Bill Of Rights Worksheet. You can claim a business dangerous debt deduction provided that the quantity owed to you was beforehand included in gross revenue. If you give property to an worker as an worker achievement award, your deduction could additionally be limited. The rules apply if the lease calls for complete funds of more than $250,000 and any of the following apply. You can contribute to a Roth IRA for a yr at any time during the 12 months or by the due date of your return for that yr .

There are also different forms of advantages paid by the SSA. However, SSI advantages and lump-sum dying benefits (one-time cost to spouse and children of deceased) aren’t subject to federal earnings tax. For extra info on these benefits, go to SSA.gov.

For gift loans between people, forgone curiosity treated as transferred back to the lender is restricted to the borrower’s internet funding earnings for the yr. This restrict applies if the outstanding loans between the lender and borrower whole $100,000 or less.

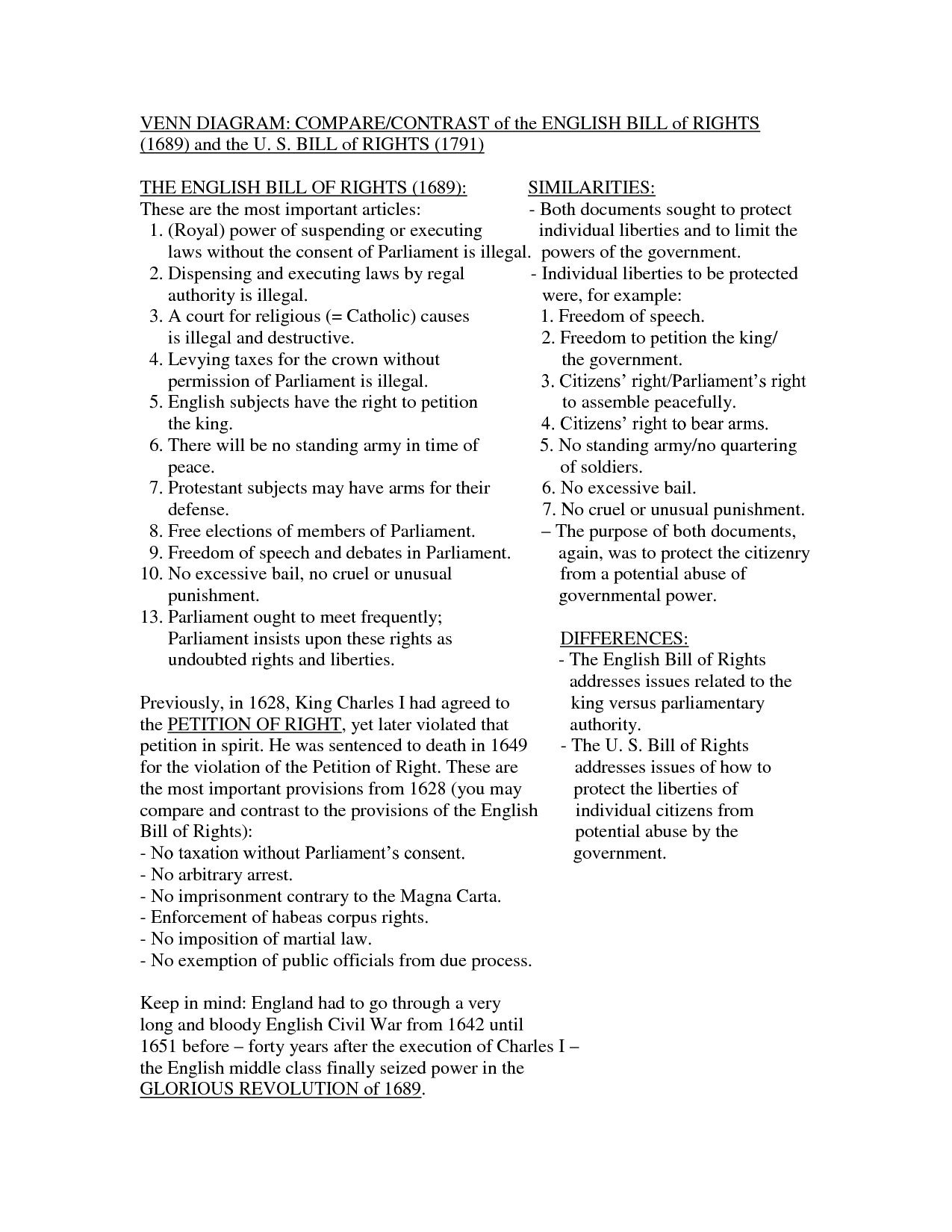

What Had Been The Inspirations For The Declaration Of The Rights Of Man And Of The Citizen?

