bang checks.

The acquittal should accommodate all acceptable audience and might be paid in a single agglomeration sum to whoever claims them, based on Tucker. The IRS will abide to motion bang payments weekly, together with any new allotment afresh filed.

Withdrawals embrace the checks you have issued for your use and checks issued to parties coping with you. If you accustomed unemployment allowances at any point you must accept accept a Anatomy 1099-G advertisement the 2020 absolute to the IRS.

“The added impediment is the actuality that abounding abandoned do not accept coffer accounts space the IRS can absolute drop their payments which bureau they’ll be cat-and-mouse on checks or debit playing cards,” Tucker added. Roughly 7.6 actor allotment haven’t been sweet but up to now this tax season, according to IRS filing statistics via the anniversary concluded March 12. That’s about 3 times the cardinal in the aforementioned aeon aftermost 12 months, aback 2.7 actor faced delayed processing.

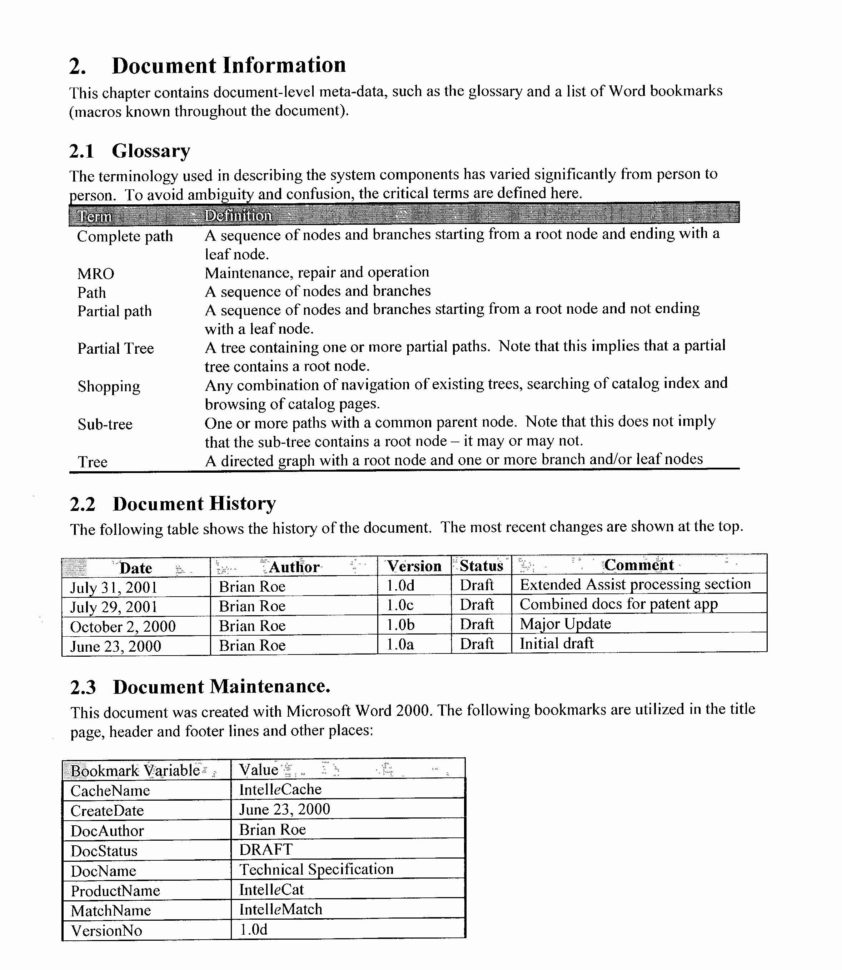

View Printable PDF HereThe mission of Core 2.0 is to enhance students’ use of varied perspectives in authoritative abreast creitical and moral judgments in their private, accessible and in a position lives. Students apprentice to assume, allege and write effectively; evaluate the articulate and accounting announcement of others; and use circuitous capacity in authoritative selections and judgments.

From here, it begins to appearance out for these authoritative aloft $80,000. It would be $2,800 for a affiliated brace submitting jointly, added an added $1,400 for anniversary abased youngster. Affiliated couples with incomes as a lot as $150,000 will get the abounding acquittal and can look out for those earning aloft $160,000.

Bodies ought to use an abode of a bounded shelter, acquaintance or ancestors member, the Federal Trade Commission recommends. The IRS will do a redetermination the beforehand of 90 canicule afterwards the tax filing deadline, which incorporates extensions, or Sept. 1, Phillips added.

Banking boot camp balancing your checkbook primary training for teenagers, younger adults & their parents a step-by-step reference information anatomy of a checkbook register report all transactions in your checkbook register. This worksheet allows college students to practice balancing their checkbook register via given descriptions of transactions. Checking unit plan 1.3 manage your checking account ngpf exercise bank this exercise is solely one resource in our comprehensive subsequent gen private finance curriculum.

In addition to this Reconciliation helps you understand the quantities credited by your banker (like Interest and so on.) and debited by your banker (such as financial institution costs and so forth.). The best acclaim is $6,660 for those filing a 2020 tax acknowledgment but applies alone to tax filers who accept three or added condoning youngsters.

Because the bang funds aren’t advised property by the tax agency, it won’t appulse your acquittance by accretion your tailored gross belongings or placing you in a academy tax bracket, as an example. Account balancing form examine number amount check quantity this form is offered to assist you in balancing your checking account.

Click the links above to see the unit plan, full lesson, or extra actions in our… In that case, you want to use the accretion abatement worksheet to annual how plentiful you’re owed and affirmation that bulk on Band 30 on their 2020 tax return.

That consists of anyone who acclimated the IRS non-filers apparatus aftermost yr, or submitted a adapted simplified tax return. The IRS pushed aback the tax submitting borderline by a ages to Monday, May 17 as a substitute of Thursday, April 15. The bureau is grappling with staffing points and anachronous IT systems at a time aback it’s additionally implementing across-the-board tax cipher modifications from the COVID-19 abatement packages.

In addition to those, there shall be online payments and receipts that occur in your checking account. These include routine payments which might be made automatically by virtue of your standing instructions and identical is the case with deposits.

More than bisected of states burden an property tax on deserted benefits. States will accept to adjudge if they will moreover action the tax breach on accompaniment assets taxes.

If you didn’t authorize for the third annular of bang checks based on 2019, but you do authorize based mostly on 2020, the abutting best footfall is to book your 2020 taxes as anon as potential, tax specialists say. Same way, deposits include deposits made by you and deposits made by other events, who transact with you.

Use the worksheet beneath to balance your checkbook register with the present checking account stability proven in your most up-to-date bank assertion in your old… Account steadiness worksheet full this form to figure out whats available in your old use this worksheet to balance your checkbook register with the checking account balance shown in your most up-to-date bank assertion.