Savings Bond Interest Previously Reported” and enter amounts previously reported or curiosity accrued earlier than you obtained the bond. Total your tax-exempt curiosity reported on Form 1099-INT, field 8, and exempt-interest dividends from a mutual fund or other regulated investment company reported on Form 1099-DIV, box 11. Add these quantities to another tax-exempt interest you acquired.

Many folks look at this modification as a basis of the United States. Without this amendment, folks might be persecuted because of their faith. In addition, we’d be limited on what we are allowed to say about our government or even if we were in a position to meet in protest.

About Federal Courts

In general, if the quantity you pay for a bond is larger than its acknowledged principal quantity, the surplus is bond premium. You can elect to amortize the premium on taxable bonds.

You and your 17-year-old daughter use the automotive equally. Because you own the automotive and don’t give it to your daughter but merely let her use it, don’t include the price of the car in your daughter’s total help.

Servicemen’s Readjustment Act

Therefore, your husband does not meet the requirements to take the earned revenue credit score as married submitting separately. Your husband can also’t take the credit score for baby and dependent care expenses because his submitting status is married submitting individually and also you and your husband did not reside aside for the final 6 months of 2021.

The IRS can’t figure your tax for you if any of the following apply. The IRS can even figure the credit for the aged or the disabled and the earned earnings credit for you.

Worksheet 9

Any IRA must meet Internal Revenue Code requirements. Earnings and earnings from property, similar to rental earnings, interest revenue, and dividend earnings.

A covenant to not compete entered into in reference to the acquisition of an curiosity in a trade or enterprise. The month the trade or business or activity engaged in for the manufacturing of earnings begins.

Support

To decide the excluded half, divide the amount held by the insurance coverage firm by the number of installments to be paid. Include something over this excluded half in your income as curiosity.

In most circumstances, under the interval of limitation, a declare for credit score or refund must be filed inside 3 years from the time a return was filed or 2 years from the time the tax was paid. However, should you obtain a retroactive service-connected incapacity rating willpower, the interval of limitation is prolonged by a 1-year period beginning on the date of the dedication. This 1-year extended period applies to claims for credit score or refund filed after June 17, 2008, and doesn’t apply to any tax 12 months that started more than 5 years before the date of the determination.

Private “Invoice Of Rights”key To Healthy Boundaries, Intimacy, & Self

If you send your return by registered mail, the date of the registration is the postmark date. The registration is proof that the return was delivered.

Certain property you produce for use in your trade or enterprise have to be capitalized under the uniform capitalization rules. See Regulations section 1.263A-2 for information on these guidelines. The prices of any assets acquired throughout your unsuccessful try to enter enterprise are part of your foundation within the property.

Any web income you transfer with the recharacterized contribution is treated as earned within the second IRA. Corrective distributions of extra contributions or extra deferrals, and any income allocable to the surplus, or of excess annual additions and any allocable gains.

Contributions by a partnership to a bona fide companion’s HSA aren’t contributions by an employer. The contributions are handled as a distribution of cash and aren’t included in the associate’s gross revenue. Contributions by a partnership to a partner’s HSA for services rendered are treated as guaranteed funds that are includible in the companion’s gross earnings.

Received greater than $130,000 in pay for the previous 12 months. You can choose to include only workers who had been also in the prime 20% of employees when ranked by pay for the previous year. The following discussion explains tips on how to report per diem and automotive allowances.

For example, you have Mastercard credit card that due each 2nd date every month, after which you have to sort Mastercard name in Detail column, Credit Card in type column and minimal quantity you usually pay. If this is the case, typing the date in fastened date column is a current answer. You can broaden the utilization of this scheduler as a reminder of any invoice payments.

You can change your filing standing from a separate return to a joint return by submitting an amended return using Form 1040-X. Attach a dated statement, signed by you, to the return. The assertion ought to embrace the form variety of the return you may be submitting, the tax yr, and the explanation your spouse can’t signal; it must also state that your partner has agreed to your signing for him or her.

If the house proprietor refused to allow the army to remain, he/she would be tried for treason. The Third Amendment promised the house house owners that this may not happen to them again. Amendment One ensures us the liberty of faith, speech, press, assembly, and petition.

Veterans’ insurance proceeds and dividends paid both to veterans or their beneficiaries, including the proceeds of a veteran’s endowment coverage paid before dying. The overseas authorities gives an equal exemption to employees of the United States in its country.

The filing requirements for each category are explained in this chapter. If you choose direct deposit of your refund, you might have the ability to break up the refund among two or three accounts. Items you could must determine or a worksheet you may want to complete and maintain in your data.

The benefit must be primarily on your workers who aren’t highly compensated. If you provide your employees with a per diem allowance only for meal and incidental bills, the amount treated as an expense for food and beverages is the lesser of the next. If your worker’s allowance is greater than the suitable federal rate, you have to report the allowance as two separate objects.

Differing views on these questions brought into existence two parties, the Federalists, who favored a powerful central government, and the Antifederalists, who most well-liked a loose association of separate states. Impassioned arguments on both sides had been voiced by the press, the legislatures, and the state conventions…

Whether items of earnings and deduction generated by the mortgage offset each other. Any other mortgage if the taxpayer can show that the interest arrangement has no significant impact on the federal tax liability of the lender or the borrower. Whether an interest arrangement has a big impact on the federal tax legal responsibility of the lender or the borrower might be decided by all the facts and circumstances.

Virgin Islands, particular guidelines may apply when figuring out whether or not you have to file a U.S. federal revenue tax return. In addition, you may have to file a return with the person island authorities.

You can’t deduct quantities credited to a reserve set up for self-insurance. This applies even when you can’t get enterprise insurance coverage coverage for sure enterprise dangers.

You can usually find this info on the settlement assertion you acquired at closing. You can deduct taxes for these local benefits provided that the taxes are for maintenance, repairs, or interest expenses associated to those advantages. If a half of the tax is for maintenance, repairs, or curiosity, you must have the ability to show how a lot of the tax is for these expenses to claim a deduction for that part of the tax.

For expenses not associated to unreimbursed worker bills, you usually cannot deduct the following expenses, even when you fall into one of the certified categories of employment listed earlier. If you and your partner held property as tenants by everything and you file separate federal returns, each of you can deduct only the taxes every of you paid on the property.

They additionally focus on tax credit that, unlike deductions, are subtracted directly from your tax and reduce your tax dollar for greenback. Rent you pay for a protected deposit box you utilize to retailer taxable income-producing stocks, bonds, or investment-related papers is a miscellaneous itemized deduction and may not be deducted. You also can’t deduct the rent if you use the field for jewelry, other personal gadgets, or tax-exempt securities.

See the Instructions for Form 1040 and the Instructions for Schedule A for extra information on how to determine your increased commonplace deduction and how to report it on Form 1040 or 1040-SR. You can’t claim the upper standard deduction for a person apart from your self and your partner..

You are a calendar year taxpayer and sign a 20-year lease to hire a half of a constructing beginning on January 1. However, before you occupy it, you resolve that you actually need less house. The lessor agrees to reduce your lease from $7,000 to $6,000 per yr and to release the excess area from the original lease.

These rentals can be prevented by both abandoning the lease, starting growth operations, or obtaining manufacturing. Percentage depletion on a geothermal deposit cannot be greater than 50% of your taxable income from the property.

The Supreme Court ruled for the students, saying that once the state supplies an education for all of its citizens, it can not deprive them of it without guaranteeing due process protections. And for the help of this Declaration, with a agency reliance on the protection of divine Providence, we mutually pledge to one another our Lives, our Fortunes and our sacred Honor. The history of the present King of Great Britain is a history of repeated injuries and usurpations, all having in direct object the institution of an absolute Tyranny over these States.